In the sprawling ecosystem of blockchain projects vying for mainstream attention, few have matched the organic, viral momentum of Notcoin. Launched in early 2024 as a simple tap-to-earn game within Telegram, Notcoin didn’t just capture users’ idle moments; it funneled them straight into the TON blockchain, igniting Notcoin TON adoption on an unprecedented scale. Today, with Toncoin trading at $0.5264, down slightly by -0.0146% over the last 24 hours, the lingering effects of this experiment underscore a patient investor’s dream: sustainable growth rooted in accessible mechanics rather than hype.

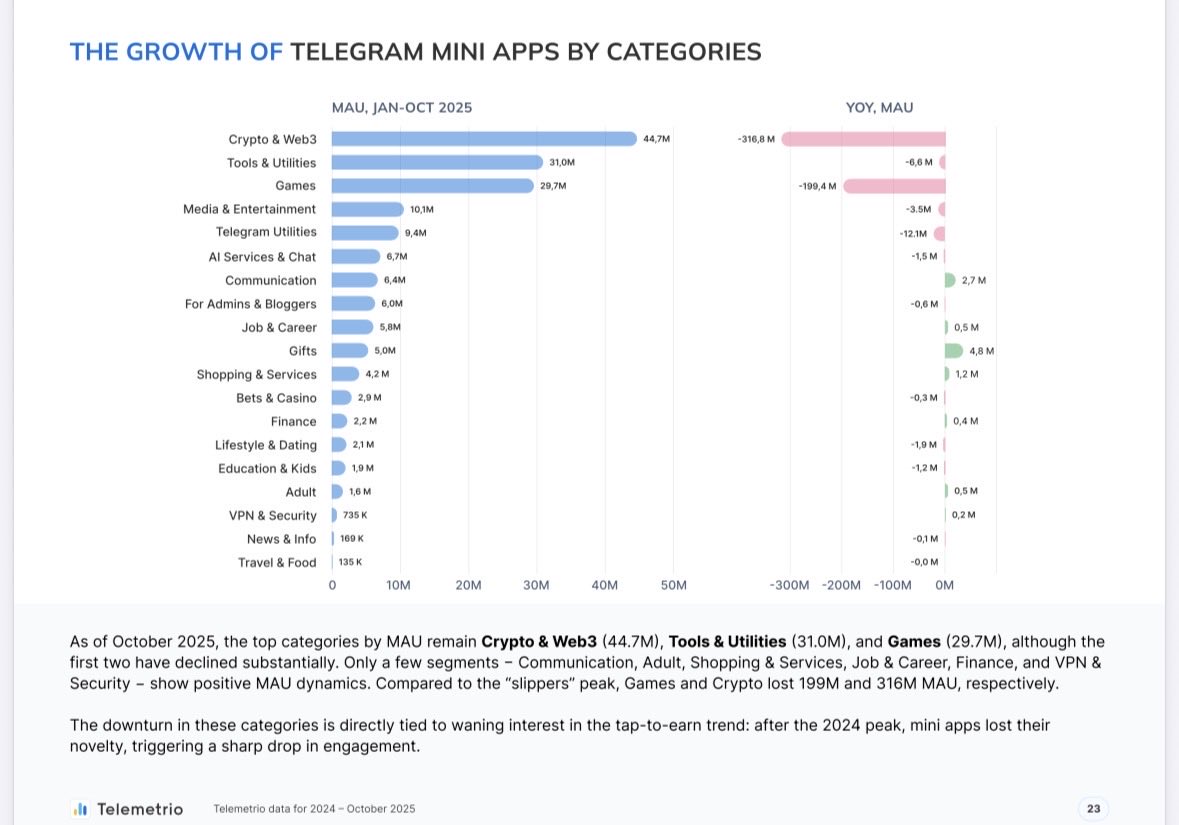

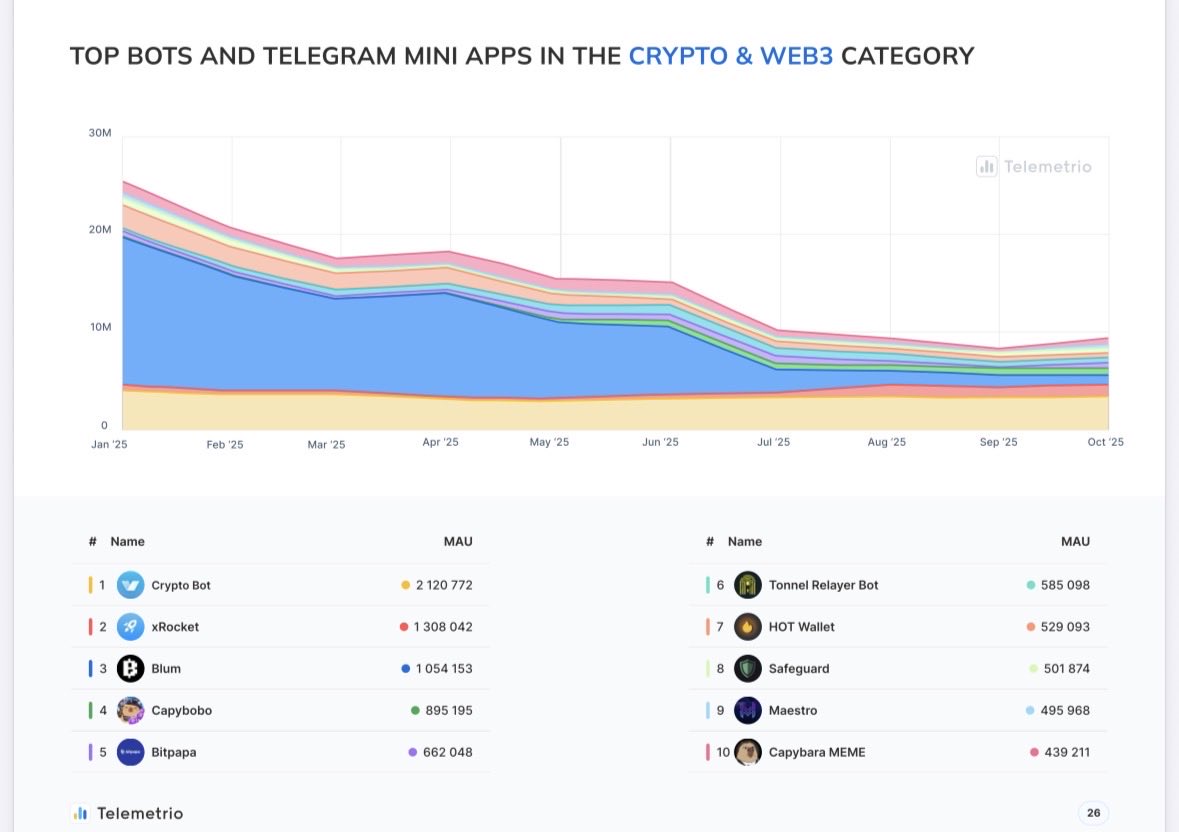

Notcoin’s genius lay in its frictionless entry point. Players tapped a coin on their Telegram screen to earn NOT tokens, a gamified ritual that required no prior crypto knowledge. By May 2024, this had drawn over 35 million users, many experiencing blockchain for the first time through seamless token airdrops. What followed was a cascade: TON’s activated wallets doubled to 8.5 million in just one month, proving that Telegram tap-to-earn growth could convert casual messengers into on-chain participants overnight.

Notcoin’s Mechanics: Simplicity as the Ultimate Onboarding Tool

At its core, Notcoin distilled cryptocurrency interaction to its essence: tap, earn, share. Built as a Telegram Mini App on The Open Network (TON), it leveraged Telegram’s billion-plus user base without demanding app downloads or wallet setups. Users started instantly via a bot, accumulating points convertible to NOT tokens upon listing. This TON mini apps onboarding model bypassed traditional barriers like seed phrases and gas fees, which often deter newcomers.

