Telegram’s Gifts are getting a game-changing upgrade: mergeability. Imagine combining those digital trinkets you’ve collected into rarer, powerhouse NFTs. This Telegram Gifts mergeable feature on the TON blockchain promises to slash NFT supply dramatically, from around 2.4 million holders toward roughly 600,000 unique assets. It’s a smart play to boost rarity, value, and most importantly, Toncoin adoption through everyday Telegram interactions.

Right now, Toncoin trades at $0.7098, dipping slightly by -0.003940% over the last 24 hours, with a high of $0.7263 and low of $0.7050. This stability amid broader crypto volatility underscores TON’s resilience, fueled by innovations like this upgrade.

How the Mergeable Upgrade Transforms Telegram Gifts

Telegram Gifts started as fun, blockchain-backed NFTs users send to friends, powered by TON for seamless, low-cost minting and transfers. But with millions in circulation, their appeal risked dilution. Enter mergeability: users can now fuse multiple identical or compatible Gifts into a single, upgraded NFT. Think of it like alchemy for digital collectibles – two common Gifts become one rare epic.

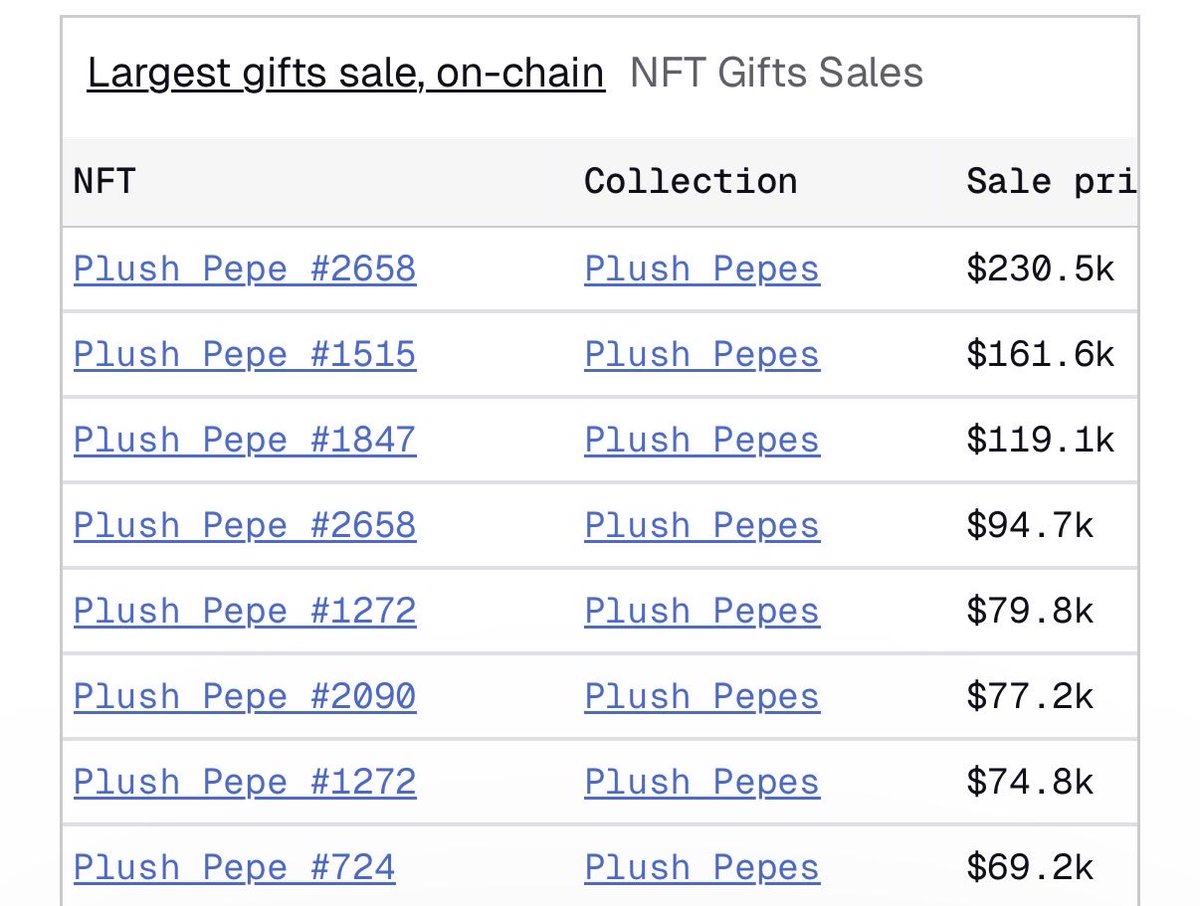

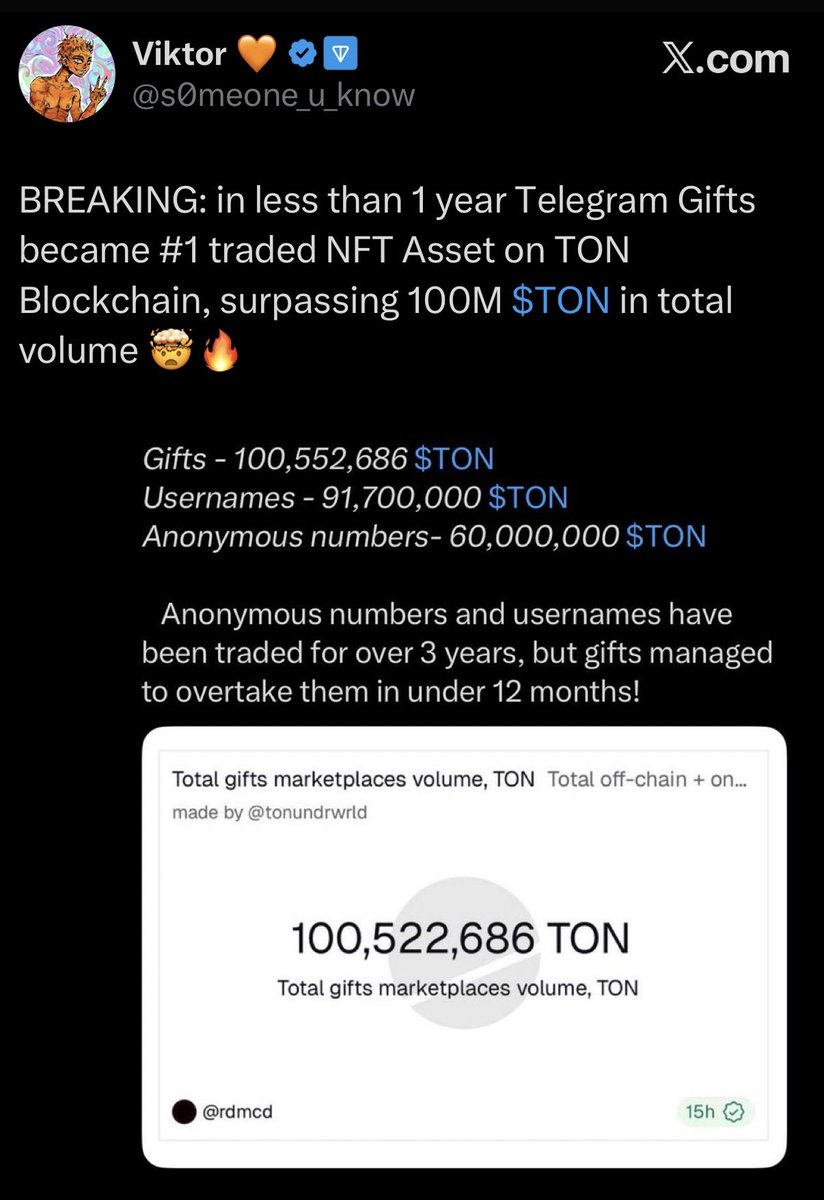

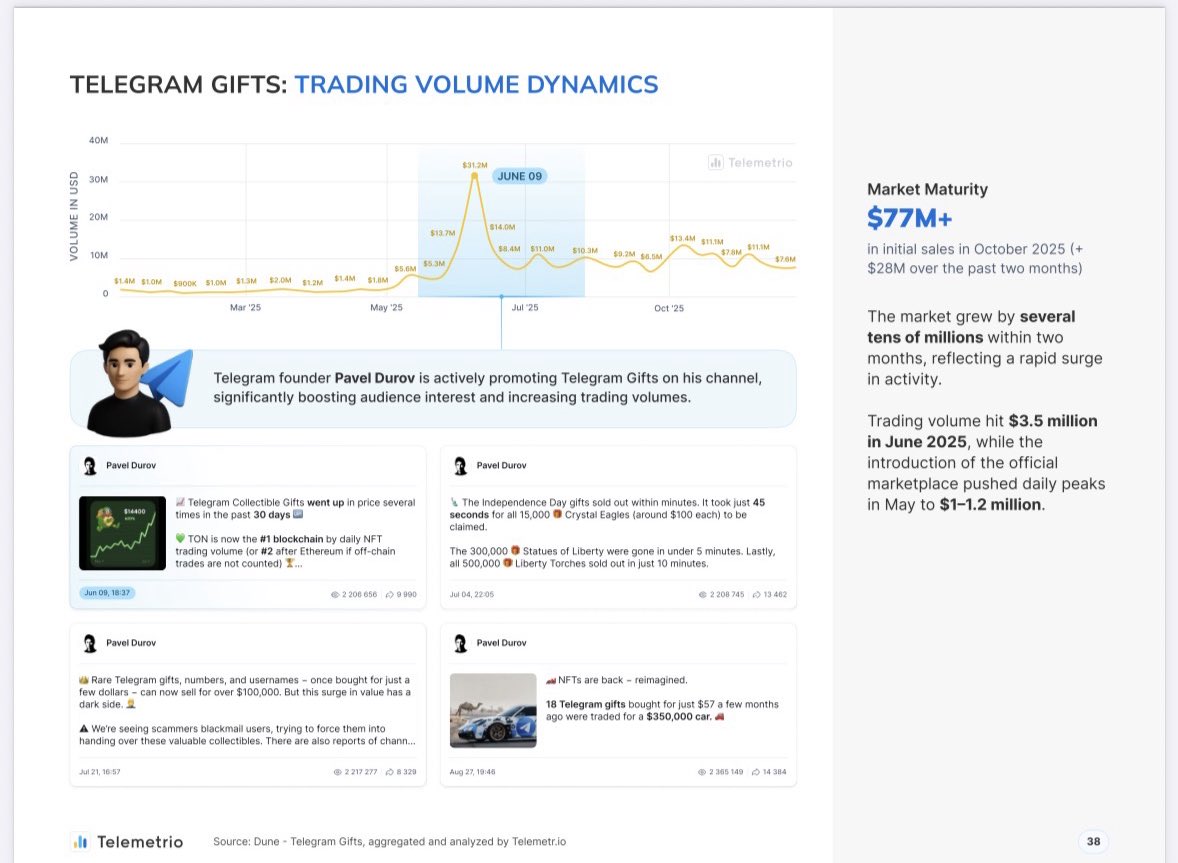

This isn’t just cosmetic. Merging burns the originals, permanently reducing TON NFT gifts supply reduction. Viktor from the TON community highlighted this on X, noting Telegram’s aggressive push into NFT Gifts development. The result? Scarcity surges, prices climb, and trading volume on TON explodes, drawing in collectors and speculators alike.

