In a move that underscores the maturing trajectory of The Open Network (TON), Coinbase’s listing of Toncoin (TON) has opened floodgates for mainstream accessibility. As of the latest data, Toncoin trades at $1.39, reflecting a solid 24-hour gain of and $0.0340 or and 2.48%, with a daily high of $1.42 and low of $1.34. Spot trading for the TON-USD pair went live on November 18,2025, at around 9: 00 a. m. PT, subject to liquidity conditions, marking a watershed moment for Telegram’s blockchain ambitions.

This development arrives amid TON’s steady climb, bolstered by integrations on platforms like Gemini, Robinhood, and Zengo. For enthusiasts and investors eyeing TON ecosystem growth 2026, the Coinbase nod signals institutional validation, potentially amplifying on-chain activity within Telegram’s vast user base.

Coinbase Entry Catalyzes TON Liquidity Surge

Coinbase, as the premier U. S. exchange, brings regulated exposure to millions. The TON-USD pair’s activation has already enhanced liquidity, a critical factor for price stability and broader trading volumes. Pre-listing buzz from sources like TON Strategy Company and Coinbase Markets on X highlighted the November 18 rollout, with spot trading now fully operational on coinbase. com and the app. Users can seamlessly buy, sell, convert, send, and receive TON, bridging retail curiosity with sophisticated investment strategies.

Consider the ripple effects: Coinbase Ventures’ direct purchase of TON tokens from Telegram, as revealed by TON Foundation president Manuel Stotz to The Block, underscores deep confidence. This isn’t mere speculation; it’s strategic positioning. In my view, such backing fortifies TON against volatility, positioning it as a cornerstone for Telegram TON adoption boost. Historical parallels with other listings suggest an initial volume spike, followed by sustained interest as traders leverage Coinbase’s robust infrastructure.

TON’s price resilience at $1.39 post-listing speaks volumes. Far from a fleeting pump, this reflects underlying network strength, with Telegram’s 900 million-plus users providing a unique moat. Developers and projects can now tap Coinbase’s liquidity for smoother deployments, from DeFi protocols to mini-apps.

TON Open Network Support Meets Telegram’s Scale

The Open Network’s architecture, born from Telegram’s vision, thrives on scalability and low fees. Coinbase’s TON Open Network support via the listing amplifies this, enabling frictionless Toncoin USD trading on Coinbase. Imagine channel owners monetizing via TON payments or bots handling instant settlements; these use cases gain credibility with a top-tier exchange endorsement.

Recent ecosystem updates from ton. org detail November 2025 milestones, including cross-chain bridges and gaming integrations. Coinbase’s involvement accelerates this momentum, drawing institutional capital that traditional chains envy. I’ve long argued that TON’s Telegram symbiosis offers unmatched distribution; now, with Coinbase, it transitions from niche to necessity.

Explore how this listing drives mass adoption through Telegram channels.

- Enhanced liquidity reduces slippage for large trades.

- Regulated access appeals to cautious investors.

- App integration simplifies onboarding for Telegram users.

Market data reinforces optimism: at $1.39, TON outperforms many peers amid broader crypto consolidation, hinting at untapped potential.

Strategic Implications for Ecosystem Builders

For developers, the listing means reliable funding rails. TON’s Proof-of-Stake model, combined with sharding, handles Telegram-scale throughput effortlessly. Coinbase’s stamp of approval validates this tech stack, encouraging dApp proliferation. Prediction models now factor in heightened visibility; short-term, expect consolidation around $1.39, with upside from adoption catalysts.

Toncoin (TON) Price Prediction 2027-2032

Post-Coinbase Listing Forecasts: Enhanced Liquidity and Telegram Ecosystem Growth

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $1.80 | $2.40 | $3.20 | +73% |

| 2028 | $2.20 | $3.50 | $5.00 | +46% |

| 2029 | $2.80 | $5.00 | $8.00 | +43% |

| 2030 | $3.50 | $7.00 | $12.00 | +40% |

| 2031 | $4.50 | $9.50 | $18.00 | +36% |

| 2032 | $6.00 | $13.00 | $25.00 | +37% |

Price Prediction Summary

Toncoin (TON) is positioned for substantial growth following its November 2025 Coinbase listing, which boosts liquidity and exposes it to millions of users. Projections account for Telegram’s vast ecosystem adoption, market cycles, and tech upgrades, with average prices rising from $2.40 in 2027 to $13.00 by 2032 (CAGR ~45% from 2026’s $1.39 baseline). Bullish max reflects full Telegram integration; bearish min considers regulatory hurdles.

