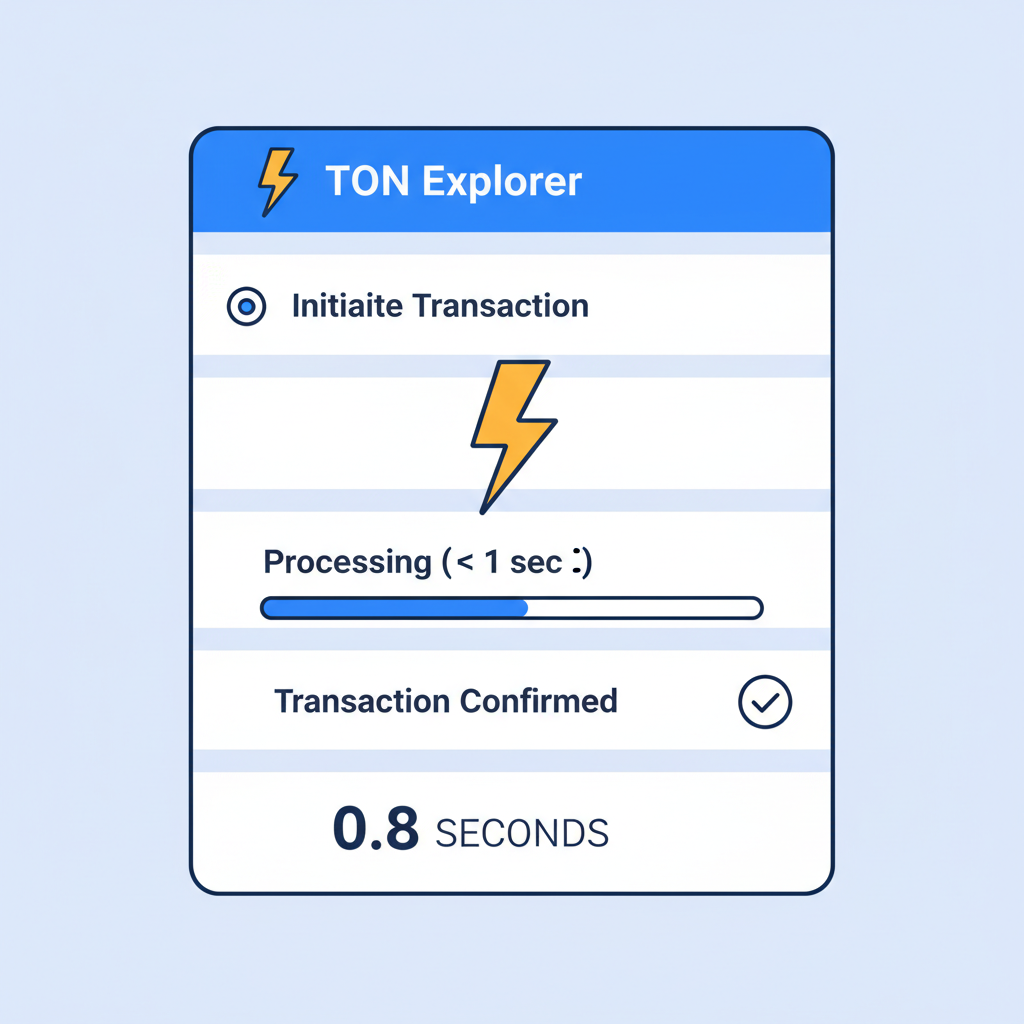

The Open Network (TON) just hit a game-changing milestone on its testnet: transactions finalizing in under one second. This TON sub 1 second transactions breakthrough slashes the typical five-second wait for block minting, making Toncoin interactions feel instantaneous. With Toncoin trading at $1.51 after a 24-hour dip of $-0.0120 (-0.7900%), this Toncoin testnet speed upgrade arrives at a pivotal moment, fueling excitement for broader Telegram blockchain fast finality.