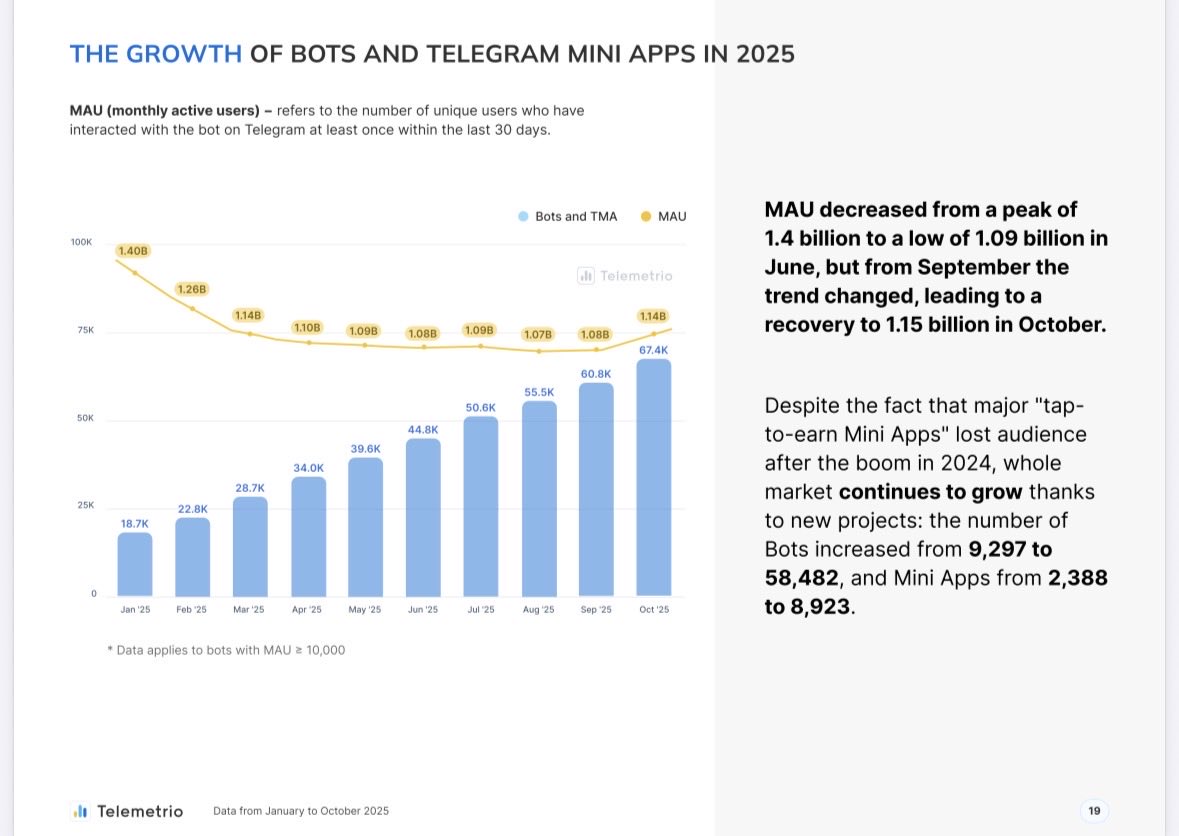

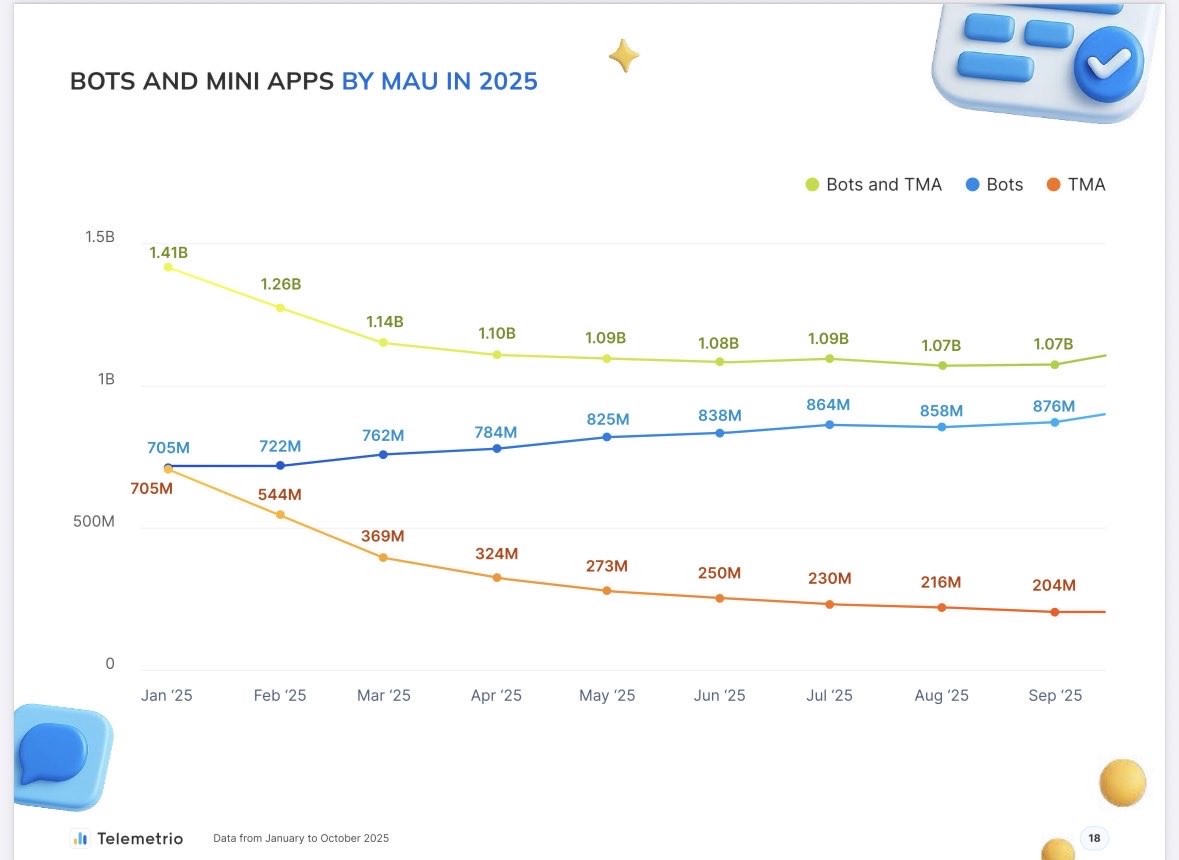

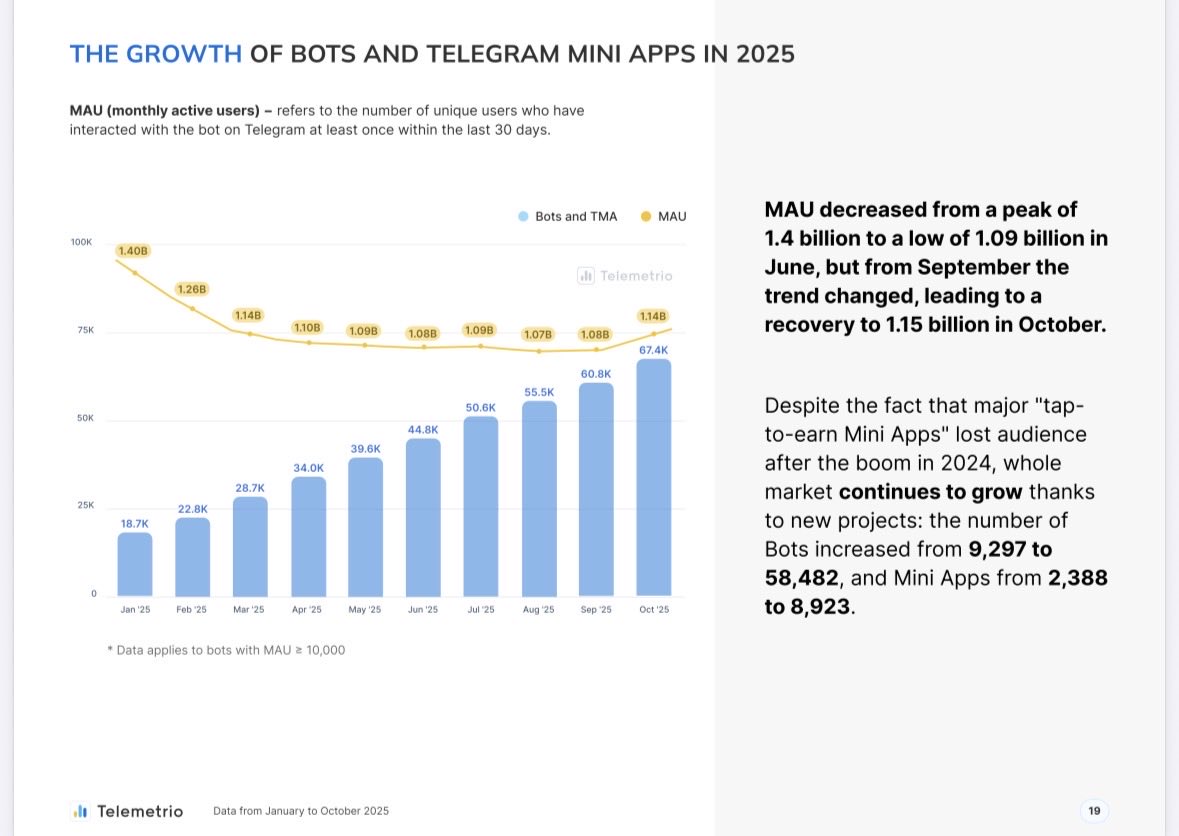

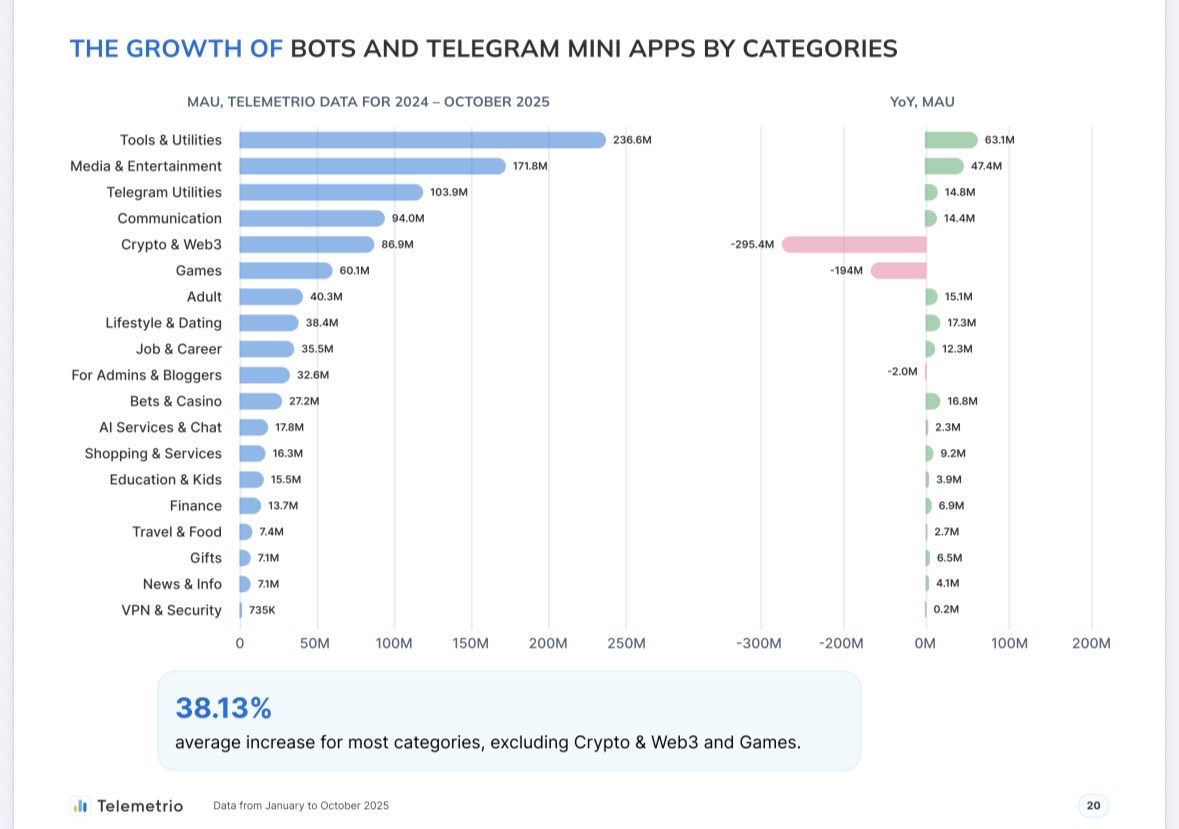

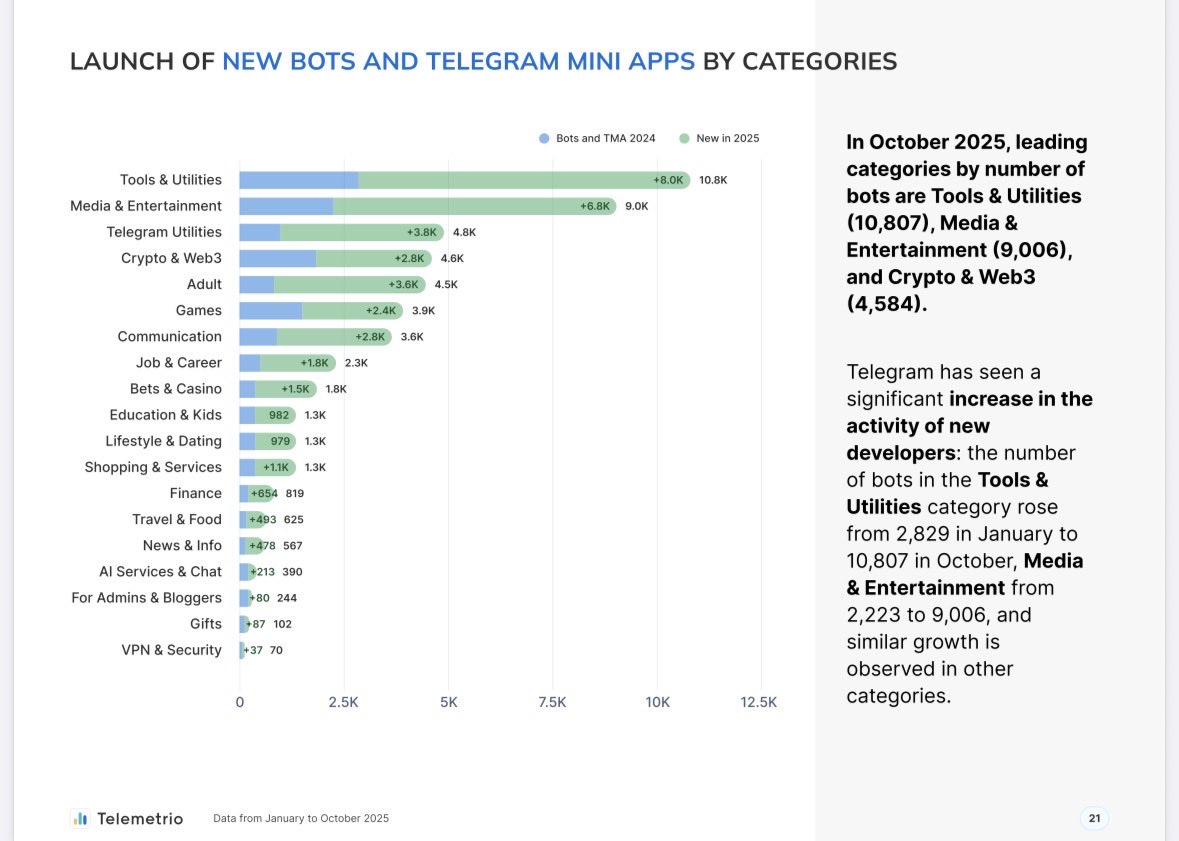

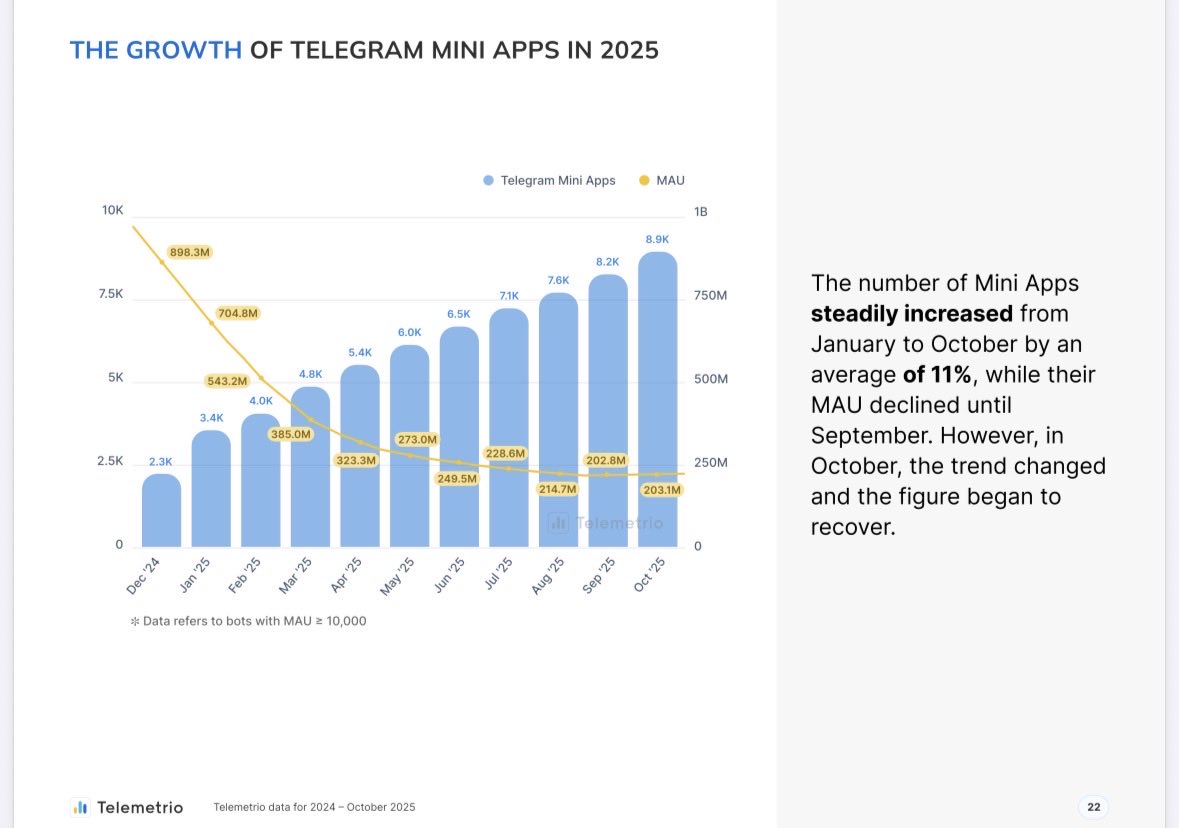

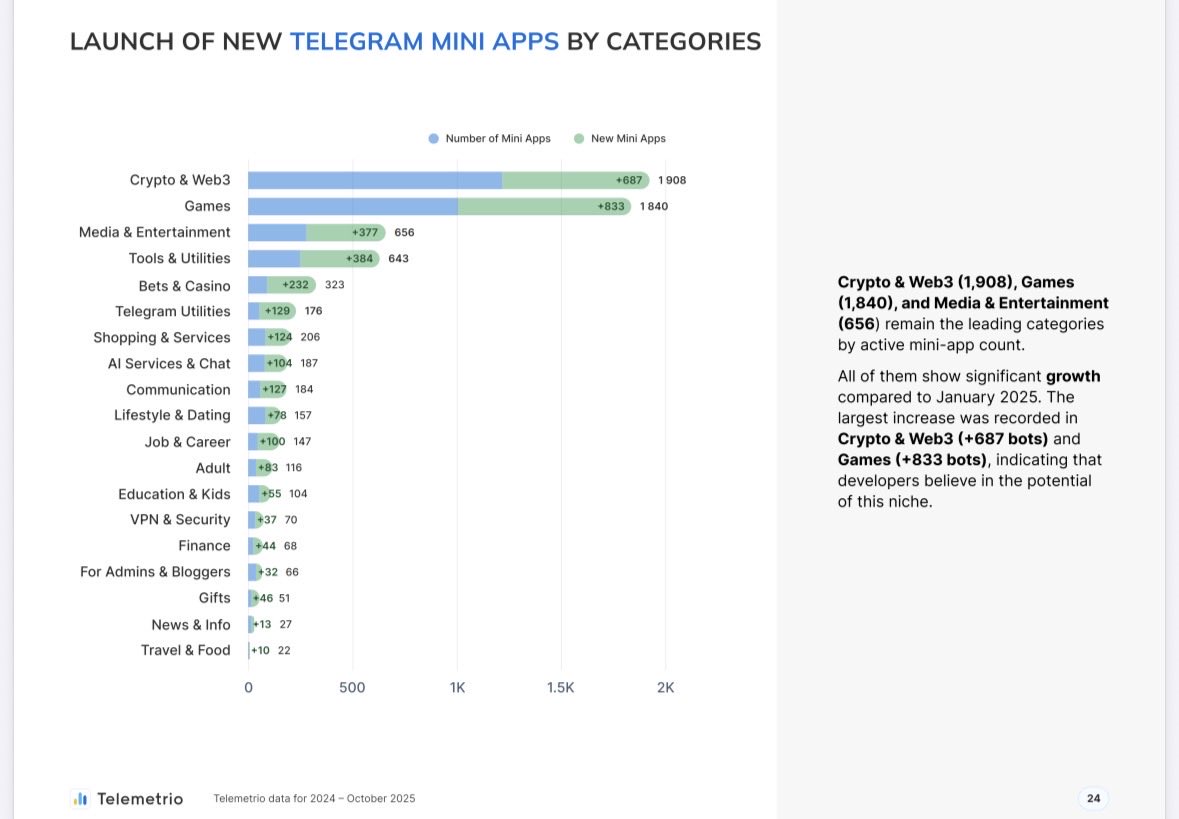

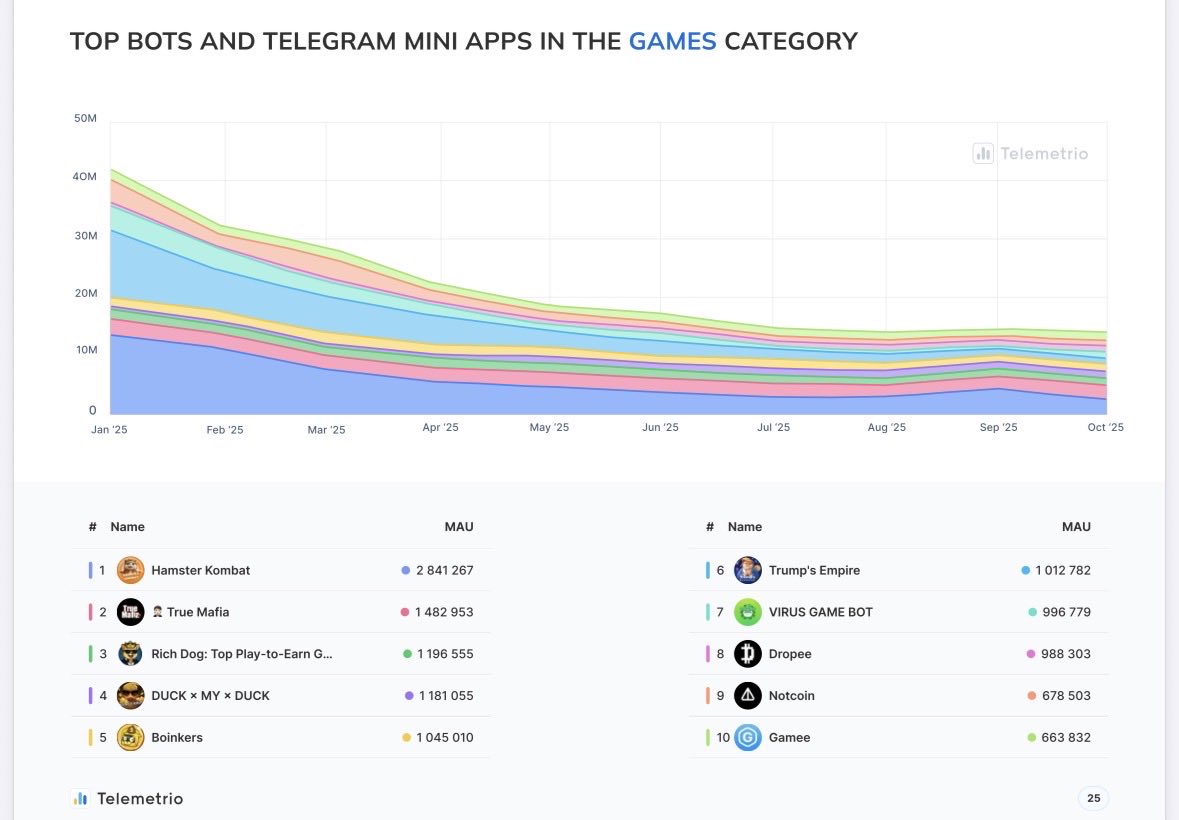

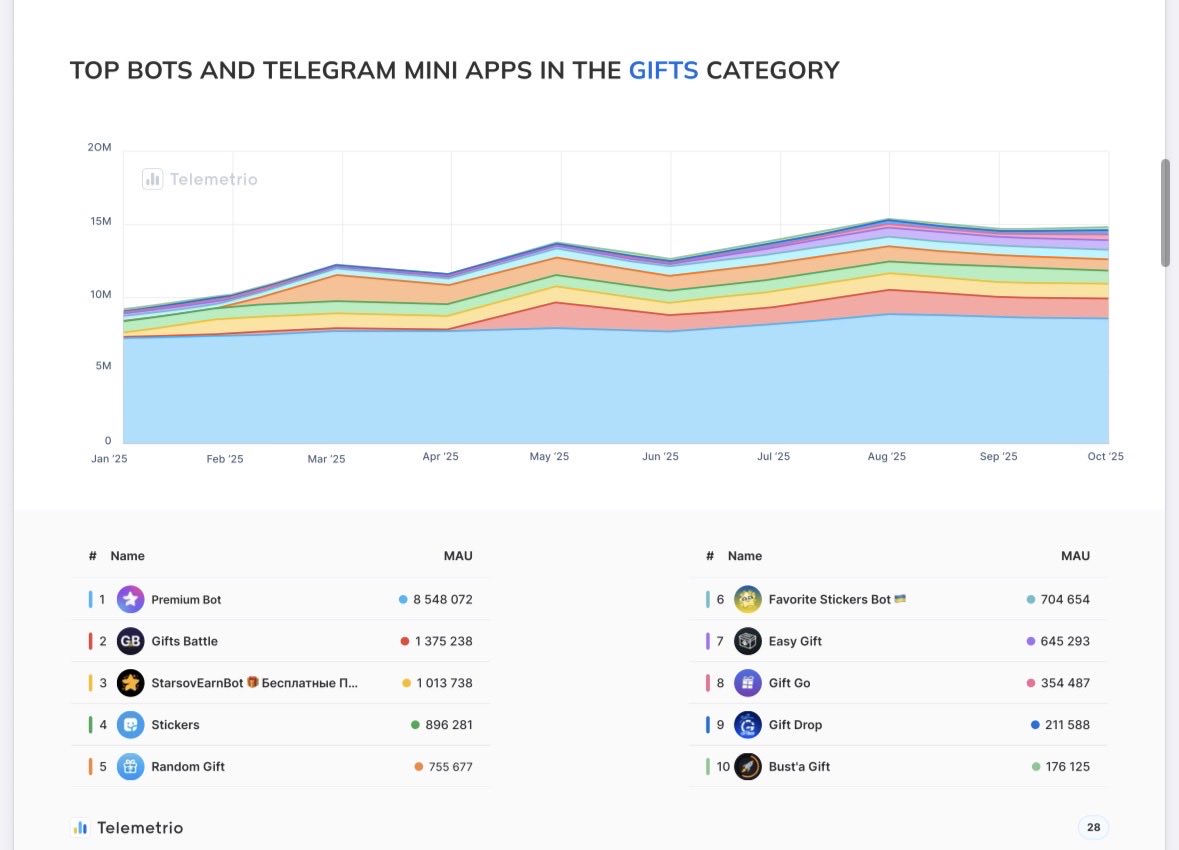

Consider the data: TON accounts surged from 4 million to over 128 million within a year, largely credited to Notcoin and its successors like Hamster Kombat, which hit 300 million users by late 2024. Early 2026 reports highlight Telegram Mini Apps exceeding 50 million monthly active users, a