DeFi on The Open Network (TON) is rapidly evolving, and the pace of innovation is being set by protocols like Omniston, the liquidity aggregation engine developed by STON. fi. As decentralized finance matures, the fragmentation of liquidity across multiple decentralized exchanges (DEXs) and platforms has become a persistent barrier to seamless trading and user experience. Omniston directly addresses this by unifying liquidity sources, optimizing swap rates, and embedding DeFi directly into Telegram – the messaging platform with 900 million monthly active users.

Why Liquidity Aggregation Matters for TON DeFi

The core challenge for any blockchain ecosystem aiming for mainstream adoption is liquidity fragmentation. On TON, as on other chains, liquidity often resides in disparate pools managed by different DEXs or market makers. This leads to inefficiencies: users face poor swap rates, high slippage, and increased transaction costs. For developers, integrating with each source individually means higher maintenance overheads and slower time-to-market.

Omniston solves these pain points with a decentralized Request-for-Quote (RFQ) system. When a user initiates a swap, Omniston fetches real-time quotes from multiple DEXs and market makers across the TON ecosystem. It then executes the trade at the best available rate – all within seconds. This not only guarantees optimal pricing but also democratizes access to deep liquidity for every participant, regardless of their entry point.

Telegram-Native DeFi: Removing Barriers to Entry

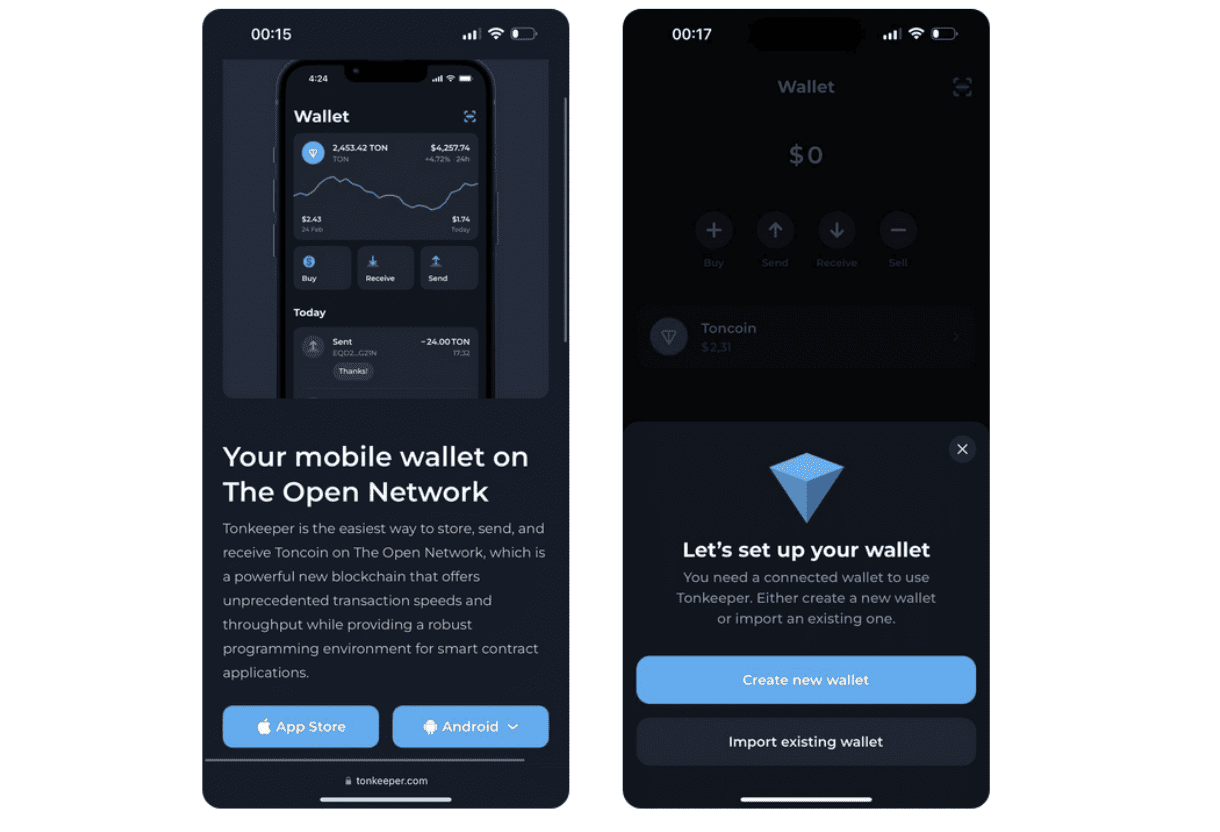

The integration of Omniston within Telegram is a game-changer for DeFi accessibility. Instead of requiring users to navigate external dApps or browser extensions, token swaps can now be performed directly inside Telegram chats using TON Wallet. This frictionless approach dramatically lowers onboarding barriers for new users and leverages Telegram’s massive user base as an organic funnel into DeFi.