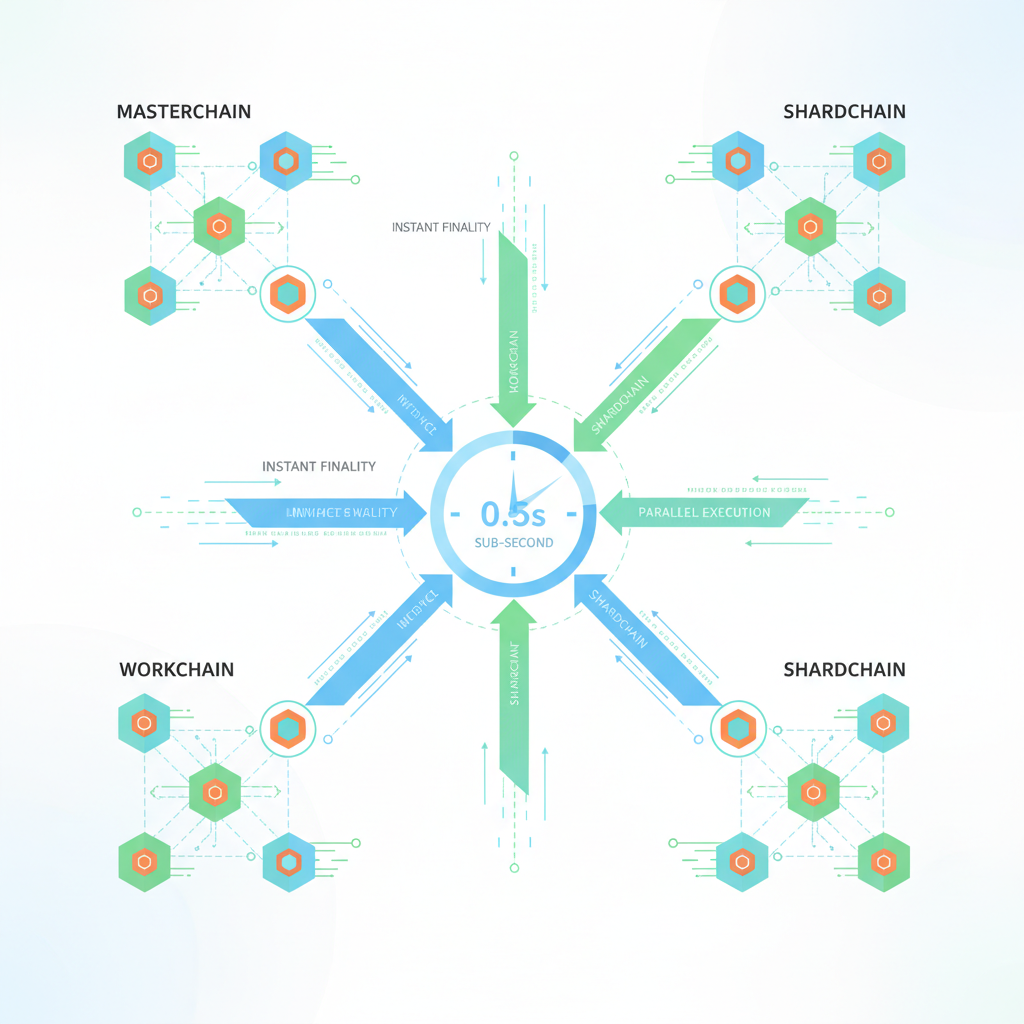

TON’s architecture, built for massive scale, already handles over 20,000 transactions per second with fees under $0.01. But sub-second finality elevates it from capable to unbeatable for real-world apps. Imagine sending Toncoin via Telegram without the lag that plagues other chains; this is the seamless experience users crave.

Understanding Transaction Finality in TON

Transaction finality means a blockchain operation is irreversible, no forks or reorgs possible. On TON, it traditionally took about five seconds per block. Now, testnet demos prove TON real-time transactions adoption is viable, confirming transfers almost instantly. Tonscan defines a TON transaction as transferring assets or data between accounts, and this speed makes them feel like app notifications.

Why does this matter? Speed barriers kill user retention. Slow finality leads to failed swaps, anxious waits, and abandoned wallets. TON’s leap addresses that head-on, positioning Toncoin as the go-to for high-volume dApps.

