As Toncoin hovers at $1.48 with a modest 24-hour gain of and $0.0100 ( and 0.5700%), the blockchain’s ecosystem just notched a pivotal advancement. On February 9,2026, the TON Foundation unveiled TON Pay, a wallet-agnostic SDK that embeds native crypto payments straight into Telegram Mini Apps. This isn’t mere hype; it’s a calculated move to transform Telegram’s 1.1 billion monthly users into everyday crypto transactors, slashing barriers like clunky checkouts and high fees. Developers now have a toolkit for one-tap settlements using Toncoin and USDT, with average fees under $0.01 and sub-second confirmations. In a market where friction kills adoption, TON Pay positions Toncoin as the seamless payment rail for social commerce.

TON Pay’s Architecture: Built for Frictionless Telegram Integration

At its core, the TON Pay SDK leverages TON Connect for wallet integration, sidestepping the pitfalls of prepaid gas or multi-step approvals that plague other chains. Imagine a user in a Telegram Mini App spotting a digital good, tapping pay, and watching Toncoin or USDT flow instantly without leaving the chat. This unified flow supports merchants by handling settlement directly, reducing operational headaches. The SDK’s wallet-agnostic design means it pairs with any TON-compatible wallet, broadening accessibility. Early focus on Mini Apps makes sense: these lightweight apps already power games, tools, and shops within Telegram, reaching users primed for impulse buys.

From my vantage as a long-term investor, this SDK addresses a macro trend I’ve tracked for years: the convergence of messaging and money. Traditional payment processors charge 2-3% per swipe; TON Pay delivers microtransactions at pennies. With Toncoin’s price steady at $1.48 amid broader market flux, this launch reinforces its utility beyond speculation, anchoring value in real-world use cases like in-app purchases and subscriptions.