Practically, it’s user-friendly. Open your Telegram wallet, select Gifts to merge, confirm the TON fee (pennies, thanks to TON’s speed), and voila – a shinier asset in your collection. This embeds blockchain utility into casual messaging, onboarding millions without jargon.

Supply Shock: From Abundance to Rarity on TON

Current stats paint a clear picture: over 2.4 million Gift holders, but post-merge, that could consolidate to 600,000 or fewer. Each merge event destroys supply, mimicking token burns that have already trimmed Toncoin’s circulating supply by billions through staking locks. This ton nft gifts supply reduction mirrors successful NFT projects where utility-driven mechanics skyrocket floor prices.

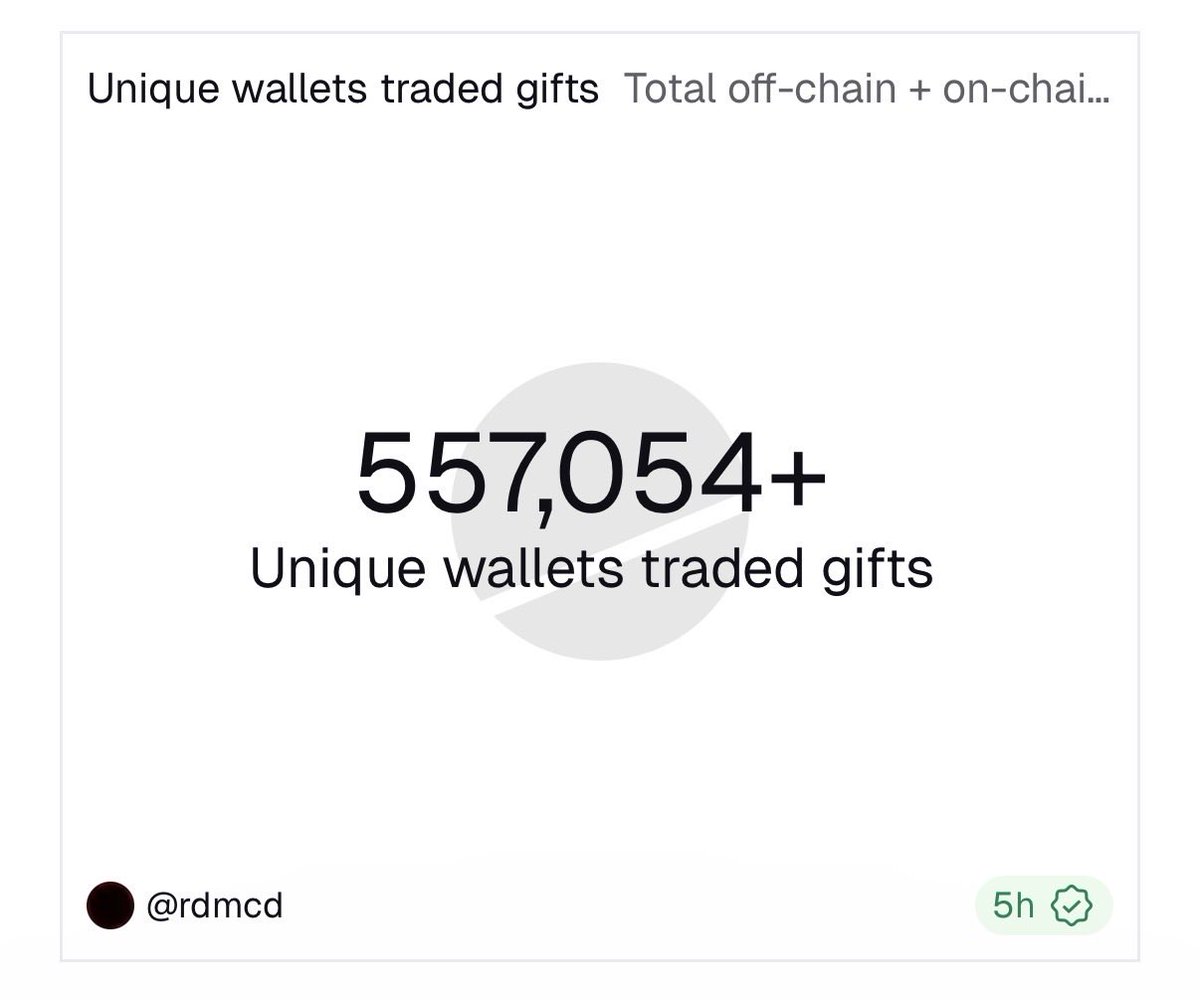

Look at recent hype. Snoop Dogg’s Telegram NFT Gifts collection sold out in 30 minutes, pulling in $12 million on TON. Pavel Durov himself touted it on X. That’s not anomaly; it’s proof of