TON Testnet: The Engine of Innovation

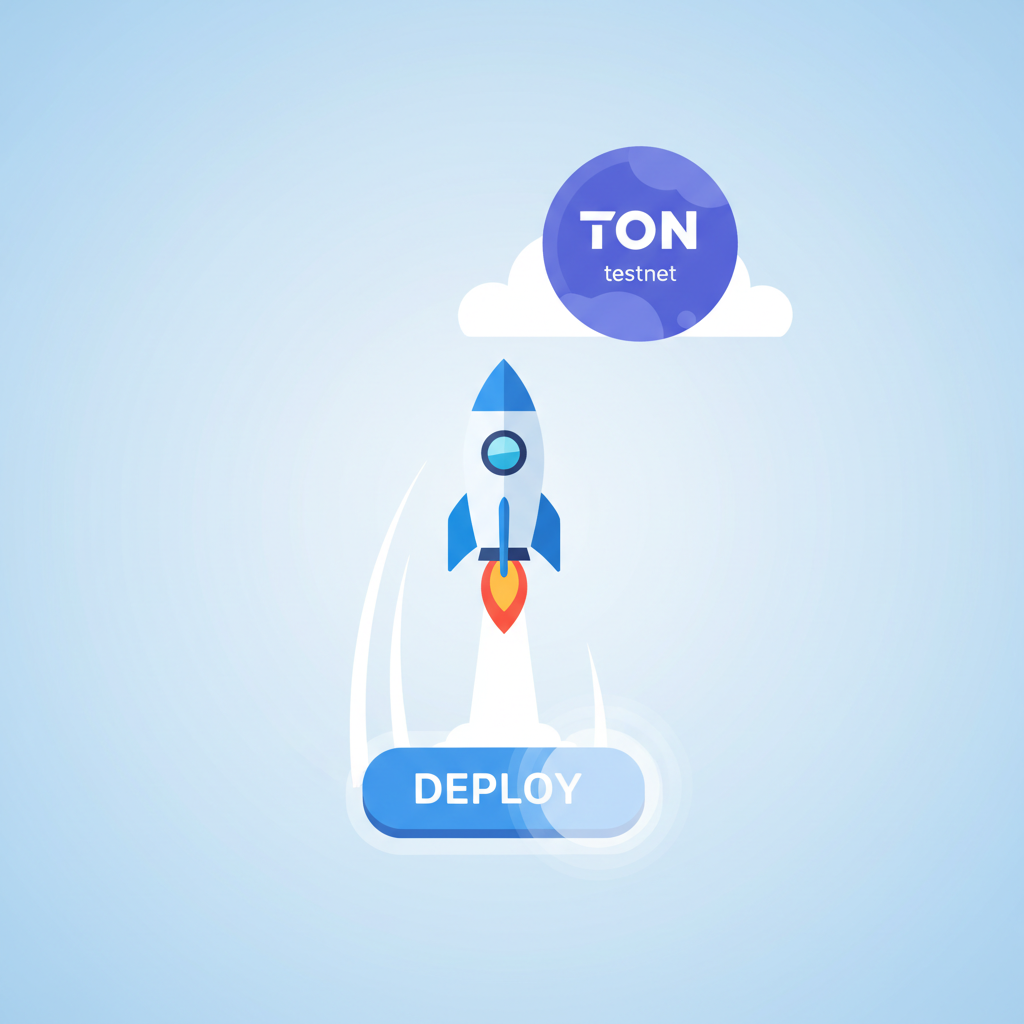

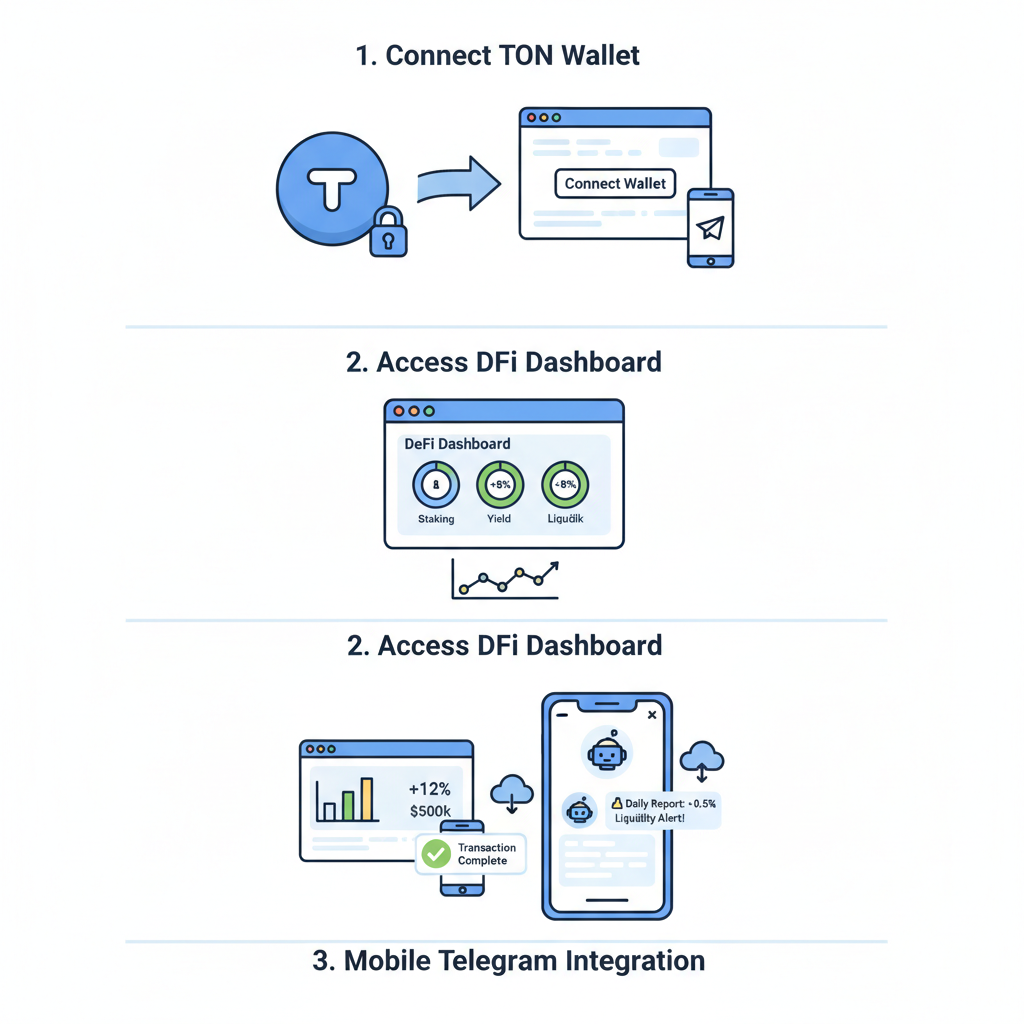

TON’s testnet isn’t playground stuff; it’s where bleeding-edge features like this Toncoin scalability improvements get battle-tested before mainnet. Developers use it via wallets like MyTonWallet, a non-custodial option blending security and speed. GitHub docs confirm mainnet and testnet are the core networks, with no splinter chains planned soon.