Unlocking Toncoin Adoption Through Mini App Monetization

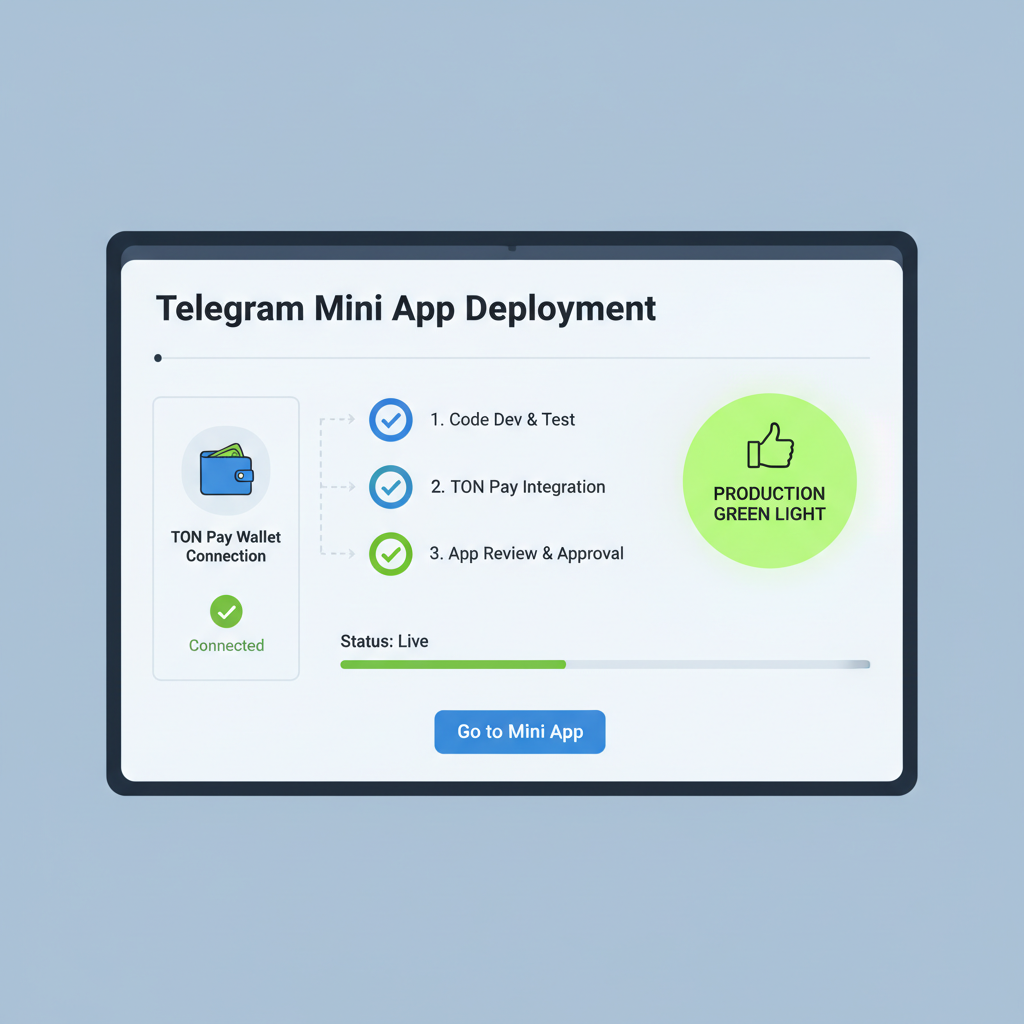

Telegram Mini Apps aren’t just novelties; they’re a burgeoning economy. TON Pay supercharges this by enabling Telegram mini apps payments that feel native, not bolted-on. Developers gain simplified wallet management and analytics, while users enjoy gasless-like experiences without the tech debt. The roadmap hints at expansions: subscriptions, fiat off-ramps tailored by region, and MPC wallets for enhanced security. Collaborations with custodians ensure compliance, a nod to the regulatory realities that have slowed crypto payments elsewhere.

Consider the numbers. Telegram’s scale dwarfs most social platforms, yet crypto penetration remains nascent. By embedding Toncoin crypto payments, TON Pay could onboard millions via familiar interfaces. I’ve seen equities pivot on payment innovations; Toncoin, at $1.48, stands at a similar inflection. This isn’t about pumping prices short-term but cultivating enduring demand through developer tools that scale.

Toncoin (TON) Price Prediction 2027-2032

Forecasts based on TON Pay SDK adoption in Telegram Mini Apps, starting from $1.48 baseline in 2026

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $1.75 | $3.20 | $5.80 |

| 2028 | $2.20 | $4.50 | $8.50 |

| 2029 | $3.00 | $6.50 | $12.00 |

| 2030 | $4.20 | $9.00 | $16.50 |

| 2031 | $5.50 | $12.00 | $22.00 |

| 2032 | $7.00 | $15.50 | $28.00 |

Price Prediction Summary

Toncoin is forecasted to experience robust growth from 2027 to 2032, propelled by TON Pay’s seamless integration into Telegram’s 1.1 billion user ecosystem. Average prices are projected to climb from $3.20 in 2027 to $15.50 in 2032, reflecting bullish adoption scenarios with minimums hedging bearish market cycles and maximums capturing peak potential.

Key Factors Affecting Toncoin Price

- Mass adoption of TON Pay SDK enabling one-tap payments with Toncoin and USDT in Telegram Mini Apps

- Sub-second settlements and <$0.01 fees boosting microtransactions and developer monetization

- Expansion to web platforms, subscriptions, gasless txns, and fiat off-ramps

- Telegram’s 1.1B user base driving network effects and mainstream crypto entry

- Crypto market cycles, with bull runs amplifying growth post-2026 launch

- Regulatory compliance via local custodians, mitigating risks

- Competition from other L1 payment rails and potential Telegram policy changes

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Key Benefits Driving 2026 Momentum

What sets TON Pay apart in the crowded TON Telegram integration space? First, sub-second settlements make it viable for everything from sticker packs to premium content. Fees averaging below $0.01 democratize microtransactions, a boon for creators in emerging markets. Second, its single-package simplicity means even solo devs can integrate without a backend overhaul. Merchants settle in TON or USDT, with future fiat ramps smoothing cash-outs.

Patience rewards the prepared. As Toncoin trades at $1.48, up 0.5700% today, TON Pay lays groundwork for exponential growth. Check out how Telegram Mini Apps and Toncoin are revolutionizing on-chain payments for deeper context. This SDK isn’t just code; it’s the bridge to Toncoin adoption 2026, turning casual users into stakeholders.

Merchants must align with Telegram’s policies, but the upside is clear: diversified revenue in a compliant framework. Early adopters will capture mindshare as the ecosystem matures.