Key Factors Affecting Toncoin Price

- Coinbase listing and multi-exchange support increasing liquidity and retail/institutional access

- Telegram’s 900M+ users fueling mini-apps, payments, and Web3 adoption

- TON blockchain scalability improvements and DeFi/GameFi expansions

- Favorable regulatory developments for Telegram-linked assets

- Crypto market bull cycles and Bitcoin halving effects

- Competition from L1/L2 blockchains and macroeconomic volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Businesses eyeing Telegram for Web3 entry find TON-USD trading a gateway. From NFT marketplaces to yield farms, liquidity inflows will spur innovation. This phase of TON ecosystem growth 2026 pivots on such milestones, transforming Telegram from messenger to economic hub.

“Coinbase will add support for Toncoin (TON) on The Open Network, ” reads the official tease, now reality.

Stakeholders should monitor volume metrics; sustained inflows could propel TON toward new highs, cementing its role in decentralized finance.

Developers building on TON now benefit from this liquidity lifeline, enabling faster iterations and larger-scale pilots. With Toncoin trading steadily at $1.39, the network’s total value locked shows promising upticks, signaling genuine utility beyond hype.

Unlocking Everyday Use Cases in Telegram

Telegram’s billion-strong audience transforms TON from a speculative asset into a practical currency. Channel owners can accept Toncoin USD trading on Coinbase inflows for premium content, while bots process microtransactions at negligible cost. This Coinbase Toncoin listing lowers barriers, letting users fund wallets directly via the exchange and spend seamlessly in-app. I’ve seen similar integrations spark viral growth; TON’s poised for that trajectory, especially with upcoming features like cross-chain transfers via Chainlink CCIP.

Learn how Toncoin powers payments for Telegram channel owners.

Such frictionless economics draw creators and merchants alike. Gaming mini-apps, already popular, gain from instant settlements, reducing churn and boosting retention. For businesses, this means embedding Web3 without forcing users off Telegram, a game-changer for Telegram TON adoption boost.