Telegram’s 900 million users discovering blockchain value. Mergeability amplifies this, turning passive holders into active participants who pay in Toncoin for upgrades.

- Fewer total Gifts mean higher per-asset demand.

- Upgraded tiers unlock exclusive perks, like premium Mini App access.

- TON blockchain’s 10x transaction speed improvements handle the surge effortlessly.

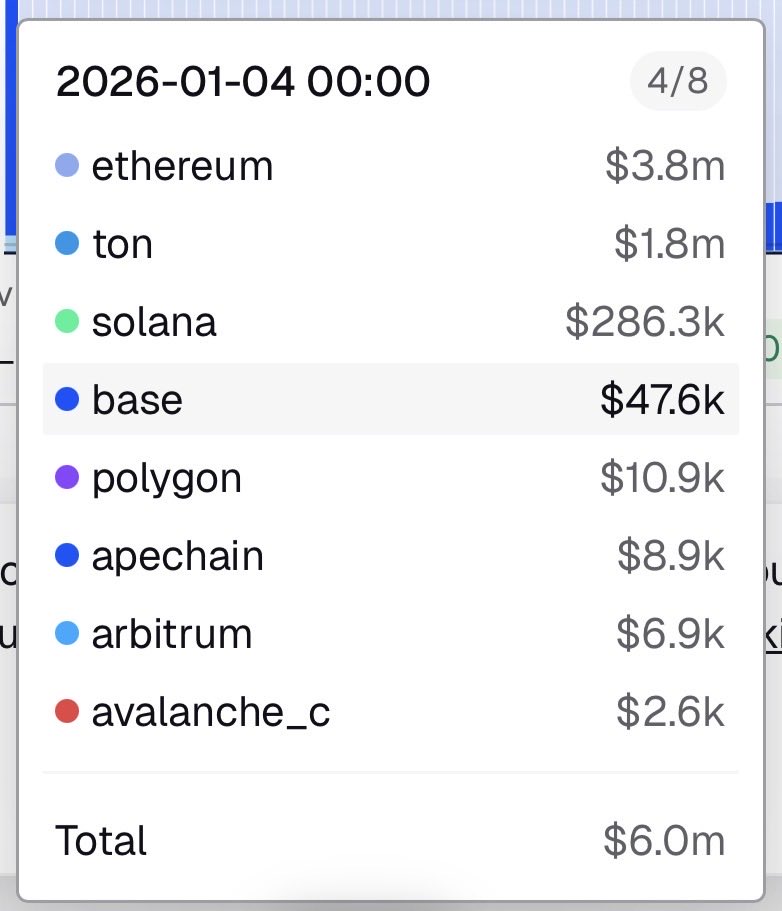

DeFi on TON has seen trading volumes jump 97% to $345 million recently, per ecosystem updates. Gifts merging funnels that liquidity straight to Toncoin, as every action requires it.

Accelerating Toncoin Adoption Through Social Capital

TON. org calls it “social capital” – Gifts as verifiable ownership in Telegram’s ecosystem. This upgrade cements toncoin adoption telegram gifts, blending Web3 with Web2’s stickiest app. Mini Apps like DOGS’ Gift Fest already tap play-to-earn, with tokens like NOT and MAJOR thriving on STON. fi.

