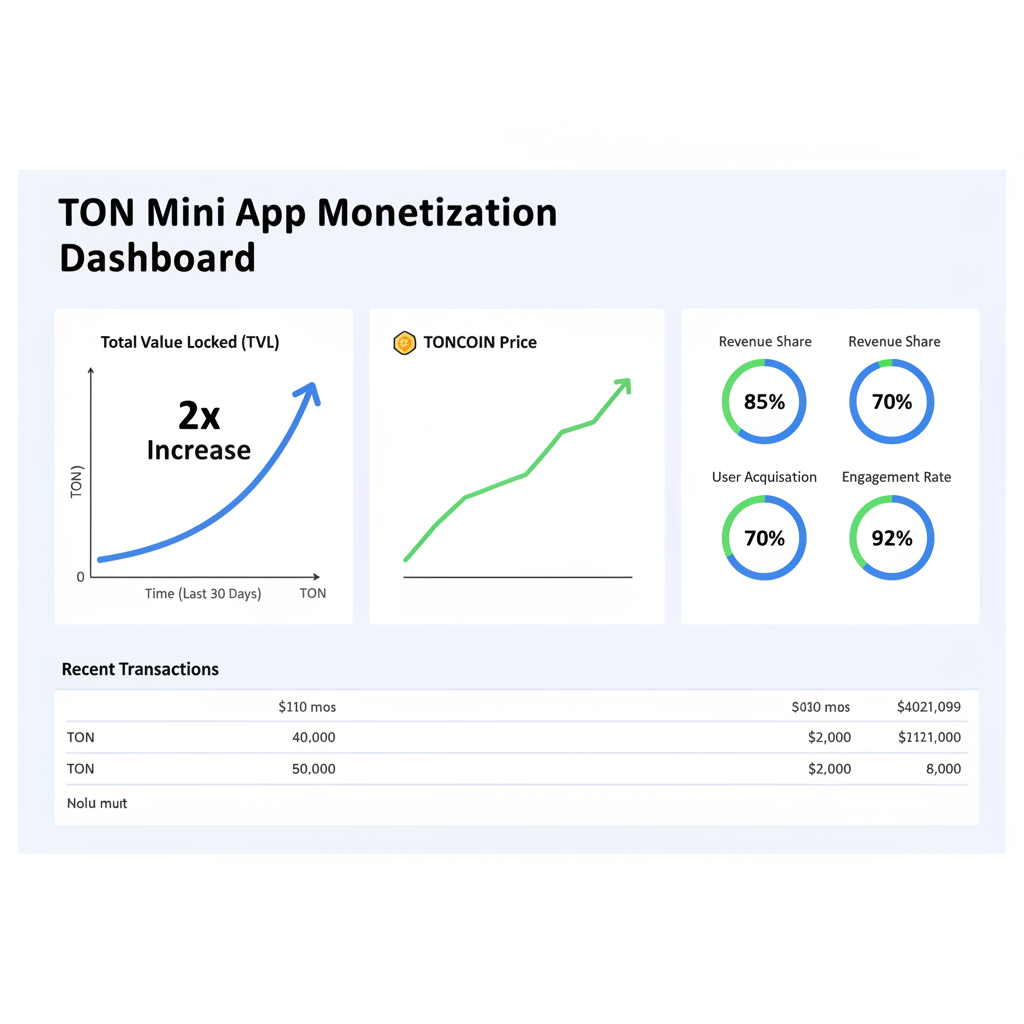

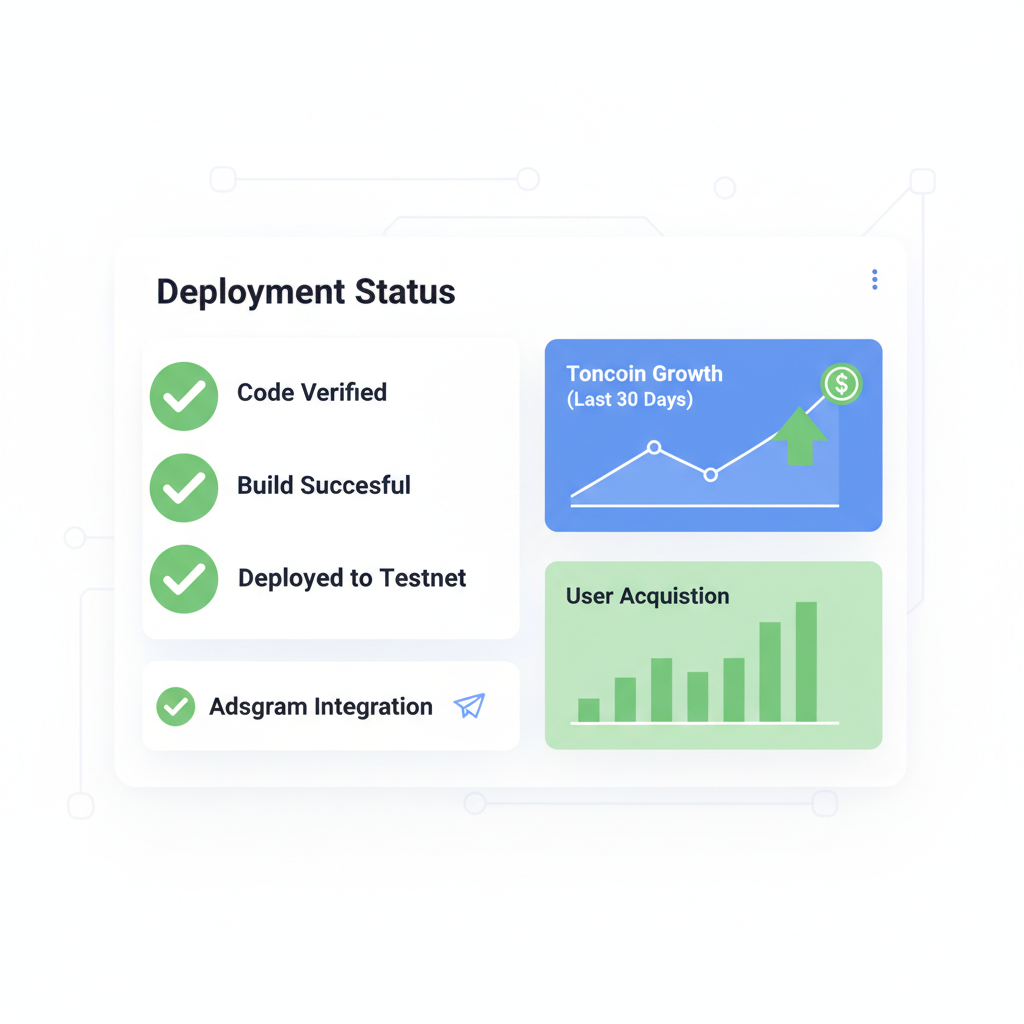

In early 2026, Telegram Mini Apps have surged past 50 million monthly active users, turning the TON blockchain into a mobile-first powerhouse for Toncoin adoption. With Toncoin trading at $0.5315 after a slight 24-hour dip of -0.0143%, the ecosystem’s momentum feels unbreakable. Developers stand at the forefront of this wave, leveraging seamless Telegram integration to onboard millions without the usual crypto friction. This isn’t hype; it’s a blueprint for mass adoption, fueled by tools like TON Pay and a $1 billion liquidity program that has pushed daily active addresses beyond 3.1 million.

The exclusive Telegram-TON partnership, locked in January 2025, has supercharged this growth. Features like Adsgram let developers earn Toncoin through in-app ads, while TON Space enables cross-chain swaps right inside chats. For developers eyeing Telegram Mini Apps Toncoin strategies, the focus shifts to sustainable niches: productivity tools, social apps, and games that keep users hooked and transacting. I’ve managed portfolios through bull and bear cycles, and TON’s blend of social virality with low-cost scalability reminds me of early Ethereum’s promise, but optimized for Telegram’s billion-user base.