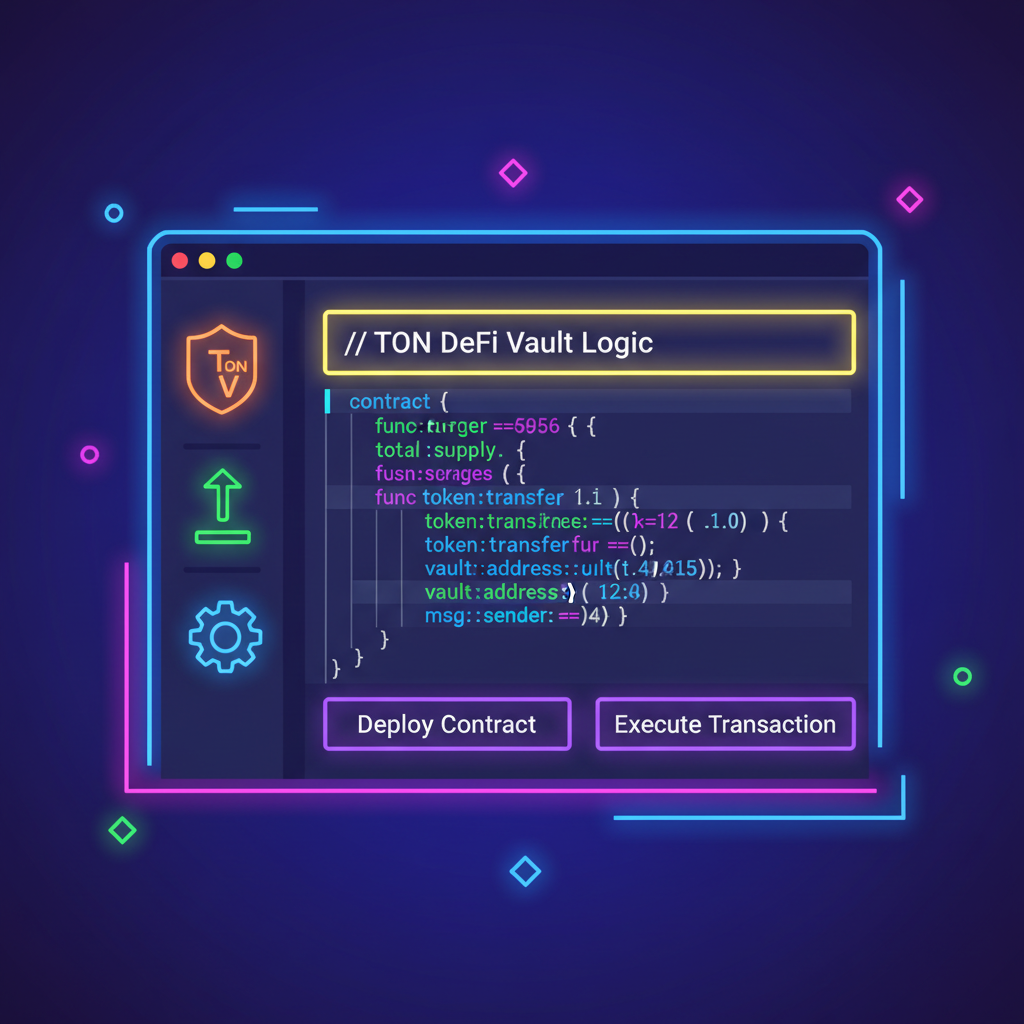

YouTube tutorials from creators like Nikandr Surkov guide building DeFi on TON’s testnet chain, emphasizing wallet integration and blockchain basics. This environment lets projects simulate real loads, proving sub-second finality holds under pressure. Tonscan’s testnet explorer lets anyone peek at these lightning-fast ops right now.

Historically, TON wallets in Telegram processed over a billion transactions in 2024, thanks to low fees and quick confirmations. Dropping to sub-second? That’s rocket fuel for tap-to-earn games, mini-apps, and payments exploding across 900 million Telegram users.

Why Sub-Second Speed Drives Toncoin Adoption

TON’s Telegram roots give it a distribution edge no other chain matches. Embedded wallets mean one-tap Toncoin sends, no clunky extensions needed. With testnet proving Telegram blockchain fast finality, expect a surge in on-ramps for casual users dipping into DeFi or NFTs.

This isn’t hype; it’s mechanics meeting mass markets. High throughput plus instant finality crushes congestion issues on Ethereum or Solana during peaks. Toncoin at $1.51 reflects steady value amid upgrades, with 24-hour range from $1.51 low to $1.54 high signaling resilience.

Toncoin (TON) Price Prediction 2027-2032

Forecasting impacts of sub-1 second transaction finality on adoption and value growth within the Telegram ecosystem

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.80 | $3.20 | $5.50 | +112% |

| 2028 | $2.50 | $5.00 | $8.00 | +56% |

| 2029 | $3.50 | $7.50 | $12.00 | +50% |

| 2030 | $4.00 | $10.00 | $16.00 | +33% |

| 2031 | $5.00 | $13.00 | $20.00 | +30% |

| 2032 | $6.00 | $16.50 | $25.00 | +27% |

Price Prediction Summary

Toncoin is forecasted to see significant appreciation from its 2026 price of $1.51, driven by sub-1 second finality on testnet, enabling ultra-fast transactions and boosting Telegram-integrated adoption. Base case average reaches $16.50 by 2032, with bullish maxima reflecting market cycles and scalability advantages.

