Imagine firing up Telegram, your everyday chat app with over 900 million monthly users, and seamlessly depositing USDC from Ethereum or Solana straight into your TON multi-chain wallet without bridges or extra apps. That’s the reality in 2026, thanks to Telegram’s self-custodial TON Wallet launching cross-chain deposits. With Toncoin holding steady at $0.5345 – up a modest and $0.009990 ( and 0.0191%) in the last 24 hours – this integration is fueling Toncoin Telegram integration 2026 like never before. It’s not hype; it’s actionable momentum for anyone serious about crypto adoption.

Telegram’s exclusive partnership with the TON Foundation, locked in January 2025, mandates TON Connect for all Mini Apps wallets. This isn’t just tech talk – it consolidates everything on TON, slashing friction for users dipping into Web3 via stickers, games, or payments. Toncoin’s efficiency shines here: sub-second txs, tiny fees, and now multi-chain inflows that could pump liquidity ecosystem growth.

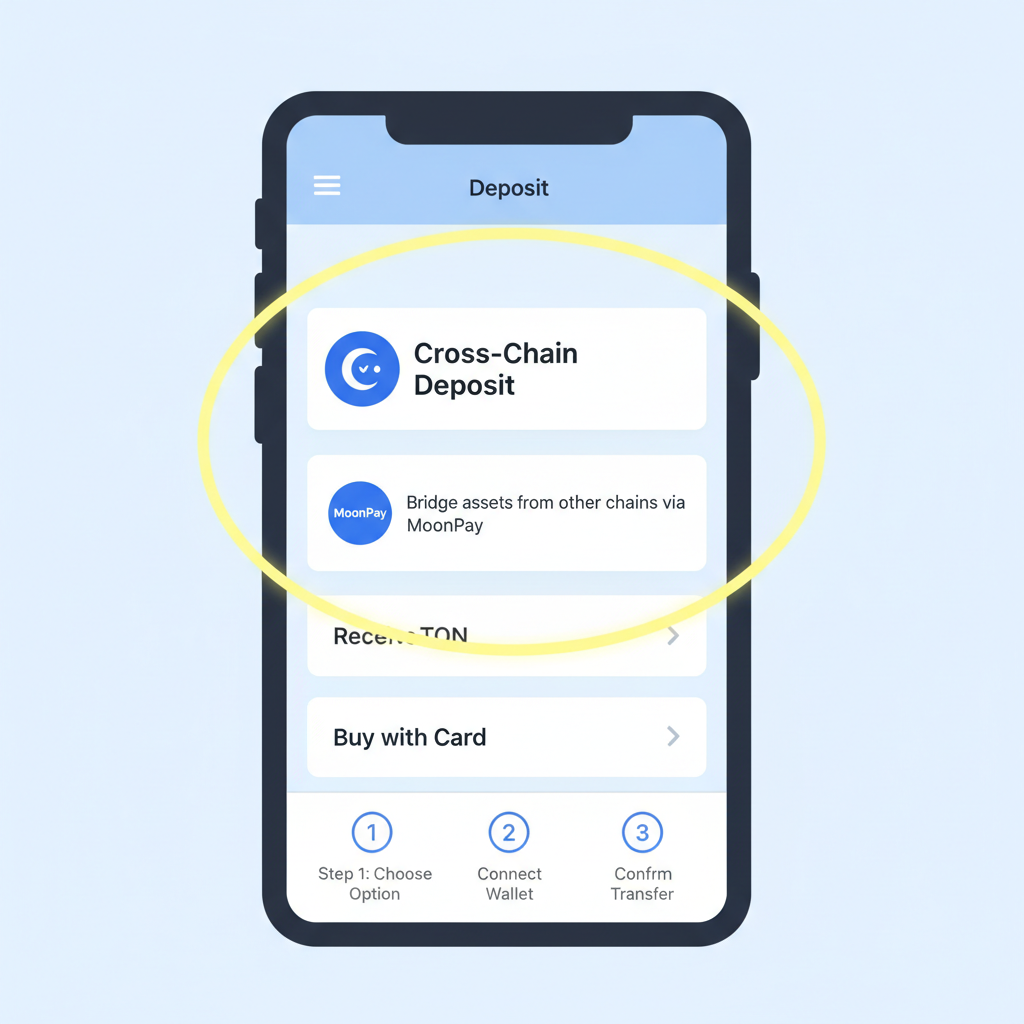

Cross-Chain Deposits via MoonPay: No More Chain-Hopping Hassles

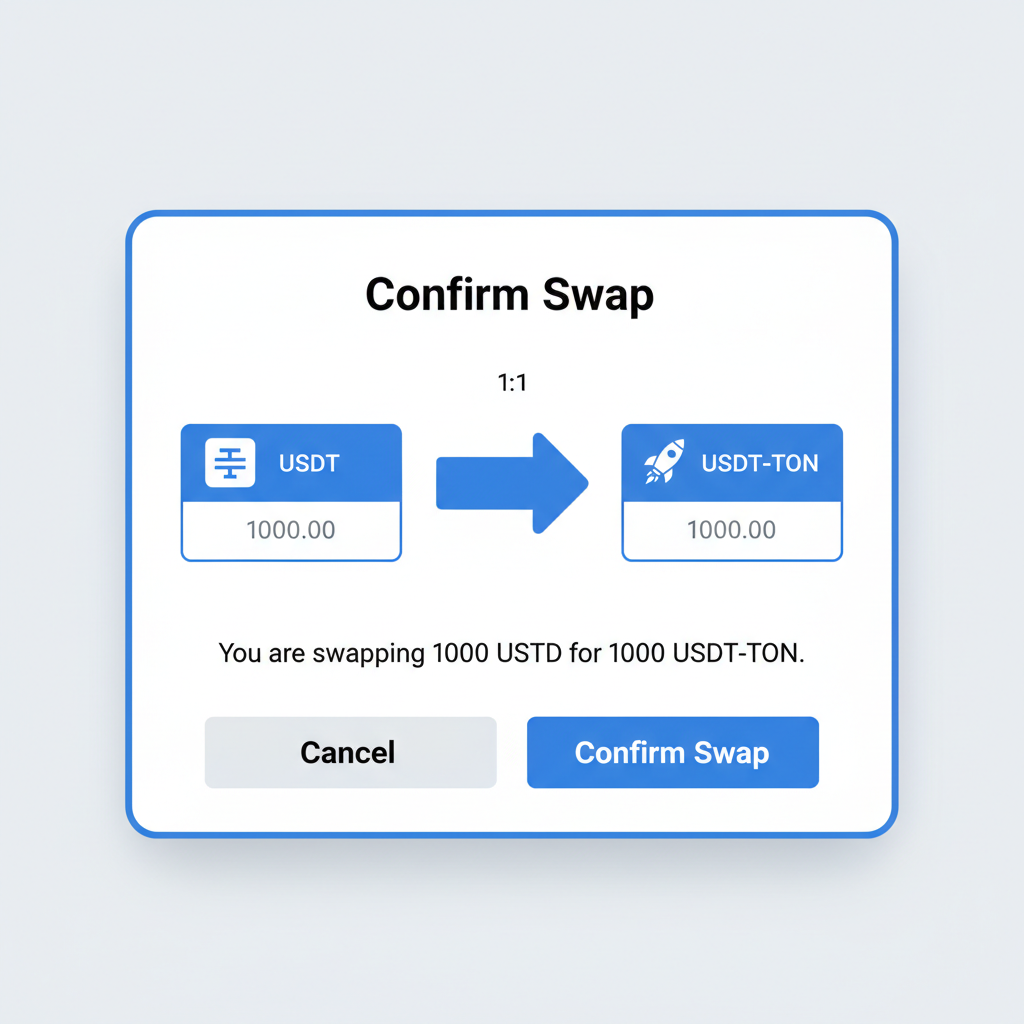