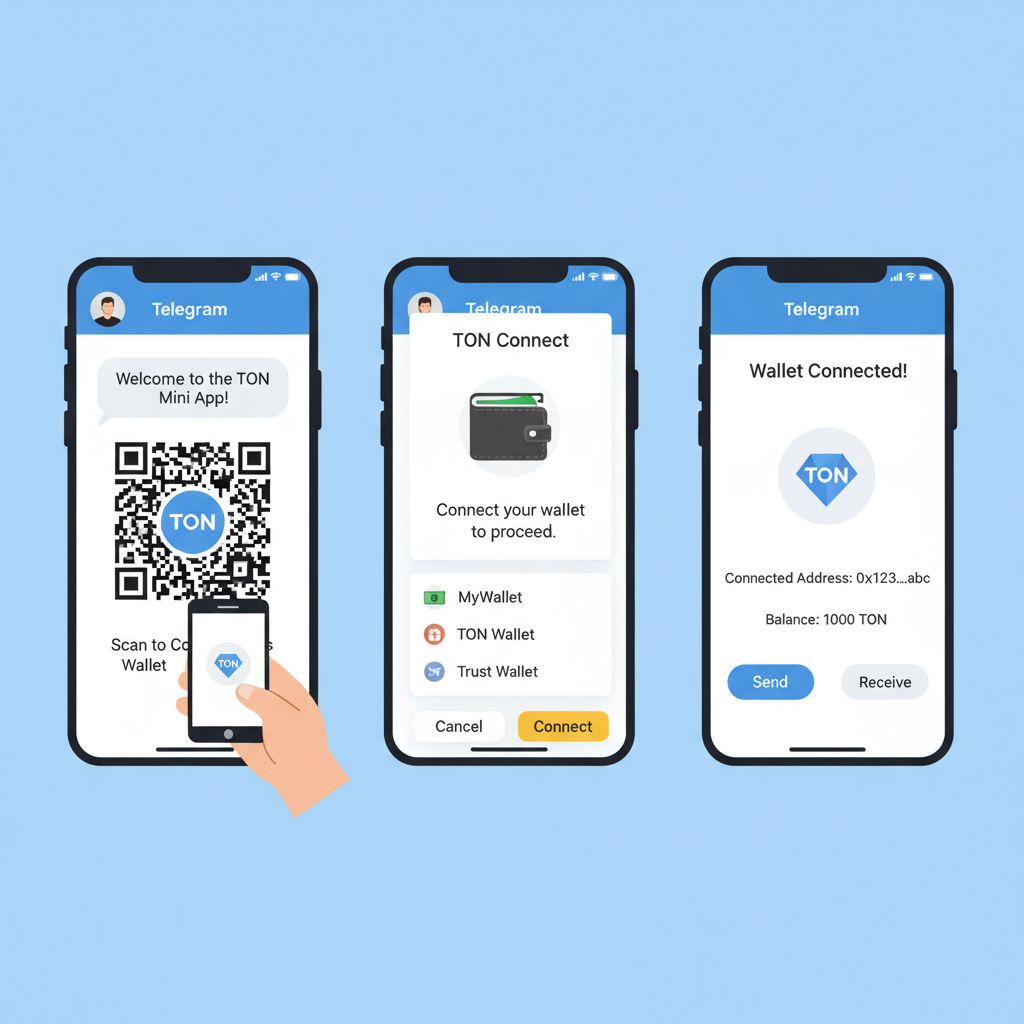

Seamless TON Connect 2.0 Integration for Frictionless Wallet Onboarding

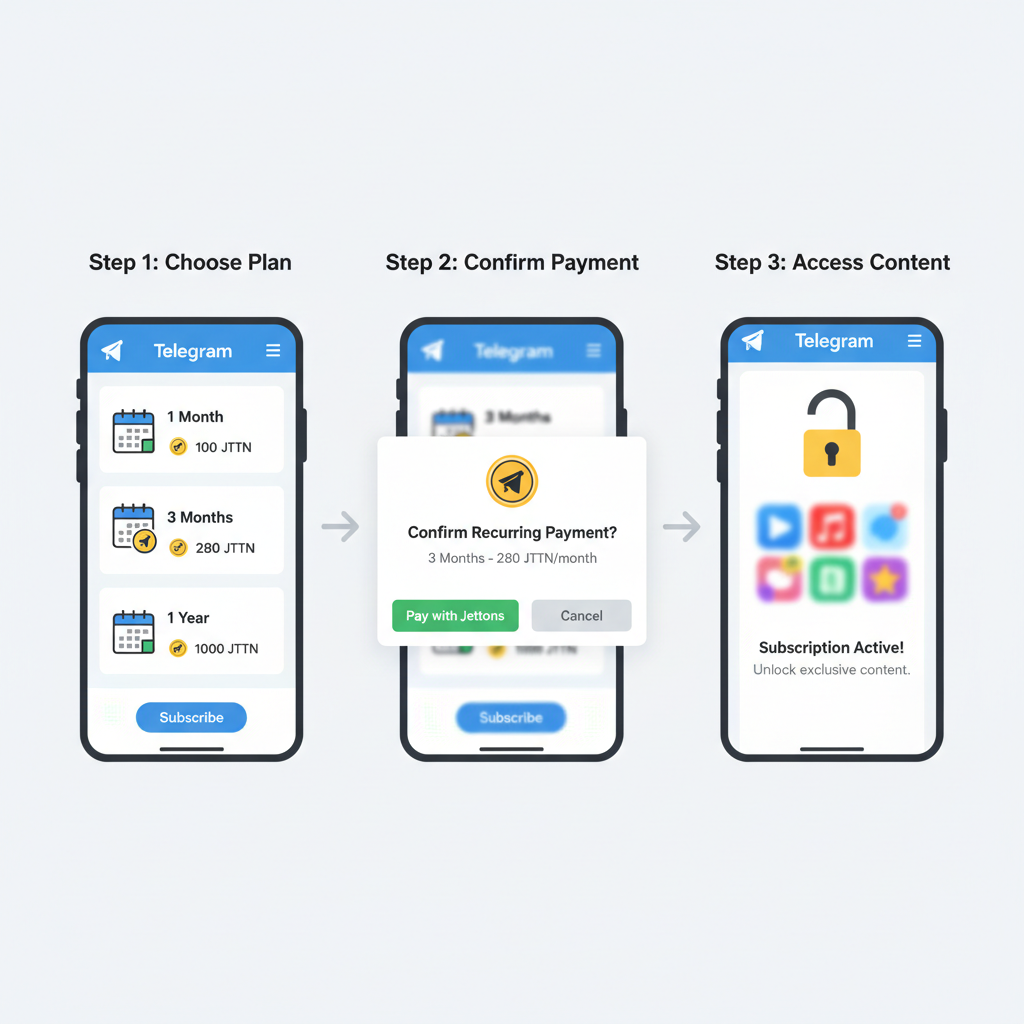

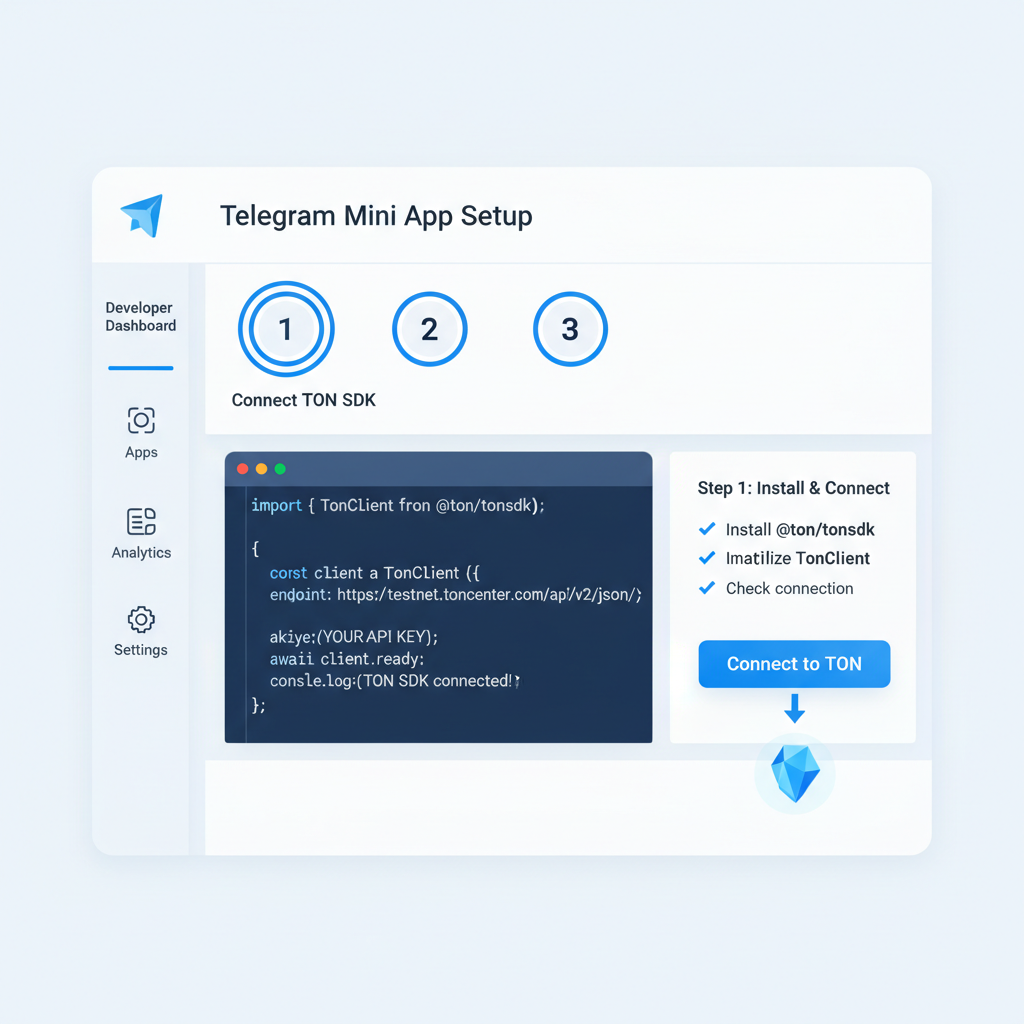

Picture this: a user taps into your Mini App, and within seconds, they’re connected to their TON wallet without downloads or seed phrases. TON Connect 2.0 makes it reality, slashing onboarding drop-off rates by up to 80% in my observations of similar integrations. Developers should prioritize this by embedding the SDK early; it’s plug-and-play with Telegram’s API, supporting biometric logins and social recovery. The result? Users hold Toncoin longer, trade more, and evangelize your app. In a space cluttered with clunky wallets, this frictionless entry is your killer differentiator for TON Mini Apps adoption.

Start with the official TON docs for implementation: initialize the connector, handle session requests, and voila, users are swapping assets natively. Pair it with Telegram’s share button for instant referrals, turning one user into ten overnight.

In-App Cross-Chain Swaps via TON Space for Enhanced Liquidity

