As Toncoin trades at $0.6506, reflecting a 24-hour decline of -3.41% from a high of $0.6913, the broader narrative remains unequivocally bullish on institutional traction. This dip, while notable, underscores short-term volatility against a backdrop of structural advancements positioning TON for sustained growth in 2026. Key players like Zodia Custody, Kiln, and CoinShares are not merely facilitating access; they are architecting the infrastructure that transforms Toncoin from a Telegram-adjacent curiosity into a cornerstone of institutional portfolios. Their combined efforts in custody, staking, and exchange-traded products (ETPs) signal a maturation phase where compliance meets yield, drawing in regulated asset managers, hedge funds, and corporate treasuries.

Institutional staking, once viewed as an experimental foray into DeFi yields, has evolved into a core competency for sophisticated investors. Zodia Custody’s 2026 predictions report frames it starkly: staking will cease to be optional, becoming an operational imperative for compliant, risk-adjusted returns. This shift aligns perfectly with Toncoin’s Proof-of-Stake mechanics, where validators secure the network while generating rewards, now accessible through enterprise-grade solutions.

Zodia Custody Unlocks Regulated TON Exposure

Zodia Custody stands at the vanguard of this transition, bridging traditional finance’s rigor with TON’s high-throughput blockchain. Backed by heavyweights Standard Chartered and Northern Trust, Zodia’s expansion into Toncoin and Jettons in 2025 marked a watershed. Collaborations with Crypto. com delivered regulated custody, enabling hedge funds and corporates to hold TON assets under familiar governance frameworks. As detailed in TON’s 2025 institutional review, this support empowered regulated asset managers to integrate Toncoin seamlessly, mitigating counterparty risks that previously deterred allocation.

Looking to 2026, Zodia’s foresight extends to stablecoins as treasury staples, but TON staking emerges as the yield engine. Institutions can now stake without forsaking compliance, leveraging Zodia’s multi-party computation custody to safeguard keys while participating in network security. This isn’t peripheral utility; data from comparable Ethereum custodians like Cobo, Coinbase, and Fidelity illustrates a pattern where top-tier custody correlates with 20-30% higher institutional inflows. For Toncoin, trading at $0.6506, Zodia’s infrastructure could catalyze similar dynamics, especially as Telegram’s 900 million users amplify real-world adoption.

Kiln-Zodia Partnership Elevates TON Staking to Institutional Standards

January 2025 witnessed a pivotal alliance: Kiln and Zodia Custody teamed up to deliver enterprise-grade staking for TON alongside other PoS leaders. This partnership addresses a critical pain point; institutions demand not just yield but audited security and operational scalability. Kiln’s platform, known for its non-custodial staking infrastructure, integrates with Zodia’s regulated vaulting to offer seamless on-ramps for large-scale TON positions.

