In the evolving landscape of blockchain adoption, few ecosystems have captured the imagination quite like Toncoin within Telegram. As of February 6,2026, Toncoin trades at $0.4918, reflecting a 24-hour dip of -10.77% with a high of $0.5546 and low of $0.4368. Yet, beneath this short-term volatility lies a robust strategy fueling long-term growth: targeted Telegram airdrop tactics. These initiatives, powered by Telegram Stars and mini-apps, have simplified Web3 entry for millions, turning casual users into active participants without the usual crypto friction.

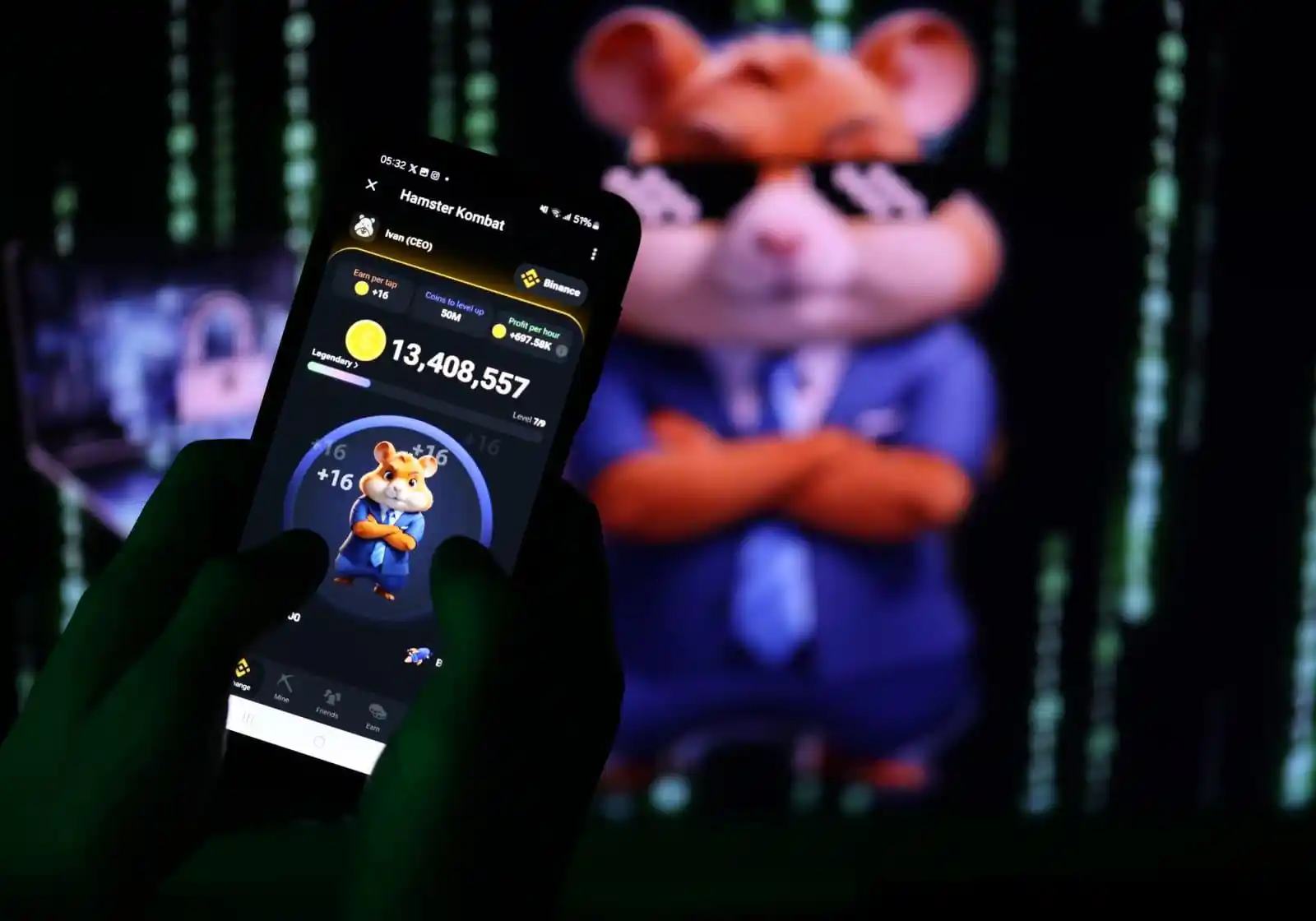

Telegram’s projected revenue surpassing $1 billion annually underscores the potency of TON-driven features like wallets and collectibles. The TON Foundation’s allocation of $22 million in Toncoin for airdrops and quests, part of a larger $40 million boost, exemplifies this commitment. Games such as Notcoin and Hamster Kombat have drawn millions, distributing TON rewards that enhance user retention and ecosystem liquidity. For patient investors, these toncoin telegram airdrop mechanics signal a maturing network, where community-driven growth outpaces hype.

Top Toncoin projects leverage five precise strategies to accelerate adoption. Each builds on Telegram’s billion-plus user base, fostering organic expansion through viral mechanics and on-chain incentives. Let’s examine the forefront tactics shaping toncoin community growth telegram.

Viral Referral Programs via Telegram Mini-Apps

At the core of Toncoin’s surge are viral referral programs embedded in Telegram mini-apps. These aren’t blunt pyramid schemes; they’re thoughtfully designed loops that reward genuine network effects. Users invite friends via seamless share buttons, earning TON fractions upon verified wallet connections. Consider the mechanics: a mini-app like a clicker game prompts referrals with escalating multipliers, where the tenth invite yields double rewards. This has propelled user acquisition costs near zero for projects, as organic sharing within Telegram channels amplifies reach exponentially.