leap from late 2025 figures. Notcoin, valued at a peak market cap implying $2.2 billion, wasn’t just a game; it was a Trojan horse for blockchain literacy.

Notcoin operates primarily as a gamefi and community token within the Telegram ecosystem, built on TON. Its core “clicker” mechanic turned passive scrolling into active earning.

This approach aligns with my long-held belief that true adoption stems from utility disguised as entertainment. Investors watching Toncoin at $0.5264 should note how these mechanics embed value accrual directly into daily habits.

Viral Strategies Fueling Toncoin’s Ecosystem Boom

Notcoin pioneered Toncoin viral strategies that rippled across the TON landscape. Referral systems rewarded sharing with friends, creating exponential network effects within Telegram groups. Each tap not only minted points but also seeded TON wallets automatically, turning social chatter into on-chain activity. By integrating with Telegram’s vast distribution, Notcoin achieved what marketing budgets alone rarely can: organic virality.

Follow-on projects amplified this. Hamster Kombat and Catizen rode the wave, onboarding hundreds of millions more. TON’s ecosystem exploded, with Mini Apps hitting 50 million MAU in early 2026, driven by mobile-first design. Analysts now eye Toncoin’s trajectory, with predictions ranging from $3.5 by year-end if adoption sustains, to bullish $15 thresholds amid institutional inflows. Yet, at $0.5264, the asset trades with the patience of a project still maturing its foundations.

Read more on how Telegram Mini Apps drive mass adoption of Toncoin and DeFi.

Toncoin (TON) Price Prediction 2027-2032

Forecasts driven by Telegram tap-to-earn mechanics like Notcoin, mini-apps growth (50M+ MAU), and TON ecosystem expansion from current $0.53 baseline in 2026

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $1.80 | $3.50 | $6.00 | +133% |

| 2028 | $3.00 | $5.50 | $10.00 | +57% |

| 2029 | $4.50 | $8.00 | $15.00 | +45% |

| 2030 | $6.50 | $11.00 | $22.00 | +38% |

| 2031 | $9.00 | $15.00 | $30.00 | +36% |

| 2032 | $12.00 | $20.00 | $40.00 | +33% |

Price Prediction Summary

Toncoin (TON) is set for substantial growth from 2027-2032, fueled by Notcoin’s tap-to-earn success and Telegram’s massive adoption. Averages could rise from $3.50 in 2027 to $20 by 2032, with bullish highs up to $40 amid institutional inflows and mini-apps boom; bearish mins reflect regulatory/market risks.

Key Factors Affecting Toncoin Price

- Telegram Mini Apps surge to 50M+ MAU, onboarding non-crypto users via games like Notcoin/Hamster Kombat

- TON wallet growth from millions to hundreds of millions, boosting network effects