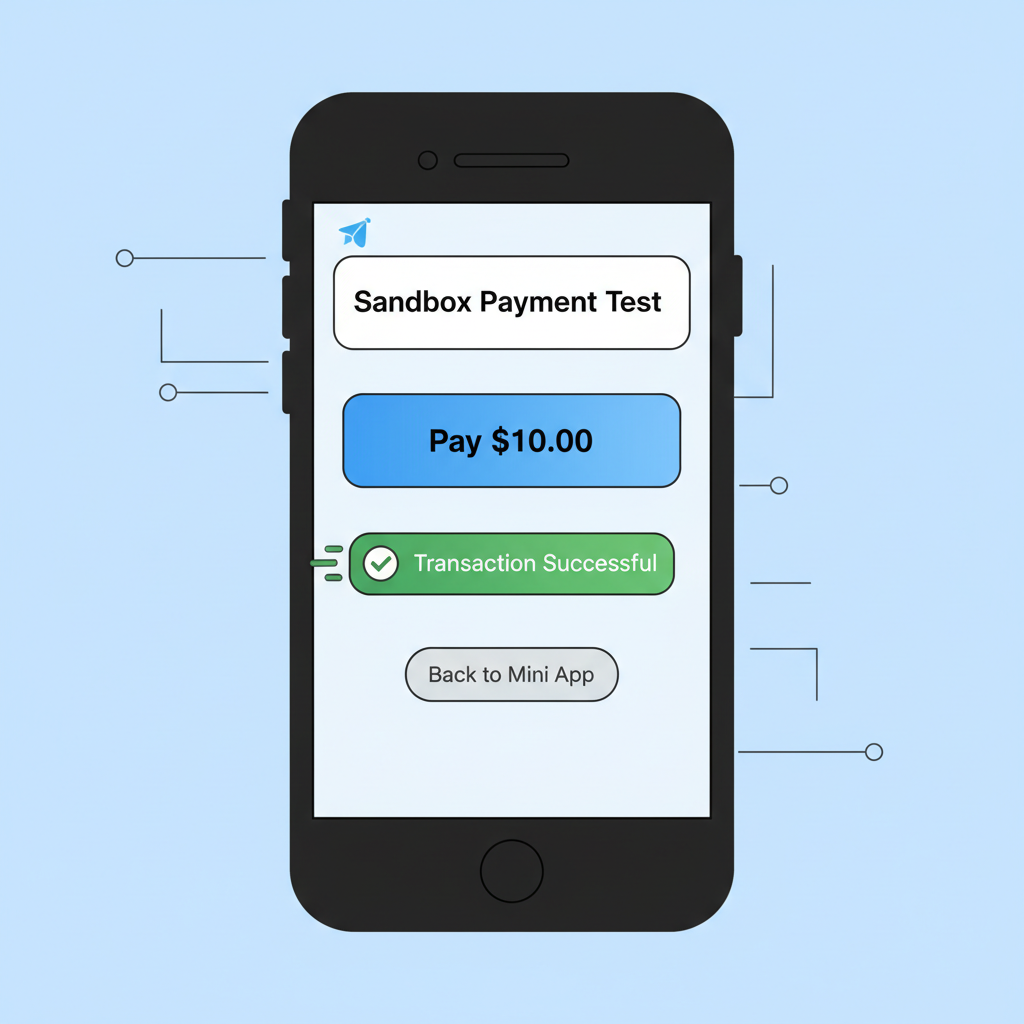

Integrating TON Pay demands a measured approach, starting with environment setup and progressing to live transactions. Developers familiar with Telegram’s ecosystem will appreciate how the SDK abstracts complexities, letting you focus on user experience over boilerplate code.

Hands-On with TON Pay SDK: A Developer’s Integration Blueprint

The beauty of TON Pay SDK lies in its minimal footprint. Begin by installing via npm: npm install @tonpay/sdk. Next, initialize with your app’s Telegram init data, ensuring TON Connect compatibility. This wallet-agnostic layer detects user wallets seamlessly, prompting one-tap approvals without custom UI hacks.

Once wired in, crafting a payment flow is straightforward. Pass transaction details like amount, recipient address, and payload via the SDK’s createPayment method. Users confirm via their wallet modal, and callbacks deliver settlement proofs. This flow supports seamless TON payments, ideal for dynamic pricing in games or e-commerce Mini Apps.

JavaScript Example: TON Pay SDK Initialization, 1 TON Payment Button, and Settlement Handling

To integrate TON Pay SDK into your Telegram Mini App, begin by initializing the SDK with your API credentials and the Telegram WebApp’s initData for secure context. This example demonstrates creating a simple button for a 1 TON payment, initiating the transaction, and setting up a settlement callback to handle confirmations thoughtfully—ensuring your app responds patiently to blockchain finality without rushing user experience.