Key TON Use Cases Unlocked

-

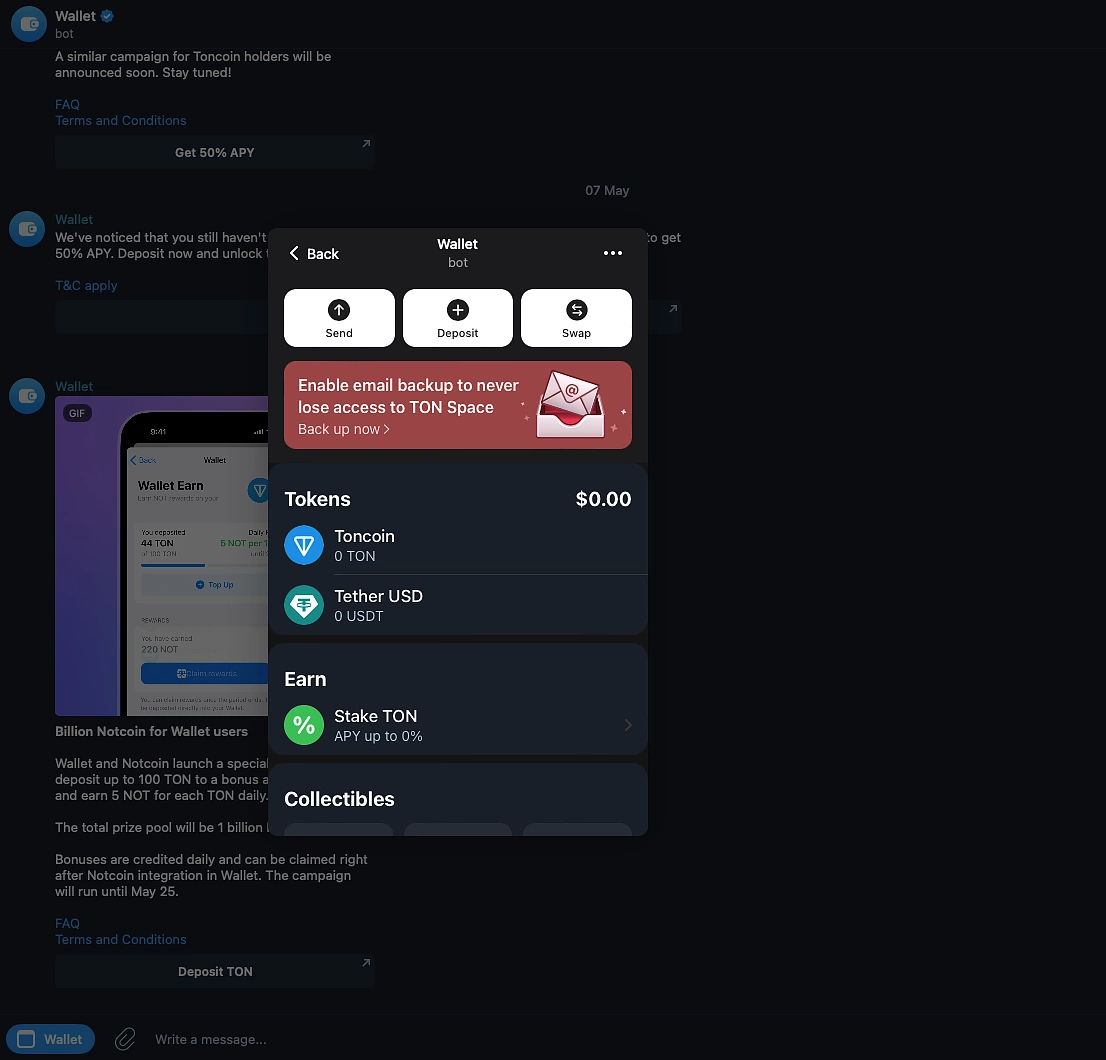

Telegram Payments: Send and receive Toncoin ($TON, currently at $1.39) directly in chats via the official @wallet bot, now easier with Coinbase’s TON-USD pair for quick fiat on-ramps.

-

Channel Monetization: Telegram channel owners earn Telegram Stars (convertible to TON) from paid subscriptions and gifts, boosted by Coinbase’s listing enhancing TON liquidity for global creators.

-

Bot Transactions: Automate payments to Telegram bots for services like premium access or custom tasks using TON, with Coinbase enabling seamless USD-to-TON conversions for users worldwide.

-

Mini-App Gaming: Play tap-to-earn games like Hamster Kombat or Notcoin in Telegram mini-apps, funding in-game items with TON purchased effortlessly on Coinbase.

-

NFT Drops: Collect and trade Telegram-linked NFTs on TON marketplaces like Getgems, with Coinbase’s spot trading (live since Nov 18, 2025) improving access and liquidity.

These applications compound network effects. As more users trade TON on Coinbase, on-chain volume rises, reinforcing the $1.39 price floor amid 2.48% daily gains. Highs near $1.42 underscore momentum without overextension.

Navigating Risks and Opportunities Ahead

No listing escapes scrutiny. Regulatory headwinds persist, yet Coinbase’s compliance framework shields TON users. Volatility remains; that 24-hour low of $1.34 tested resolve, but quick recovery affirms resilience. My hybrid analysis, blending macro trends with on-chain data, points to sustained inflows from institutional players like Coinbase Ventures, who bought directly from Telegram.

Opportunities abound in DeFi and socialFi. TON’s sharding ensures scalability for Telegram’s scale, outpacing congested rivals. Projects leveraging this for yield optimization or social tokens stand to capture outsized gains as liquidity deepens.

Investors should weigh these dynamics. At $1.39, TON offers entry before broader recognition hits. Pair this with Telegram’s Mini App Store expansions, and TON ecosystem growth 2026 looks robust.

Telegram wallet integrations further simplify adoption, turning casual chats into economic exchanges. Users send TON peer-to-peer or tip creators effortlessly, all backed by Coinbase’s infrastructure. This synergy bridges TradFi and DeFi, fulfilling my thesis on hybrid finance.

Dive into TON wallet’s role in Telegram adoption.

Forward-looking, expect partnerships amplifying TON Open Network support. From enterprise pilots to global remittances, TON carves a niche. Volumes post-listing already surpass pre-November levels, per ecosystem trackers. Sustained trading at highs around $1.42 bodes well for breaking resistance.

| Metric | Pre-Listing | Post-Listing |

|---|---|---|

| 24h Volume | Medium | High |

| Liquidity Depth | Moderate | Strong |

| User Onboarding | Steady | Accelerated |

Ultimately, Coinbase’s embrace positions TON as Telegram’s economic engine. Builders, investors, and users alike gain tools to thrive in this integrated future. Track on-chain metrics closely; they reveal the true adoption story beyond headlines.