From my vantage as a long-term holder, this tactic shines in its patience-testing nature. Early participants grind referrals over weeks, building habits that translate to sustained engagement. Data from 2024’s 5000% wallet growth hints at continuation, with mini-apps now integral to Telegram Stars exchanges. Security remains paramount: stick to verified bots and isolate wallets to safeguard against phishing, ensuring referrals fuel growth, not grief.

Milestone-Based On-Chain Quests with TON Rewards

Shifting from social virality, milestone-based on-chain quests anchor users to the TON blockchain. Projects delineate clear progression: complete ten transactions, stake 10 TON, or govern via votes to unlock tiered airdrops. The TON Foundation’s 30 million TON distribution, valued at $188 million previously, now channels through these quests, blending gamification with utility. Toncoin’s sharded architecture ensures low fees, making micro-quests viable even at $0.4918 per token.

This approach cultivates depth over breadth. Participants aren’t passive droppers; they evolve into stakers and voters, fortifying network security. I’ve observed parallels in equities, where milestone incentives retain talent long-term. In TON, quests tie directly to Telegram Stars earnings, letting users convert in-app activity to blockchain assets frictionlessly. The result? A self-reinforcing economy where viral airdrops toncoin 2026 evolve into habitual on-chain behavior.

Toncoin (TON) Price Prediction 2027-2032

Projections Based on Telegram Airdrop Tactics, Stars Integration, and Ecosystem Growth from 2026 Baseline ($2.00 Avg)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $1.50 | $2.80 | $4.50 | +40% |

| 2028 | $2.00 | $4.20 | $7.00 | +50% |

| 2029 | $3.00 | $6.30 | $10.50 | +50% |

| 2030 | $4.50 | $9.45 | $15.75 | +50% |

| 2031 | $6.50 | $13.23 | $22.00 | +40% |

| 2032 | $9.00 | $18.52 | $30.00 | +40% |

Price Prediction Summary

Toncoin’s integration with Telegram via airdrops, Stars, and mini-apps positions it for strong growth amid mass adoption. Average prices are forecasted to compound progressively, reaching $18.52 by 2032 in bullish scenarios, with min/max reflecting bearish corrections and bull market peaks.