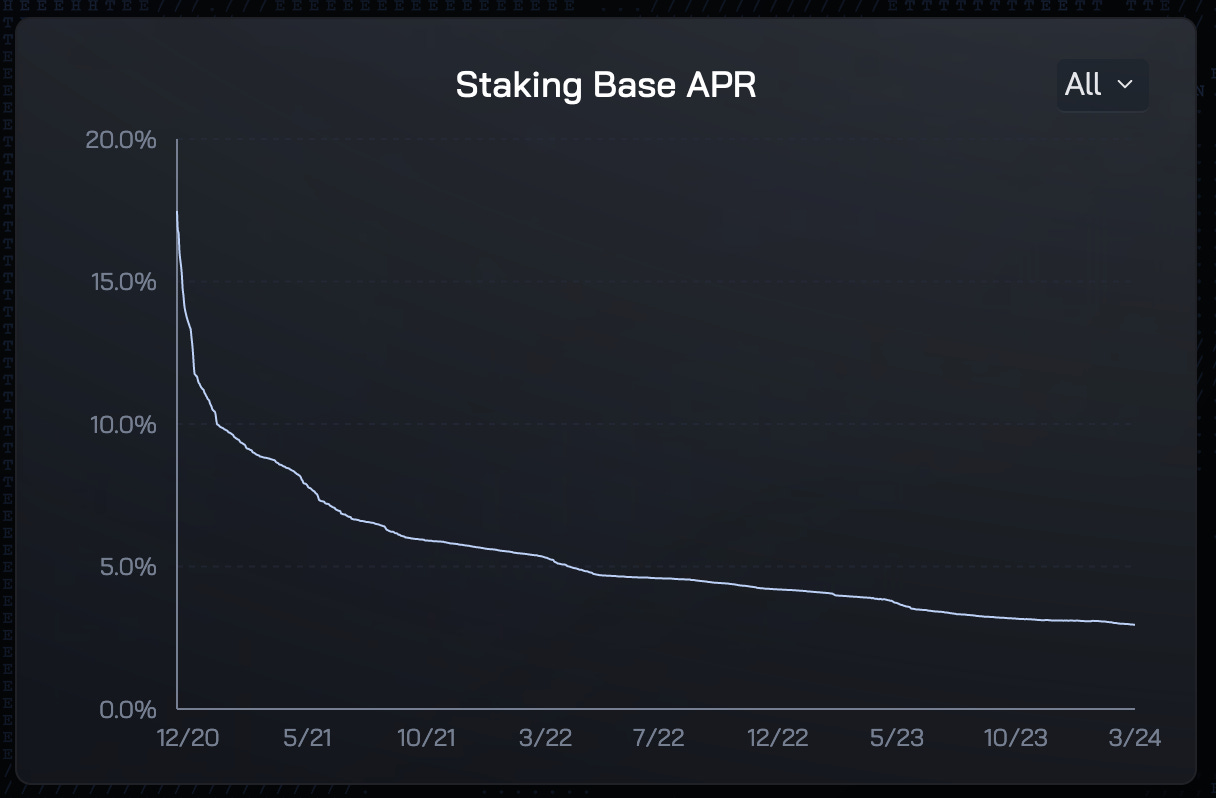

Quantitatively, TON staking yields hover around 4-5% annually, far outpacing traditional fixed-income alternatives amid elevated interest rates. For a portfolio holding Toncoin at $0.6506, this translates to compounded returns that enhance Sharpe ratios without exotic derivatives. Kiln’s tools further enable slashing protection and automated restaking, minimizing downtime risks that plague retail stakers. In my analysis, this duo positions TON treasury strategies ahead of peers; AlphaTONCapital and tonstrat proponents will note how such primitives enable sophisticated DeFi plays within compliant wrappers.

Toncoin (TON) Price Prediction 2027-2032

Institutional Adoption Driving Growth: Zodia Custody, Kiln Staking, CoinShares & 21Shares ETPs

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth % (Avg) |

|---|---|---|---|---|

| 2027 | $1.50 | $3.00 | $6.00 | +50% |

| 2028 | $2.00 | $5.00 | $10.00 | +67% |

| 2029 | $3.00 | $8.00 | $15.00 | +60% |

| 2030 | $4.50 | $12.00 | $22.00 | +50% |

| 2031 | $6.00 | $18.00 | $32.00 | +50% |

| 2032 | $8.00 | $25.00 | $45.00 | +39% |

Price Prediction Summary

Toncoin (TON) is forecasted to experience substantial growth from 2027 to 2032, propelled by accelerating institutional adoption through regulated custody (Zodia, Crypto.com), staking services (Kiln), and yield-bearing ETPs (CoinShares, 21Shares). Starting from an estimated 2026 average of $2.00, prices could average $25.00 by 2032 in the base case, with bullish highs up to $45.00 amid Telegram ecosystem expansion and market bull cycles. Bear cases account for corrections, maintaining progressive upside.

Key Factors Affecting Toncoin Price

- Institutional staking normalization via Zodia Custody, Kiln, and Crypto.com partnerships

- CoinShares Physical Staked Toncoin ETP (0% fees, 2% yield) and 21Shares TONN ETP driving European inflows

- Telegram’s 900M+ user base enhancing on-chain activity and Jetton token adoption

- Regulatory clarity boosting institutional custody and treasury allocation

- High-performance blockchain (high TPS) positioning TON competitively against L1 rivals

- Post-halving market cycles (2028, 2032) amplifying altcoin gains

- Potential market cap expansion from ~$1.6B to $50B+ by 2032 in bullish scenarios

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

CoinShares ETP Pioneers Zero-Fee Staked TON Access

CoinShares amplified this momentum in October 2025 with the launch of the CoinShares Physical Staked Toncoin ETP (CTON) on the SIX Swiss Exchange. Boasting 0% management fees – a crypto ETP first – and a targeted 2% staking yield, CTON democratizes TON exposure for European investors. Physically backed and sharing staking rewards directly, it sidesteps the fee drag that erodes returns in traditional products.

Complementing this, 21Shares’ Toncoin Staking ETP (TONN) offers a 1.92% yield with 100% physical backing, further validating the model. CoinShares’ 2026 outlook underscores hybrid finance’s rise, where tokenised funds and ETPs fuse digital assets with TradFi liquidity. At current levels of $0.6506, these vehicles provide a low-friction entry, potentially channeling billions from ETF-savvy inflows. Historically, similar Bitcoin and Ethereum ETPs have captured 10-15% of eligible AUM within the first year; TON’s unique Telegram synergy could accelerate this to 20% or more, driven by Jetton ecosystem expansion.