// Import or assume TON Pay SDK is loaded via script tag

// e.g.,

// Step 1: Initialize TON Pay SDK in Telegram Mini App context

const tonPay = new TonPaySDK({

apiKey: 'your-tonpay-api-key', // Obtain from TON Pay dashboard

telegramInitData: window.Telegram.WebApp.initData, // For secure Mini App verification

network: 'mainnet' // or 'testnet' for testing

});

// Step 2: Create a payment button for 1 TON (in nanotons: 1e9)

const payButton = document.getElementById('pay-1-ton');

payButton.addEventListener('click', async () => {

try {

// Create payment request

const paymentRequest = await tonPay.createPayment({

amount: 1000000000n, // 1 TON in nanotons (BigInt for precision)

currency: 'TON',

description: 'Payment for premium features in Mini App',

payload: 'miniapp-order-12345' // Optional order reference

});

// Initiate the payment via TON Connect or embedded wallet

const result = await tonPay.initiateTransaction(paymentRequest);

if (result.success) {

console.log('Transaction sent:', result.txId);

// Step 3: Handle transaction success and register settlement callback

tonPay.onSettlement(result.txId, (settlementData) => {

console.log('Funds settled successfully:', settlementData);

// Update UI, unlock features, notify backend, etc.

window.Telegram.WebApp.showAlert('Payment confirmed! Thank you.');

// Example: Unlock premium content

document.getElementById('premium-content').style.display = 'block';

});

}

} catch (error) {

console.error('Payment initiation failed:', error);

window.Telegram.WebApp.showAlert('Payment failed. Please try again.');

}

});

// Optional: Listen for global settlement events

tonPay.on('settlement', (data) => {

console.log('Global settlement event:', data);

});This code snippet provides a robust foundation for payments. Note the use of BigInt for precise nanoton handling, error management for reliability, and event callbacks for asynchronous settlement tracking. In production, replace placeholders with real values, add loading states to the button for better UX, and integrate backend verification of settlements. Test thoroughly on testnet first to appreciate the flow’s seamlessness in fostering 2026 Toncoin adoption.

Testing merits patience. Use Telegram’s test environment to simulate wallets and edge cases like network congestion. Fees stay predictably low, under $0.01 even during peaks, preserving margins on small transactions. Deploying to production requires Telegram policy compliance, including clear terms for crypto handling. I’ve advised projects through similar integrations; the key is iterative refinement based on user feedback loops.

For deeper dives, explore how Telegram Mini Apps and TON wallet integration drive mass crypto adoption. Pairing TON Pay with bots extends reach, blending Mini App checkouts with automated fulfillment.

Real-World Tactics for Merchants and Creators

Merchants eyeing Telegram mini apps payments should prioritize UX. Dynamic pricing in TON or USDT accommodates Toncoin’s steady $1.48 value, hedging volatility. Analytics baked into the SDK track conversion rates, revealing what drives impulse buys in chats. For creators, subscriptions loom large on the roadmap, promising recurring revenue without churn.

From an investor’s lens, this SDK cements Toncoin’s edge. At $1.48, up $0.0100 (0.5700%) in 24 hours, it benefits from organic demand as Mini Apps proliferate. Emerging markets, where remittance fees devour earnings, stand to gain most from sub-second, low-cost transfers. Compliance partnerships with fiat providers will unlock broader appeal, converting crypto natives to everyday payers.

Challenges persist: wallet fragmentation and regulatory flux. Yet TON Pay’s design anticipates these, with MPC wallets enhancing custody and region-specific ramps easing exits. Early movers in gaming or content verticals will test these waters, informing ecosystem-wide scaling.

Charting Toncoin’s 2026 Trajectory

TON Pay isn’t isolated; it’s the linchpin in TON’s Telegram symbiosis. As Mini Apps evolve into full-fledged storefronts, Toncoin crypto payments become the default. Picture 1.1 billion users tipping creators or buying virtual goods with Toncoin at $1.48, each transaction reinforcing network effects. My 18 years tracking trends affirm: utility begets adoption. This SDK shifts Toncoin from speculative asset to indispensable rail.

Developers, start small: prototype a payment button today. Merchants, audit your Mini App for integration hooks. With fees this low and speeds unmatched, the cost of inaction outweighs experimentation. Toncoin’s poised at $1.48, but TON Pay unlocks the multiplier for 2026 growth. Dive in, iterate thoughtfully, and watch your project thrive amid Telegram’s expanse.