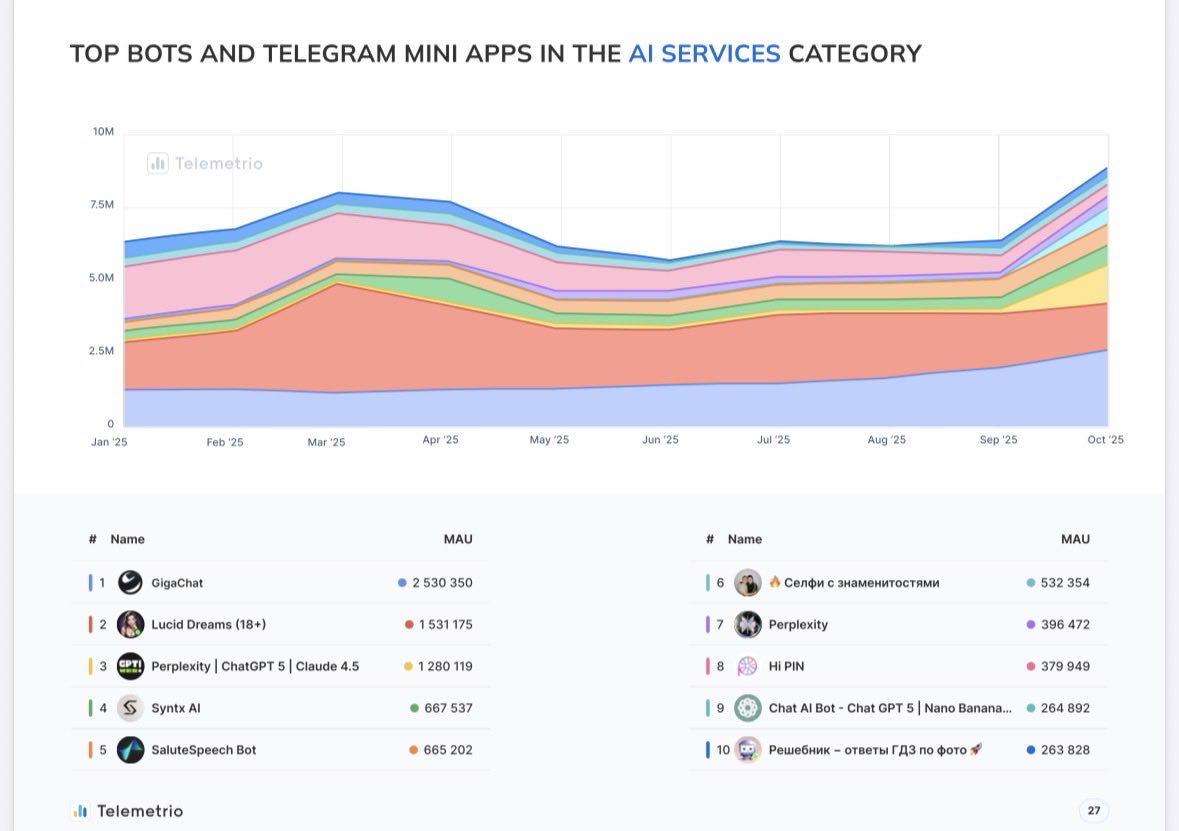

- DeFi, staking, and AI infrastructure on TON driving utility

- Regulatory tailwinds (e.g., Russia approval) and BTC Teleport bridge

- Bull market cycles post-BTC halving, institutional adoption

- Risks: Competition from Solana/Ethereum L1s, centralization concerns, macro downturns

- Realistic progression assumes 40-50% CAGR in adoption metrics

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Lasting Impact of Notcoin on TON’s User Acquisition

Delving deeper into Notcoin ecosystem impact, the numbers paint a compelling picture of sustained momentum. Notcoin’s airdrop in May 2024 wasn’t merely distributive; it activated dormant wallets and sparked secondary markets on TON. This influx diversified TON from a niche Telegram coin to a hub for GameFi and social tokens, with daily active users mirroring Telegram’s scale.

By early 2026, community growth projections tie directly to Telegram’s audience expansion, boosting Mini App engagement and TON wallet proliferation. Risks remain, including token dilution from rapid emissions, but the onboarding flywheel Notcoin ignited offers a blueprint for scalable adoption. For patient holders, Toncoin at $0.5264 represents undervalued potential in a network now primed for real-world utility.

Stakeholders should monitor how these tap-to-earn dynamics evolve, as they could redefine blockchain accessibility beyond games into payments and DeFi.

That evolution is already underway. Notcoin’s blueprint has inspired a wave of Telegram Mini Apps that layer sophisticated financial primitives atop playful interfaces, turning TON into a playground for DeFi experimentation. Developers now build tap-to-earn hybrids blending NFTs, staking pools, and yield farming, all accessible via chat. This progression cements Telegram tap-to-earn growth as a cornerstone of TON’s expansion, where user retention hinges on delight rather than obligation.

Key Milestones: A Timeline of Notcoin-Driven TON Surge

Tracing this trajectory reveals a deliberate pattern. From Notcoin’s humble clicks to ecosystem-wide proliferation, each phase amplified network effects. By Q1 2026, TON’s daily transactions rival established chains, fueled by Mini App virality. Toncoin, holding steady at $0.5264 despite market whispers of $3.5 year-end targets, embodies the quiet accumulation phase before explosive re-rating. My 18 years in assets affirm: ecosystems that onboard via joy endure longer than those preaching utility.

Yet, what elevates Notcoin beyond a fleeting fad is its Notcoin ecosystem impact on developer incentives. The game spawned a toolkit of open-source bots and smart contracts, lowering barriers for creators. TON’s low fees – pennies per interaction – paired with Telegram’s Stars payment system, enable micro-economies where players trade in-game assets peer-to-peer. This isn’t speculation; it’s habit formation, priming users for broader crypto fluency.