Former TON Foundation leaders emphasize scaling via Telegram’s gateway status. Locking events reduced Toncoin supply by 2.3 billion tokens; now, NFT mechanics do the same for Gifts. Users buy Toncoin to gift, merge, trade – creating a virtuous cycle.

TON’s edge sharpens as Telegram Mini Apps explode, channeling users into blockchain experiences. Games like DOGS’ Gift Fest blend seasonal fun with token rewards, all settled in Toncoin. Platforms like STON. fi buzz with activity – USD₮, NOT, and MAJOR lead trading pairs, proving liquidity is no issue even at Toncoin’s steady $0.7098.

This mergeable mechanic doesn’t stop at collectibles. It sparks a flywheel for ton blockchain nft volume. Traders flock to marketplaces, swapping upgraded Gifts for Toncoin profits. Developers integrate it into dApps, creating gift-based economies. Everyday users, unaware they’re using DeFi, gift and merge – onboarding at scale.

Why Mergeability Fuels Everyday Toncoin Use

Picture this: you send a Gift to celebrate a friend’s birthday. They merge it with theirs for a rare version, trade it on a TON DEX, and buy more Toncoin. Each step demands TON for gas fees, swaps, and listings. With transaction speeds now 10x faster, it’s frictionless. No wonder DeFi volumes hit $345 million, up 97%.

It’s opinion time: this feels like the killer app crypto’s chased forever. Not clunky wallets or abstract yields, but social gifting turned asset alchemy. Telegram’s 900 million users hold the key to toncoin adoption telegram gifts. Mergeability lowers the barrier, making rarity tangible and rewarding.

Key Mergeable Gifts Benefits

-

Reduces NFT supply for higher value: Merging gifts dramatically cuts total supply (e.g., from millions held by 2.4M users), increasing rarity and prices on TON.

-

Boosts Toncoin demand via fees: Merging transactions require Toncoin ($0.7098) fees, driving utility and adoption on TON blockchain.

-

Enhances rarity tiers with perks: Combine gifts to unlock higher tiers offering exclusive benefits and collectible appeal.

-

Drives trading volume on TON DEXes: Rarity boosts activity on platforms like STON.fi, surging DeFi volumes.

-

Onboards users via fun interactions: Easy merging in Telegram Mini Apps turns gifting into engaging blockchain entry point.

TON’s design shines here – sharded architecture handles spikes from viral merges without hiccups. Compare to congested chains; TON processes thousands per second, pennies per tx. That’s developer catnip, luring more Mini Apps and protocols.

Ecosystem Synergies: Gifts Meet DeFi and Gaming

Gifts aren’t isolated. Pair them with STON. fi for instant liquidity, or DOGS for gamified earning. Recent ecosystem updates spotlight this: Snoop Dogg’s drop wasn’t solo; it ignited a wave. Pavel Durov’s X post amplified the buzz, selling out in 30 minutes for $12 million. Mergeability takes that energy mainstream.

Staking locks have burned 2.3 billion Toncoin already. Now, NFT burns add deflationary pressure on Gifts, indirectly propping Toncoin utility. At $0.7098, with a 24-hour range of $0.7050 to $0.7263, it’s poised for upside as adoption compounds.

Telegram and TON form the ultimate Web3 gateway, turning messages into money-makers.

Animoca Brands’ podcast with TON execs nails it: scale via Telegram’s reach. dApps thrive on rapid tx, diverse use cases. From play-to-earn to social capital, telegram mergeable gifts ton threads it together.

Forward thinkers see TON as DeFi’s next hub. With mergeable Gifts slashing supply and spiking engagement, Toncoin’s path to billions in daily volume clears. Holders at $0.7098 aren’t just speculating; they’re betting on a network where utility meets ubiquity. Dive in, merge up, and watch adoption accelerate.