Announced mid-February 2026, the TON Wallet’s new feature partners with MoonPay to let you fund directly from Ethereum, Solana, TRON, BSC, Polygon, Arbitrum, and Base. Drop in USDC or USDT, and it auto-converts 1: 1 to USDT on TON. I love this because it kills the biggest onboarding killer: manual swaps and gas wars. For developers building Telegram Mini Apps, it means users stay in-app, boosting retention and self-custodial TON wallet adoption.

Picture this: You’re trading on Solana, spot a hot TON mini-app game like Otters, and bridge funds in seconds. No KYC walls, no waiting. This funnel – Telegram’s 900M users to TON – is why Toncoin’s narrative dominates 2026 reviews. Check the 24h range: low $0.5161 to high $0.5348. Steady as she goes, primed for breakout.

Bitcoin and Ethereum Join the TON Party

TON Wallet didn’t stop at alts. Now hold, send, and trade wrapped BTC and ETH right inside Telegram. This multi-chain flex opens TON to Bitcoin maxis and ETH degen alike, who can park assets securely without leaving the app. It’s a strategist’s dream: liquidity from majors flows into TON’s DeFi, games, and payments, accelerating TON liquidity ecosystem growth.

In my six years watching chains, this screams mass adoption. Telegram’s mini-app store already pushes TON wallets like Tonkeeper and MyTonWallet via TON Connect. Add BTC/ETH, and suddenly grandma’s Bitcoin is funding her Notcoin plays. Actionable tip: If you’re holding BTC above its recent highs, test a small wrapped deposit today – timing is everything.