Key Factors Affecting Toncoin Price

- Telegram’s 900M+ users and mini-apps (e.g., Notcoin, Hamster Kombat) driving viral adoption

- Airdrop programs and $200M+ in rewards boosting community engagement

- Telegram Stars enabling seamless fiat-to-TON transactions

- TON blockchain scalability via sharding and PoS enhancements

- Favorable market cycles post-2026 recovery and regulatory clarity for Telegram-integrated crypto

- Competition from L1s mitigated by unique Telegram ecosystem moat

- Macro factors: rising Web3 demand and Toncoin’s utility in fees, staking, governance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

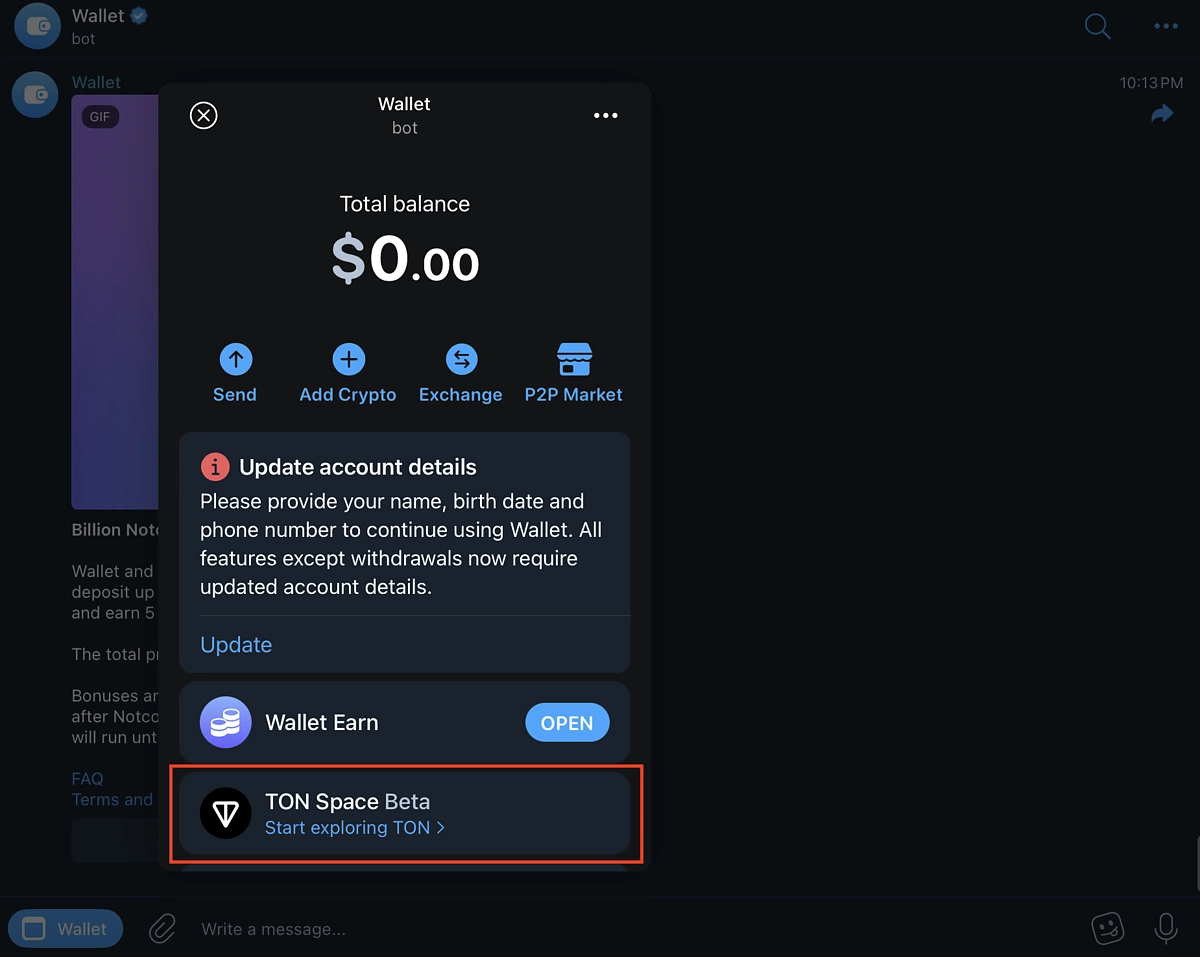

Seamless Integration with Telegram Wallet for Frictionless Airdrops

No tactic rivals the elegance of Telegram Wallet integration for airdrops. Users claim rewards with one tap, no seed phrase juggling required. This bridges Telegram’s micro-economy to TON, where Stars purchases fund mini-app interactions, yielding automatic TON drips. Premium users and channel subscribers receive priority tiers, aligning incentives with Telegram’s subscription model.

Patience rewards here: wallets auto-compound small claims, turning daily logins into compounding positions. At current $0.4918 pricing, even modest airdrops accumulate meaningfully over months. Projects report 40% retention lifts from this seamlessness, underscoring why TON’s community takeover post-Telegram handover proved resilient. For developers, it’s a blueprint: embed wallet calls natively, watch adoption soar.

Layering sophistication onto this foundation, tiered airdrops target Telegram channel growth and premium users, creating stratified incentives that mirror real-world loyalty programs. Basic subscribers snag initial TON drops for joining, while premium tiers unlock multipliers based on engagement metrics like message reactions or post shares. At $0.4918 per Toncoin, these drops feel tangible, encouraging upgrades that boost Telegram’s revenue while swelling TON’s active addresses. Projects calibrate tiers meticulously: silver for 30-day retention, gold for referrals plus staking, ensuring rewards scale with commitment.