Why force users to bounce between apps when TON Space brings DeFi to their fingertips? This strategy taps into the cross-chain swap revolution, letting Mini App users exchange ETH, BTC, or USDT for Toncoin without leaving Telegram. As one developer noted on Medium, it’s a game-changer for daily setups. Liquidity pools on TON are deepening thanks to the $1 billion incentive, ensuring tight spreads even at $0.5315 per Toncoin.

For Toncoin developer strategies 2026, integrate TON Space SDK to enable one-tap swaps. Focus on UX: real-time quotes, gasless previews, and Toncoin rewards for high-volume traders. This not only boosts retention but funnels external liquidity into TON, amplifying adoption. I’ve seen portfolios balloon from such integrations; imagine your app becoming the gateway for Telegram’s 900 million users dipping into DeFi.

Toncoin (TON) Price Prediction 2027-2032

Forecasts driven by Telegram Mini Apps growth to 50M+ MAU, TON Pay integration, $1B liquidity incentives, and ecosystem adoption

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Avg YoY Growth (%) |

|---|---|---|---|---|

| 2027 | $0.90 | $1.40 | $2.20 | +100% |

| 2028 | $1.80 | $2.80 | $4.50 | +100% |

| 2029 | $2.50 | $4.50 | $7.00 | +61% |

| 2030 | $3.50 | $6.50 | $10.00 | +44% |

| 2031 | $4.50 | $8.50 | $13.00 | +31% |

| 2032 | $6.00 | $11.00 | $17.00 | +29% |

Price Prediction Summary

Toncoin is set for robust growth from its 2026 baseline of ~$0.70 average, fueled by Telegram’s Mini Apps ecosystem exploding to 50M+ MAU, TON Pay for seamless payments, Adsgram monetization, and institutional use cases. Bullish scenarios project up to $17 by 2032 amid mass adoption, while minimums account for market cycles and regulatory risks. Overall outlook: strongly positive with 15x potential on average prices.

Key Factors Affecting Toncoin Price

- Telegram Mini Apps reaching 50M+ MAU driving user engagement and TON utilization

- TON Pay SDK enabling wallet-agnostic crypto payments in apps

- $1B liquidity incentive program boosting market cap beyond $17B

- Institutional adoption in payments, stablecoins, and asset tokenization

- Adsgram for developer monetization via TON-earning ads

- Exclusive Telegram-TON partnership accelerating mass adoption from 1B users

- Scalable dApps and cross-chain swaps enhancing ecosystem utility

- Market cycles favoring recovery and growth post-2026 consolidation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