TON Pay Turns Mini Apps into Checkout Machines

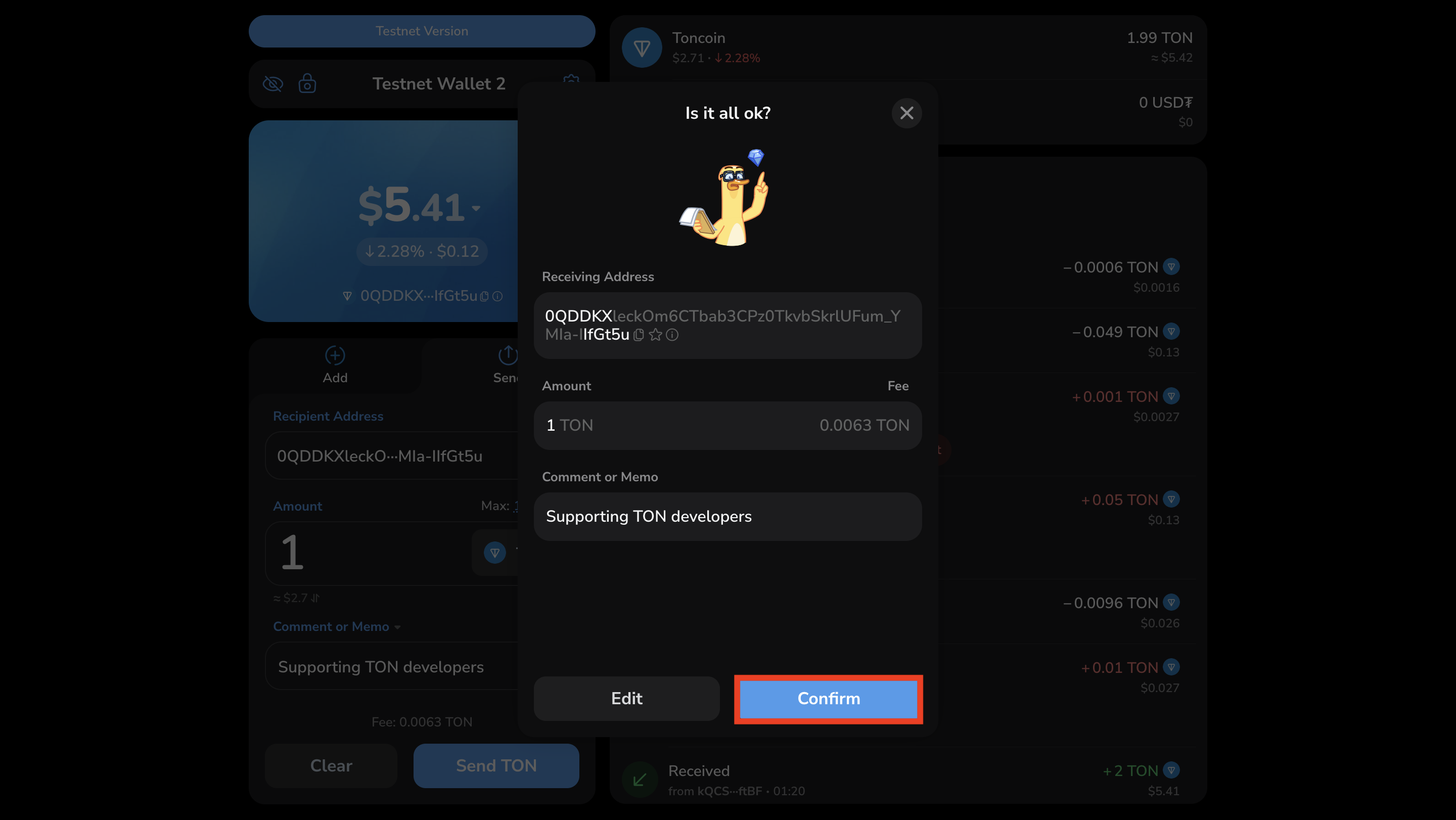

Enter TON Pay, the Foundation’s SDK dropping one-tap Toncoin and USDt payments for merchants and Mini Apps. Sub-second settlements, wallet-agnostic (Tonkeeper, Telegram bot, you name it). Rolled out first in Mini Apps, it’s turning Telegram into a crypto checkout layer. With 900M and users, this could eclipse traditional ramps.

Developers, integrate TON Pay now: support tokenized incentives, NFTs, ownership models. It’s frictionless onboarding on steroids. Toncoin at $0.5345 feels undervalued here – distribution via Telegram is the real alpha. I’ve seen chains falter on UX; TON nails it. For investors, watch Mini App volume; that’s your leading indicator.