Actionable Tactics for Sustaining Viral Momentum

5 Key TON Strategies Inspired by Notcoin

-

1. Frictionless Wallet Auto-Creation via Bots: Notcoin leveraged Telegram bots for seamless TON wallet creation, doubling activated wallets to 8.5 million in a month and onboarding 35 million users by May 2024.

-

2. Referral Bonuses Tied to Telegram Shares: Viral growth through Telegram-integrated referrals, as seen in Notcoin and successors like Hamster Kombat (300M+ users by Oct 2024), rewarding shares with bonuses.

-

3. Airdrop Ladders Rewarding Milestones: Tiered airdrops based on tap-to-earn progress, converting Notcoin players into active TON participants and fueling wallet growth from 4M to 128M accounts.

-

4. Cross-Game Interoperability on TON: Seamless asset and progress sharing across Mini Apps like Hamster Kombat and Catizen, boosting TON’s ecosystem to 50M+ monthly active users by early 2026.

-

5. Community Governance for Token Burns: TON community-driven decisions on burns and economics, inspired by Notcoin’s model, supporting sustainable growth amid Telegram’s expanding Mini App adoption.

These tactics, distilled from Notcoin’s playbook, offer projects a roadmap to replicate success. Prioritize social loops: every tap should invite collaboration, embedding TON natively into group dynamics. For investors eyeing Toncoin at $0.5264, the real alpha lies in spotting successors early – apps fusing tap-to-earn with AI agents or real-world asset tokenization. Telegram’s 2026 roadmap hints at such integrations, potentially catapulting TON mini apps onboarding to hundreds of millions.

Diversification tempers risks. While Notcoin sparked the fire, TON’s maturation demands evolution. Watch for regulatory nods, like rumored Russia approvals, which could unlock institutional liquidity. Price forecasts vary – Traders Union at $3.5, Bitget pushing $15 amid viral app surges – but fundamentals anchor my outlook: a network with 128 million accounts isn’t hype; it’s infrastructure.

Projects building on this foundation must balance growth with sustainability. Tokenomics refinements, such as Notcoin’s post-airdrop burns, prevent dilution. Community treasuries fund grants, nurturing a virtuous cycle. As Toncoin navigates its current $0.5264 perch – with 24-hour highs at $0.5362 and lows at $0.5122 – patience rewards those who discern signal from noise.

Ultimately, Notcoin proved that blockchain adoption thrives when invisible. Its tap-to-earn alchemy transformed Telegram from messenger to gateway, positioning TON as the mobile chain for the masses. For developers, investors, and enthusiasts, the invitation stands: engage now, as this ecosystem scales from games to global finance. The metrics – exploding wallets, persistent MAU – signal not a peak, but a plateau before ascent.

Explore further in our guide on how Toncoin is leveraging Telegram’s 1 billion users for Web3 mass adoption.