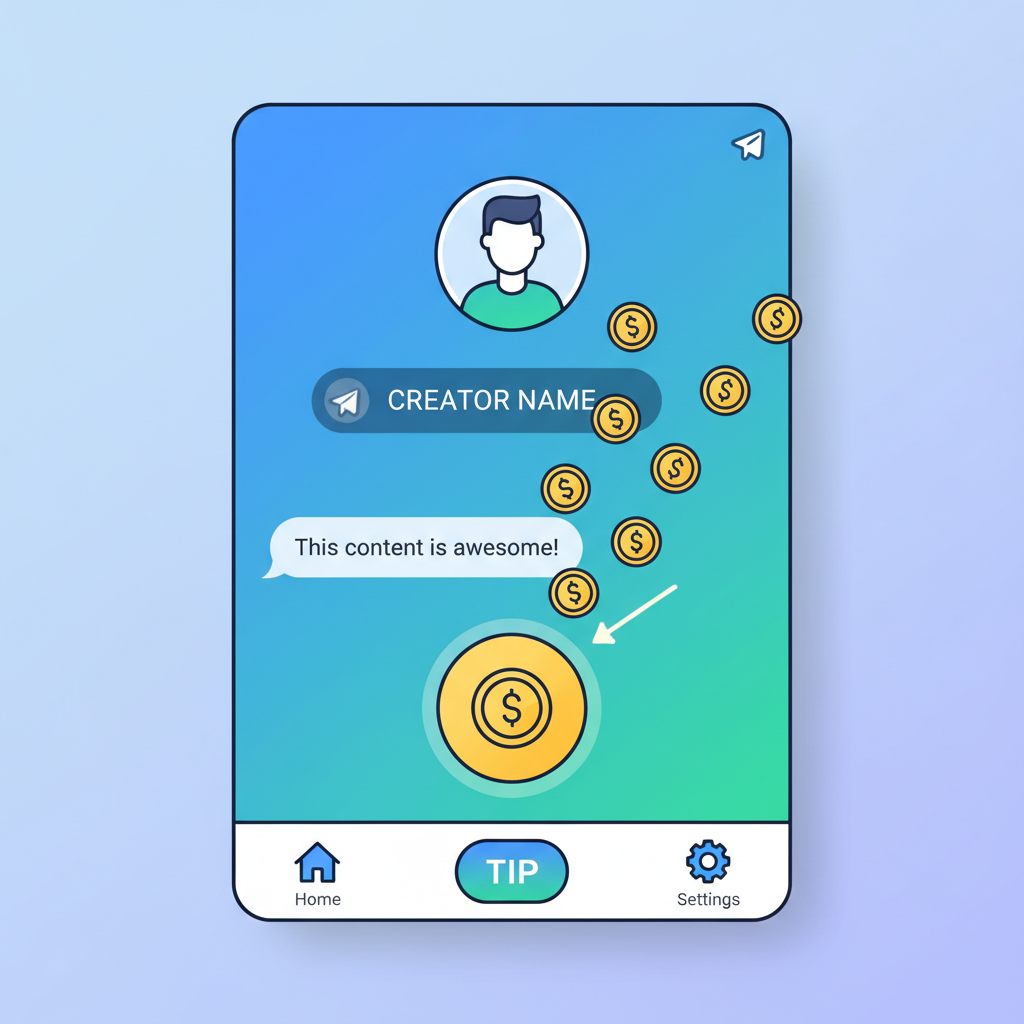

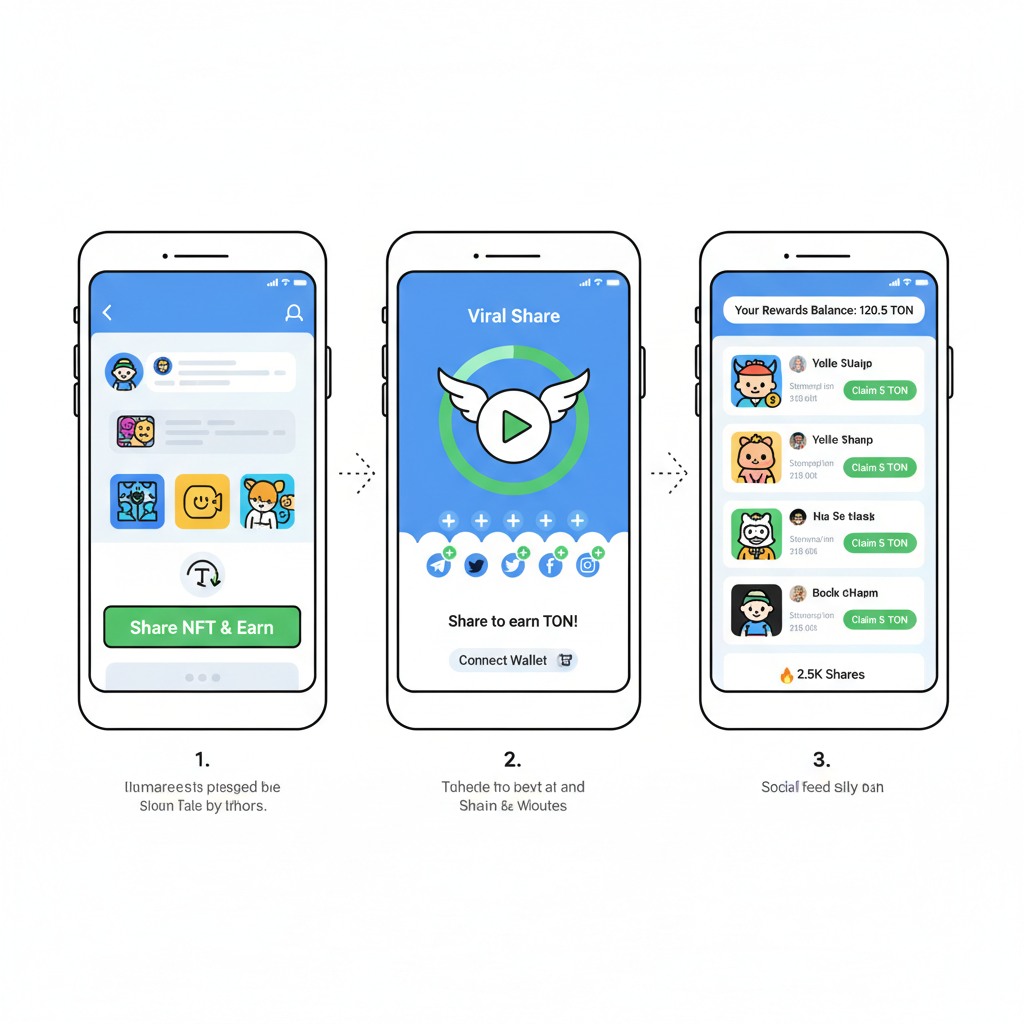

Gamified Play-to-Earn Mechanics with Toncoin Rewards

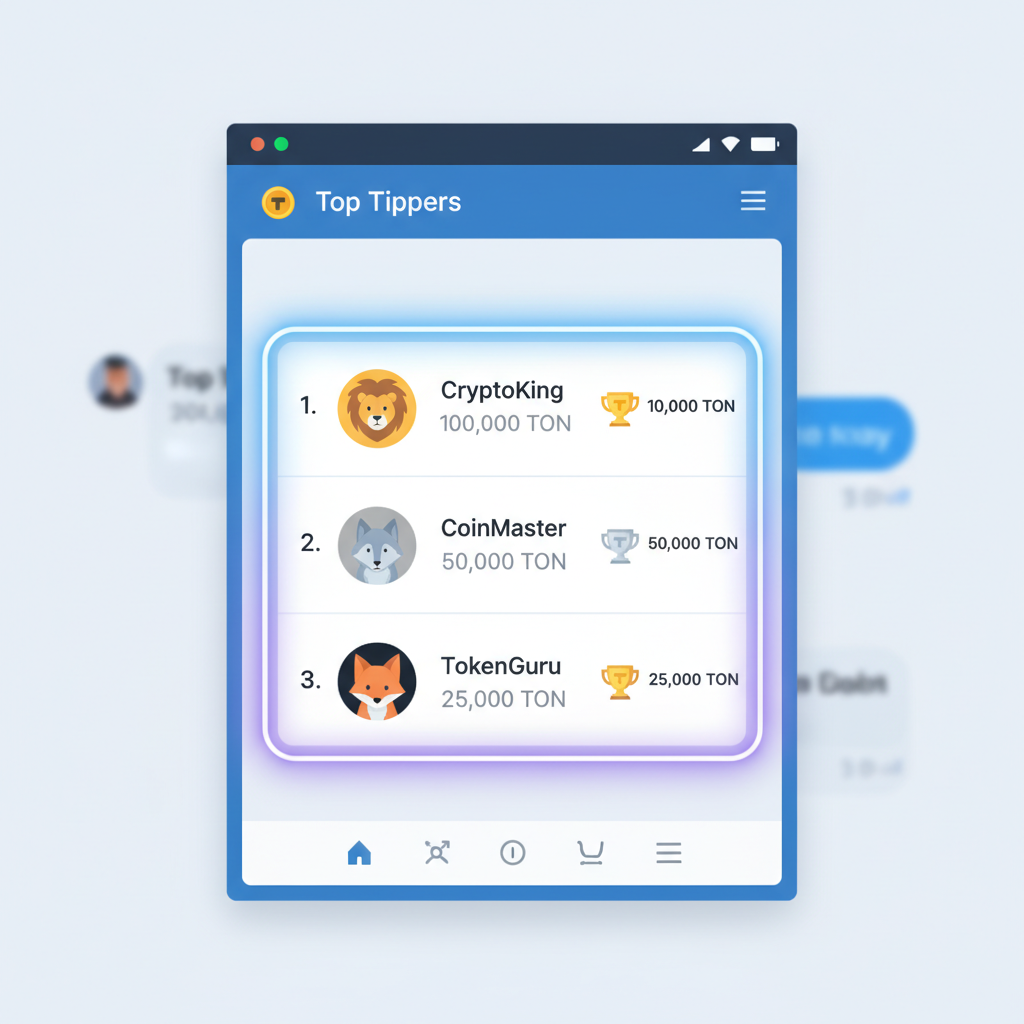

Games dominate Telegram Mini Apps, and for good reason: they’re addictive and monetizable. Infuse Telegram blockchain games with play-to-earn using Toncoin rewards to hook casual players. Think daily quests yielding 10-50 TON, leaderboards with jackpot pools, and NFT upgradables earned in-app. DroomDroom’s explosion to 50 million users proves mobile-first gaming scales virally on TON’s low fees.