Toncoin (TON) Price Prediction 2027-2032

Projections based on Telegram multi-chain wallet integration, TON Pay, cross-chain deposits, and accelerating adoption amid 900M+ users

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.50 | $2.80 | $5.00 | +167% |

| 2028 | $2.20 | $4.50 | $8.00 | +61% |

| 2029 | $3.00 | $6.20 | $11.00 | +38% |

| 2030 | $4.00 | $8.50 | $15.00 | +37% |

| 2031 | $5.50 | $11.50 | $20.00 | +35% |

| 2032 | $7.50 | $16.00 | $28.00 | +39% |

Price Prediction Summary

Toncoin is set for substantial growth from 2027-2032, fueled by Telegram’s ecosystem dominance, seamless multi-chain features, and Web3 onboarding. Average prices projected to surge from $2.80 to $16.00, with highs up to $28.00 in bullish scenarios driven by adoption and market cycles.

Key Factors Affecting Toncoin Price

- Telegram Mini Apps and 900M+ user base driving mass onboarding

- Cross-chain deposits (ETH, SOL, etc.) via MoonPay boosting liquidity

- TON Pay SDK enabling frictionless payments in Mini Apps

- BTC/ETH support in TON Wallet expanding utility

- Favorable market cycles post-2024/2028 halvings and regulatory clarity

- TON’s high-speed L1 scalability vs. competition

- Potential market cap growth to $40B+ by 2032 in bull case

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These predictions hinge on execution, but Telegram’s momentum gives me confidence. Toncoin at $0.5345 is a steal if you’re positioning for Telegram blockchain seamless crypto flows. The real edge? Everyday users won’t notice the blockchain switch – that’s mass adoption magic.

Real-World Use Cases: From Games to Payments

Take Otters, the gamified Web3 hit on TON. Players fund via cross-chain USDT, play, earn Toncoin rewards, all without leaving Telegram. Or merchants using TON Pay for one-tap checkouts in Mini Apps – sub-second, low-fee bliss. This isn’t siloed DeFi; it’s woven into chats, bots, stickers. In 2026, TON multi-chain wallet support means Bitcoin holders dip into TON games, ETH traders fuel Mini App economies. Liquidity surges, Toncoin captures value.

I’ve analyzed enough cycles to spot winners. TON’s edge is distribution: 900 million users funneled through frictionless UX. No other chain matches this. Developers, build on it – tokenized incentives and ownership models are ripe for Mini Apps. Investors, track daily active wallets; that’s your signal as Toncoin consolidates between $0.5161 and $0.5348.

5 Key TON Wallet Benefits

-

Seamless cross-chain deposits from Ethereum, Solana, TRON, BSC, Polygon, Arbitrum & Base via MoonPay – auto-convert USDC/USDT to USDT(TON) instantly.

-

Wrapped BTC/ETH support – store, send & transact wrapped Bitcoin and Ethereum directly in your Telegram TON Wallet.

-

TON Pay for Mini Apps – one-tap Toncoin & USDt payments with wallet-agnostic TON Connect integration.

-

Self-custodial security – full control of your keys in Telegram’s non-custodial TON Wallet, no third-party risks.

-

Sub-second transactions at minimal fees – lightning-fast Toncoin transfers powering seamless Telegram adoption.

Actionable Steps: Fund Your TON Wallet Today

Don’t just read – act. Telegram’s self-custodial wallet makes onboarding dead simple. Grab USDC from any supported chain, deposit, convert to USDT-TON, and dive into ecosystem plays. For devs eyeing TON payments in bots, TON Pay SDK is plug-and-play. Timing? With 24-hour gains at and $0.009990 ( and 0.0191%), now’s prime entry before Mini App volume spikes.

Security stays non-negotiable. Self-custodial means you control keys, TON Connect standardizes connections across wallets like Tonkeeper. No more phishing roulette. This setup crushes competitors – Solana’s speed without outages, ETH’s liquidity without gas pain.

The Road Ahead for Toncoin

2026 forecasts paint TON as Telegram’s crypto backbone. Exclusive Mini Apps mandate, BTC/ETH inflows, TON Pay rollout – it’s a flywheel. Watch for more partnerships; MoonPay’s just the start. Toncoin’s steady $0.5345 reflects market digestion, but utility ramps will ignite. My take: position now, scale on volume cues. Telegram isn’t building a chain; it’s embedding one in daily life.

Stake Toncoin for yields, play Mini Apps for fun, pay with USDt for utility. This ecosystem rewards early movers. In six years of trading, few setups scream ‘adoption’ like this. Dive in – your Telegram just became a portal to Web3 wealth.