Early data shows that this integration isn’t just about convenience – it’s also about efficiency. Developers report that integrating Omniston reduces technical complexity, cutting time-to-market from 4-6 weeks down to under one week while lowering ongoing maintenance costs by up to 70%. For end-users, it means best-in-class swap rates delivered in an interface they already trust.

Key Benefits of Omniston for TON dApp Developers and Users

-

Unified Access to Deep Liquidity: Omniston aggregates liquidity from multiple decentralized exchanges and market makers on the TON blockchain, ensuring optimal swap rates and minimal slippage for users and dApps.

-

Simplified Integration for Developers: With a single integration point, developers can connect their dApps to the entire TON DeFi ecosystem, reducing integration time from 4-6 weeks to under a week and lowering maintenance costs by up to 70%.

-

Seamless DeFi Experience in Telegram: Omniston enables native token swaps and DeFi features directly within the Telegram app, leveraging Telegram’s 900 million monthly users for unmatched accessibility.

-

Request-for-Quote (RFQ) System for Best Prices: The protocol uses an advanced RFQ mechanism to fetch and compare quotes from multiple sources, guaranteeing users the best available prices for their trades.

-

Enhanced User Engagement and Accessibility: By embedding DeFi tools inside Telegram, Omniston removes barriers to entry, making decentralized finance as intuitive as sending a message and driving broader adoption.

How Omniston Works Under the Hood

At its core, Omniston acts as a universal gateway to all major TON-based liquidity sources. Its RFQ engine aggregates bids from DEXs and market makers in real time. When a user submits a trade request, whether through a standalone dApp or via Telegram Wallet, Omniston’s smart contracts compare available prices and execute at the most favorable rate.

This architecture brings several measurable advantages:

- Optimal execution: By sourcing from all available pools simultaneously, users avoid price impact caused by shallow liquidity on any single DEX.

- Simplified integration: Developers get one API endpoint to access all TON liquidity instead of building custom adapters for each exchange.

- Reduced slippage: Aggregation ensures larger trades can be executed without moving markets or incurring excessive costs.

This unified approach not only improves efficiency but also supports the long-term health of the entire TON DeFi ecosystem by attracting more liquidity providers who benefit from higher utilization rates and lower operational burdens.

As the TON blockchain ecosystem continues to mature, the role of liquidity aggregation protocols like Omniston becomes increasingly pivotal. By abstracting away the complexity of fragmented liquidity and surfacing the best available rates, Omniston is effectively democratizing DeFi for both newcomers and advanced users. The seamless integration with Telegram is more than a technical milestone – it’s a strategic move that positions TON as the most user-friendly blockchain for decentralized finance.

Real-World Impact: Lower Costs and Faster Innovation

For developers, Omniston’s plug-and-play API means less time wrestling with fragmented DEX integrations and more time focusing on product differentiation. According to recent Block Telegraph coverage, early adopters have reported a reduction in integration timelines from 4-6 weeks to under a week, alongside maintenance cost savings of up to 70%. This not only accelerates innovation but also lowers barriers for smaller teams or new projects entering the TON DeFi space.

For end-users, the impact is equally tangible. Swapping tokens within Telegram – as easily as sending a message – eliminates much of the friction that has historically kept non-technical users out of DeFi. The RFQ system ensures that every swap leverages deep liquidity across all major TON pools, minimizing slippage even during volatile market conditions. This is particularly important as TON-based assets see increasing trading volumes and broader adoption.

Expanding Use Cases Across TON and Telegram

The versatility of Omniston extends beyond simple token swaps. By providing unified access to liquidity, it enables developers to build sophisticated financial products such as yield aggregators, cross-chain bridges, lending protocols, and NFT marketplaces – all with consistent execution quality and minimal technical overhead.

Innovative TON dApps Leveraging Omniston Liquidity

-

STON.fi: The flagship decentralized exchange (DEX) on TON, STON.fi utilizes Omniston’s liquidity aggregation protocol to offer users optimal swap rates and minimal slippage. Its integration with Telegram allows users to execute token swaps directly within the app, making DeFi as intuitive as sending a message.

-

TON Wallet (Telegram Integration): By embedding Omniston-powered swaps, TON Wallet enables Telegram’s 900 million monthly active users to seamlessly exchange TON-based tokens without leaving the chat interface. This integration dramatically lowers the barrier to DeFi participation for mainstream users.

-

DeDust: As a prominent DEX aggregator on TON, DeDust leverages Omniston to source deep liquidity from multiple pools, ensuring competitive pricing and efficient trade execution for its users.

-

Tonkeeper: The popular self-custodial wallet, Tonkeeper, integrates Omniston to facilitate in-app token swaps and liquidity provision, streamlining the DeFi experience for TON ecosystem participants.