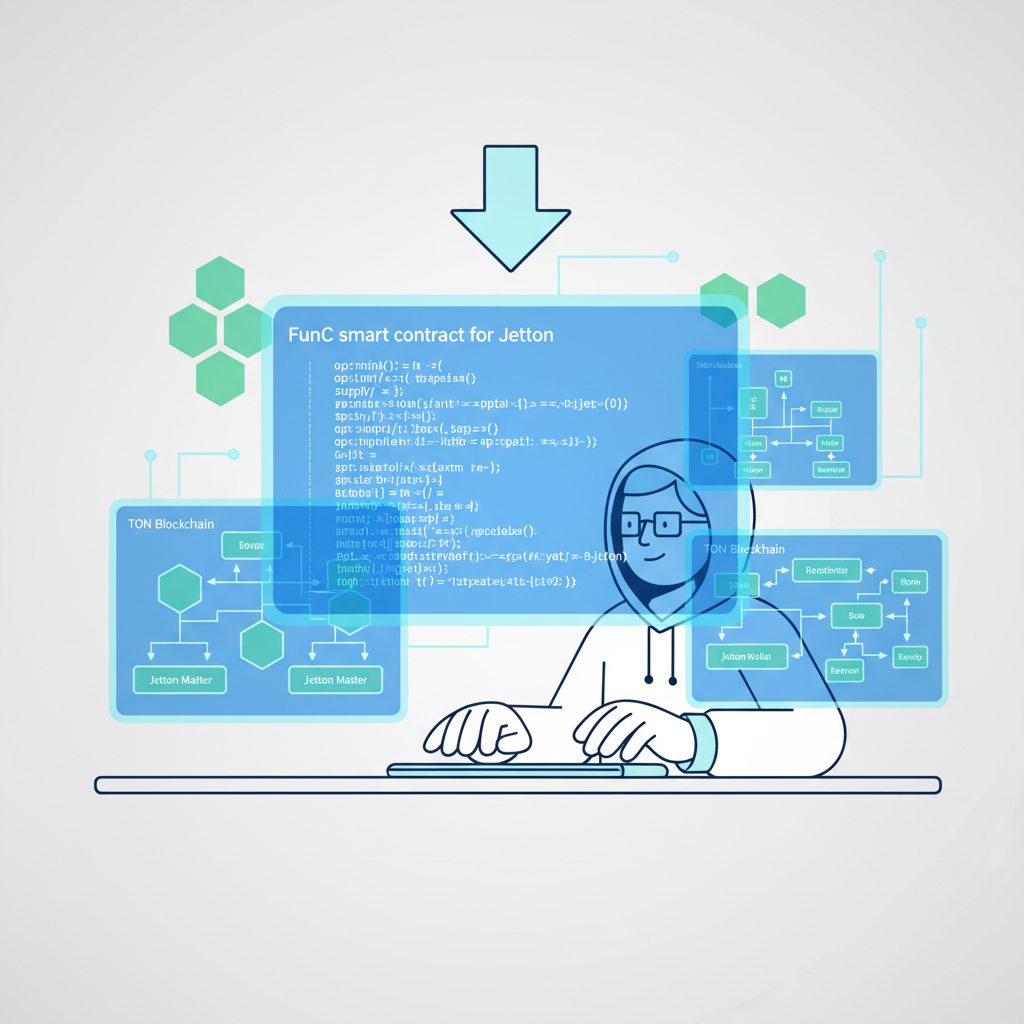

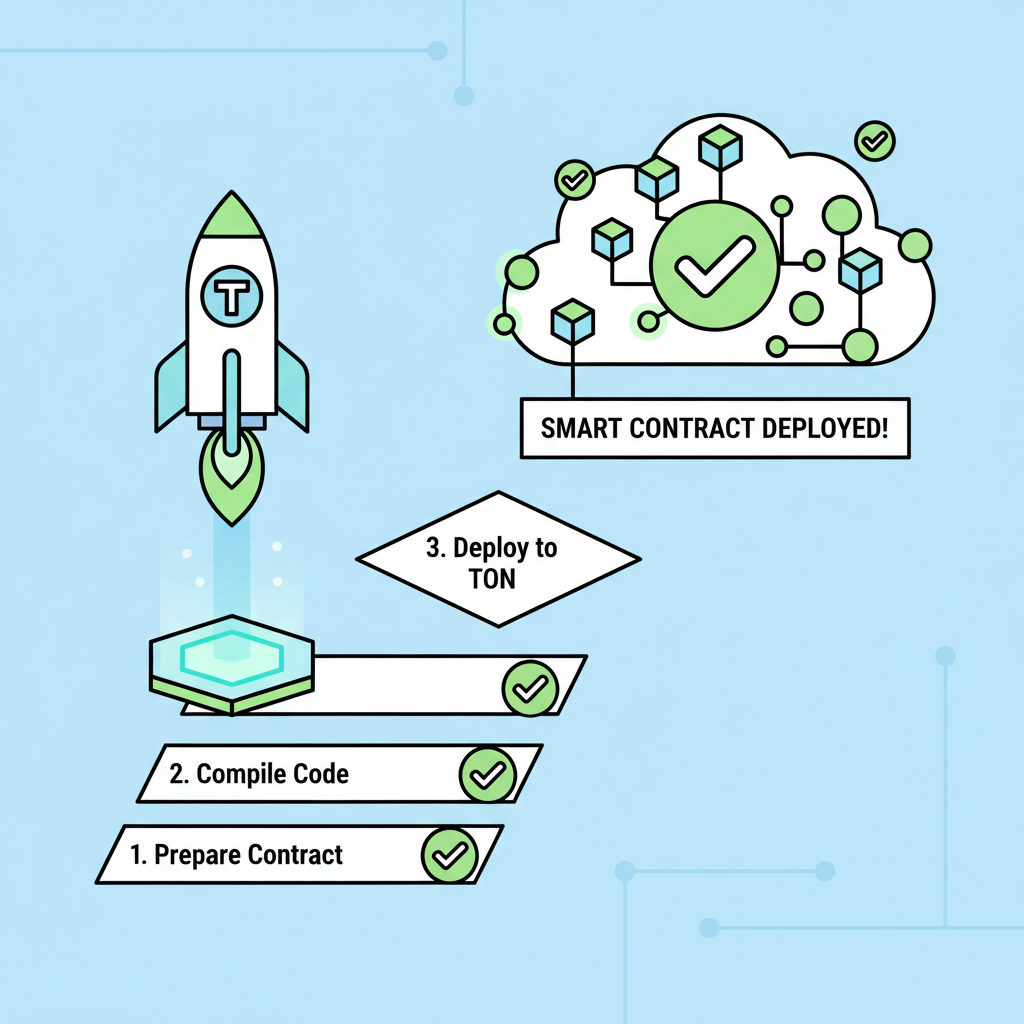

Build with FunC smart contracts for provably fair mechanics, integrating TON Connect for instant payouts. Balance reward dilution with deflationary burns to sustain Toncoin value. Developers nailing this see exponential user growth; it’s not just fun, it’s a Toncoin flywheel where players stake, earn, and reinvest seamlessly.