Key Factors Affecting Toncoin Price

- Sub-1 second transaction finality enhancing real-time usability and scalability (>20,000 TPS)

- Deep Telegram integration tapping into 900M+ users for mass adoption and tap-to-earn growth

- Ultra-low fees (<$0.01) fostering DeFi, wallets, and dApps

- Progressive market cycles with potential bull runs post-2026 halving influences

- Regulatory developments favoring efficient L1 blockchains

- Competition dynamics vs. Solana/Ethereum, where TON’s speed and ecosystem give edge

- Fundamental adoption trends from testnet successes to mainnet rollout

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Predictions like those highlight how sub-second finality could propel Toncoin’s value as adoption ramps up, especially with its current steady price of $1.51 despite a minor 24-hour dip of $-0.0120 (-0.7900%).

Developers: Build Faster, Scale Bigger

For developers eyeing Toncoin scalability improvements, this testnet upgrade is a green light. TON’s sharding and async architecture already deliver 20,000 and TPS, but instant finality means dApps won’t stutter under load. Picture high-frequency trading bots or real-time gaming economies running flawlessly on Telegram mini-apps. Resources like Tonscan’s testnet explorer let you verify these speeds yourself, watching transactions zip through in real time.

Non-custodial wallets such as MyTonWallet make testing seamless, combining top-tier security with the speed users expect. GitHub’s TON Connect guidelines keep things straightforward: stick to testnet for experiments, mainnet for production. No fragmented networks to confuse integrations.

Tutorials like that one demystify the process, showing how to deploy smart contracts that leverage sub-second confirmations. I’ve seen projects pivot to TON after battling latency elsewhere; this cements its edge for DeFi innovators.

Real-World Use Cases Explode

Telegram’s 900 million users are TON’s secret weapon. Tap-to-earn games already notched a billion transactions in 2024 with fees under $0.01 and quick finality. Sub-one-second drops that to notification speed, perfect for micro-payments, social tipping, or instant NFT mints mid-chat.

TLN Vault promises lightning-fast experiences, and testnet proves it. Businesses can now embed Toncoin payments without friction, from e-commerce bots to creator economies. This isn’t theoretical; it’s the bridge from crypto curiosity to daily habit.

TON Testnet vs Competitors: Speed & Cost Comparison ⚡

| Blockchain | Finality Time | TPS | Avg Fee (USD) |

|---|---|---|---|

| TON Testnet 💎 | <1s ⚡ | 20,000+ 🚀 | <$0.01 💰 |

| Ethereum | 12s 🐢 | 15-30 | ~$1 😤 |

| Solana | 1-2s ⚡ | 2,000 avg | ~$0.00025 💸 |

That table underscores why TON pulls ahead. Competitors hit walls during hype cycles; TON thrives on volume, mirroring Telegram’s scale.

Adoption metrics back it up. Embedded wallets drove explosive growth last year, and this speed boost targets the next billion interactions. Toncoin at $1.51 holds firm, with a tight 24-hour range ($1.51 low, $1.54 high), signaling market confidence amid upgrades.

From Testnet to Mass Mainnet Rollout

Mainnet deployment can’t come soon enough. Testnet success minimizes risks, ensuring smooth rollout without the hiccups that derail chains. Community buzz on X, from Fissionera to 0xdamx, reflects genuine momentum: “major speed improvements just went live. “

Strategic plays amplify this. Projects should prioritize Telegram integrations, tap community grants, and stress-test on Tonscan. For investors, Toncoin’s resilience at $1.51 positions it for upside as finality goes live chain-wide. Enthusiasts, grab a testnet wallet and send a few Toncoin; feel the future yourself.

TON isn’t chasing trends; it’s redefining blockchain usability. Sub-second finality on the Telegram blockchain turns Toncoin into everyday money, one instant transaction at a time. Watch adoption skyrocket as the world catches up.