These ETPs are not isolated launches; they form part of a compounding flywheel where custody begets staking, and staking fuels listed products. For asset allocators eyeing Toncoin at $0.6506, the 24-hour low of $0.6406 highlights entry opportunities amid volatility, but the real alpha lies in ecosystem depth. Jettons, TON’s native tokens, now benefit from Zodia’s custody umbrella, enabling tokenized real-world assets (RWAs) and DeFi primitives tailored for corporate balance sheets.

Crypto. com Bolsters TON Custody Amid Custodian Rankings

Crypto. com’s custody arm has deepened its TON commitment, aligning with Zodia to offer end-to-end support for institutions. This expansion coincides with Cobo’s 2026 custodian rankings, where Bitcoin and Ethereum leaders like Coinbase, Fidelity, and Anchorage set benchmarks: audited reserves, insurance coverage exceeding $500 million, and 99.99% uptime. TON custodians must match this rigor, and Crypto. com’s moves position it competitively, especially as Zodia’s parentage lends blue-chip credibility. In 2025 reviews, such infrastructure enabled hedge funds to deploy TON in yield strategies, blending network rewards with Telegram’s mini-app virality.

Quantifying impact, institutional custody inflows historically boost network TVL by 15-25% within quarters, per Ethereum analogs. For TON, with staking yields at 4-5%, a $1 billion inflow at $0.6506 equates to roughly 1.5 billion tokens staked, fortifying decentralization while distributing rewards. My view: this isn’t hype; it’s fundamentals aligning with market cycles, where post-halving Bitcoin dynamics mirror TON’s maturation.

TON Treasury Strategies: From Yield to Alpha Generation

Forward-thinking treasuries, inspired by AlphaTONCapital and tonstrat frameworks, now treat TON as a hybrid asset: yield-bearing collateral with programmable upside. Zodia’s 2026 stablecoin predictions – instant settlement and on-demand yield – dovetail with TON’s Notcoin and Hamster Kombat surges, proving Telegram’s 900 million users as a distribution moat. Institutions can deploy TON in treasury stacks: 20% allocation for staking, 10% in Jetton RWAs, hedged via ETPs. At current pricing, a $10 million position yields $400,000-$500,000 annually, risk-adjusted against Treasuries yielding sub-4%.

Key TON Staking Advantages

-

4-5% Yields: Outperform traditional bonds with compliant returns, as staking becomes an operational necessity per Zodia Custody’s 2026 predictions.

-

Regulated Custody: Secure staking via Zodia Custody & Kiln partnership for TON and PoS assets.

-

Zero-Fee ETPs: CoinShares Physical Staked Toncoin (CTON) offers 0% management fees and ~2% staking yield.

-

Telegram Growth: 900M+ users drive adoption, integrating TON into everyday finance via high-performance blockchain.

-

Slashing Protection: Automated safeguards from Kiln/Zodia ensure institutional-grade security and uptime.

-

Jetton Support: Diversify with TON’s native tokens, backed by custodians like Zodia for regulated holding.

CoinShares’ outlook on hybrid finance reinforces this: tokenized funds will dominate, with TON’s low fees (under $0.01 per tx) outpacing Ethereum L2s for treasury ops. Copper Clear (formerly CopperHQ) and similar platforms hint at next-gen clearing for TON derivatives, but Zodia-Kiln leads today.

TON ETP Comparison

| Feature | CoinShares CTON | 21Shares TONN |

|---|---|---|

| Management Fees | 0% | — |

| Staking Yield | 2% p.a. | 1.92% p.a. |

| Exchange | SIX Swiss Exchange | — |

| Backing | Physical Staked Toncoin | 100% Physical Toncoin |

| AUM Potential | Billions via institutional inflows | Billions via institutional inflows |

Challenges persist: regulatory scrutiny and oracle risks in staking. Yet, Zodia’s multi-party computation and Kiln’s slashing insurance mitigate these, outperforming retail protocols. Data from 2025 shows TON’s validator set grew 40% post-custody launches, signaling robustness.

2026 Horizon: Institutional Imperative Meets TON Scale

By 2026, Zodia posits staking as non-negotiable, much like fixed income in portfolios. TON’s trajectory – custody from Zodia/Crypto. com, staking via Kiln, ETPs from CoinShares/21Shares – positions it for $5-10 billion institutional AUM. Trading at $0.6506 with a -3.41% 24-hour mark, dips like today’s low of $0.6406 invite accumulation. Telegram integration ensures utility beyond speculation: payments, gaming, socialFi. For managers, TON offers uncorrelated returns; for developers, scalable L1. This ecosystem alchemy, rooted in compliant primitives, heralds Toncoin’s leap from niche to necessity.

Stake size matters in crypto, and TON’s institutional scaffolding delivers. With yields compounding and products proliferating, 2026 adoption accelerates, rewarding patient allocators who bet on infrastructure over impulse.