From my portfolio lens, these mechanics aren’t gimmicks; they’re engineered retention loops that mirror successful DeFi protocols I’ve allocated to, but supercharged by Telegram’s social graph. Developers prioritizing fair tokenomics will capture lasting value as Toncoin hovers at $0.5315 amid ecosystem expansion.

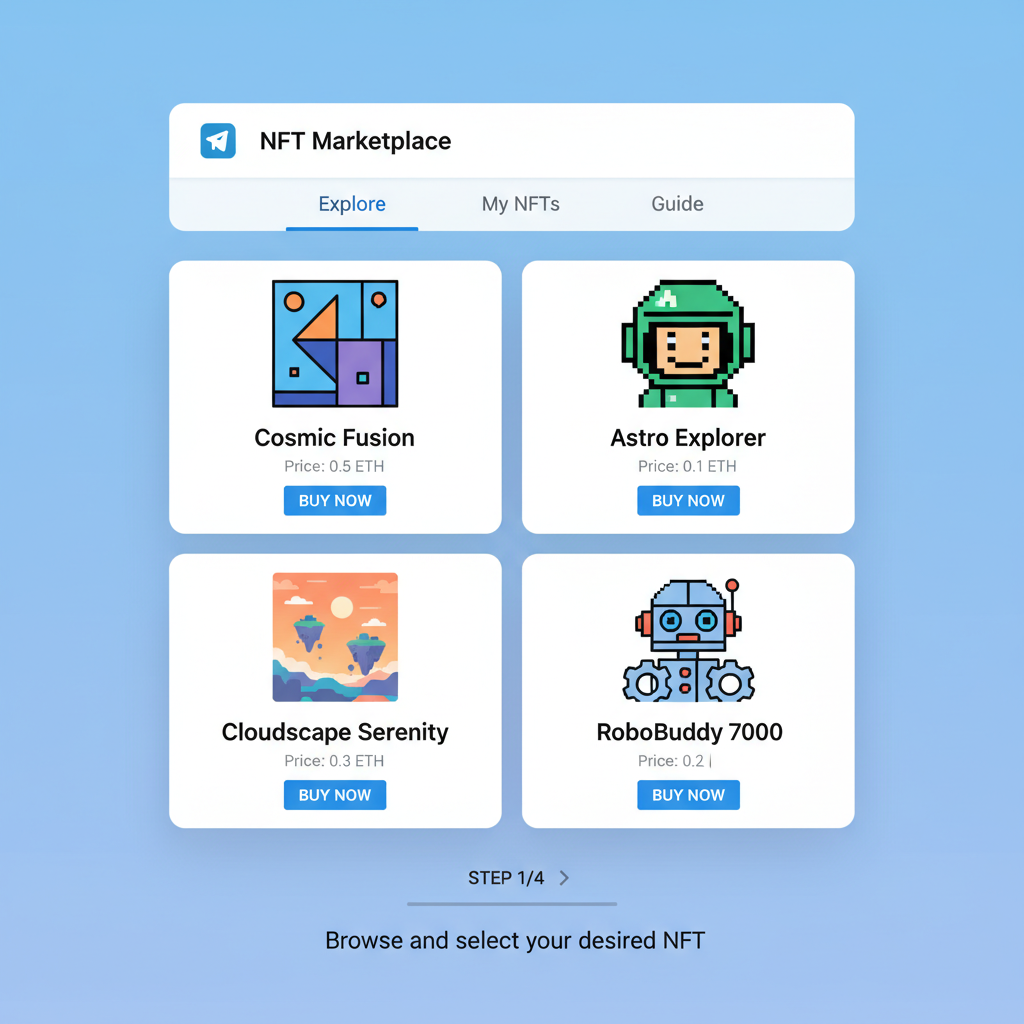

Scalable NFT Marketplaces and Collectibles for Viral Sharing

NFTs aren’t dead; they’re evolving into shareable Telegram stickers and badges that fuel Toncoin’s collectibles boom. Build marketplaces inside Mini Apps where users mint, trade, and flaunt TON-based NFTs with one-tap sharing to chats. Viral loops emerge naturally: a rare collectible gifted in a group sparks FOMO buys at $0.5315 Toncoin levels. TON’s asset tokenization edge, highlighted in institutional use cases, ensures low royalties and high throughput for millions of trades.

Leverage Jetton-NFT hybrids for bundled rewards, like play-to-earn drops. Integrate TON Space for cross-chain NFT swaps, blending liquidity from Ethereum and Solana into TON. Developers focusing on Telegram Mini Apps Toncoin virality should embed share buttons and Telegram Premium perks, turning users into marketers. This isn’t speculative froth; it’s a proven path to mass onboarding, echoing social NFTs’ role in TON’s blueprint for Telegram’s billion users.

TON Pay’s February 2026 rollout cements these strategies, enabling wallet-agnostic payments that abstract crypto complexity. Pair with the $1 billion liquidity push, and you’re not just building apps; you’re architecting Toncoin’s on-ramp for Telegram’s scale.

Across 11 years steering portfolios, I’ve rarely seen a blockchain so primed for mainstream fusion. By embedding these five strategies – from TON Connect onboarding to NFT virality – developers don’t chase adoption; they ignite it. With 50 million Mini App users and counting, Toncoin at $0.5315 signals the floor of a much larger ascent. Dive in, iterate fast, and watch your creations propel the ecosystem forward.