-

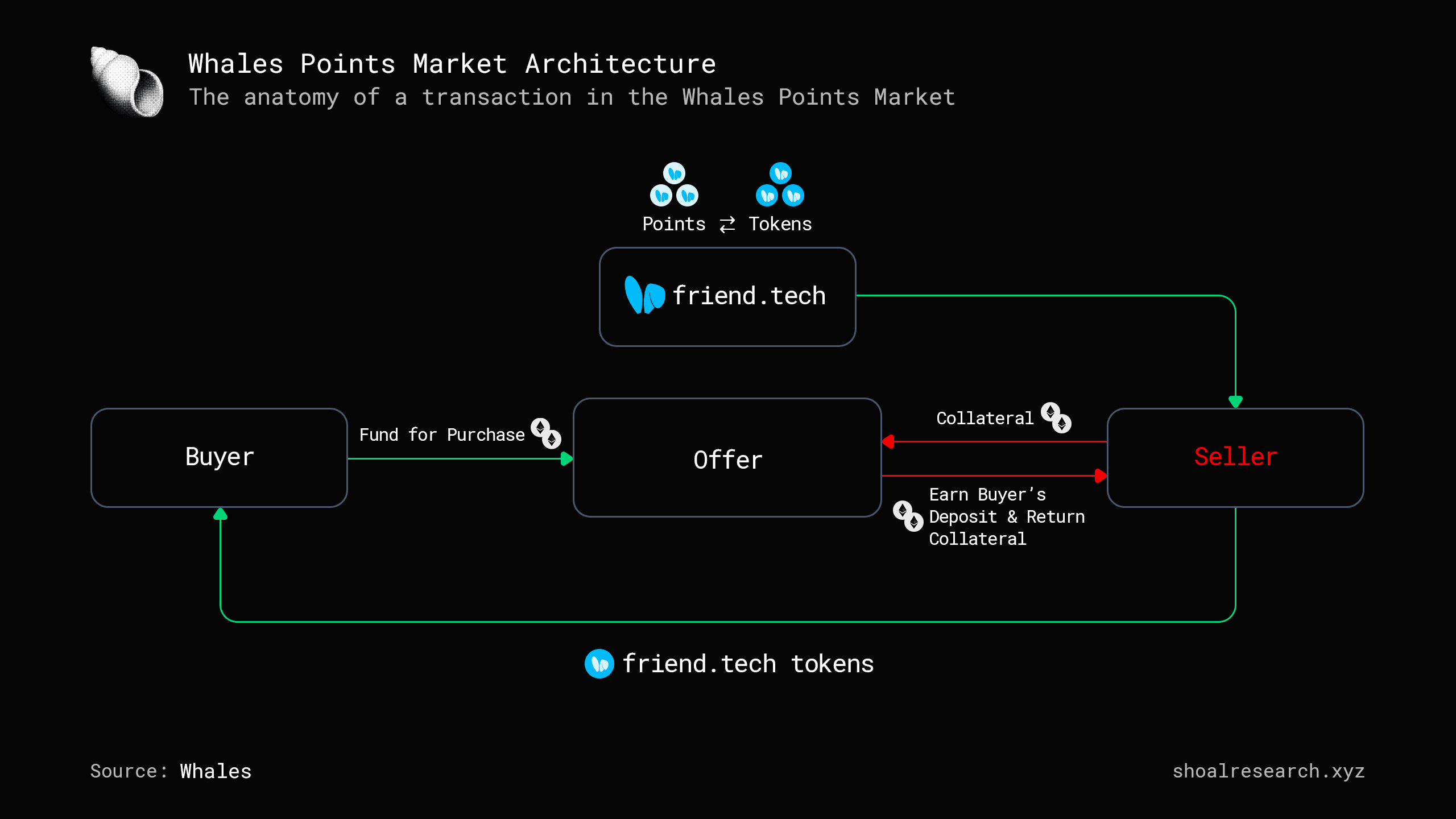

Whales Market: This peer-to-peer OTC trading platform on TON taps into Omniston’s aggregated liquidity to offer users better pricing and faster settlement for large-volume trades.

This composability is vital for growing a healthy DeFi ecosystem. As more projects integrate Omniston, network effects amplify: deeper liquidity pools attract more traders and liquidity providers, which in turn incentivizes new dApp development. The result is a virtuous cycle driving both volume and innovation on the TON blockchain.

Security and Transparency in Aggregated Swaps

Security remains paramount in any DeFi protocol. Omniston’s smart contract architecture has undergone rigorous auditing by independent third-party firms, ensuring that aggregated swaps are executed transparently and funds remain self-custodial at all times. This aligns with STON. fi’s broader mission to deliver trustless financial infrastructure within Telegram’s familiar environment.

The protocol’s open-source nature also allows community scrutiny and ongoing improvements – an essential feature for maintaining resilience as usage scales up across millions of users.

The Road Ahead: Scaling Adoption Across Web3 Messaging

The intersection of messaging apps and decentralized finance represents one of Web3’s most compelling growth frontiers. With its native integration into Telegram’s 900 million monthly active user base, Omniston is uniquely positioned to catalyze mass-market adoption for TON DeFi aggregator solutions.

Looking forward, expect further enhancements around cross-chain interoperability, advanced trading features (such as limit orders), and expanded support for new asset classes within the TON ecosystem. As more users discover how easy it is to interact with DeFi directly from their favorite chat app, we can anticipate exponential growth in both liquidity depth and transaction volumes throughout 2025.