This patient stratification appeals to my investment philosophy. It filters for dedicated holders, much like dividend aristocrats in equities reward longevity. In 2026, with Telegram Stars facilitating premium conversions, channels have ballooned, channeling toncoin adoption telegram tactics into sustained liquidity. Developers thrive by auditing tiers transparently, fostering trust amid the ecosystem’s explosive wallet growth.

Strategic Use of TON Foundation’s $22M Community Reward Pool

Crowning these tactics is the strategic deployment of the TON Foundation’s $22 million community reward pool, a war chest for airdrops and quests that amplifies every other strategy. Allocated from a broader $40 million initiative, it funds targeted distributions: 10% to viral referrers, 30% to quest completers, with the rest fueling wallet-integrated and tiered drops. This pool democratizes access, prioritizing on-chain activity over speculation, and leverages Toncoin’s multi-role utility in fees, staking, and governance.

From an analyst’s lens, this pool embodies resilience post-Telegram’s community handover. It sustains momentum even as Toncoin hovers at $0.4918 amid volatility, converting mini-app fervor into blockchain depth. Mini-games like Hamster Kombat tap it directly, blending Stars earnings with TON yields for creators. The sharded PoS design keeps participation cheap, inviting masses without barriers. Security vigilance remains key: verified bots only, isolated wallets for quests, preserving the pool’s integrity for genuine growth.

Across these five pillars, Toncoin projects orchestrate a symphony of adoption. Viral referrals ignite, quests deepen, wallet seams smooth, tiers stratify, and the reward pool sustains.

Top 5 TON Airdrop Tactics

-

Viral Referral Programs via Telegram Mini-Apps: Leverage Telegram’s mini-apps for zero-cost user acquisition, as seen in Notcoin and Hamster Kombat, which drew millions by rewarding referrals with TON tokens. This tactic fosters exponential growth, seamlessly onboarding users into the TON ecosystem without prior crypto knowledge, amplified by Telegram Stars integration.

-

Milestone-Based On-Chain Quests with TON Rewards: Encourage sustained engagement through quests on the TON blockchain, building on-chain habits. TON Foundation’s programs distribute rewards like portions of the 30 million TON ($188M at current rates) pool, turning casual Telegram users into active participants via verifiable milestones.

-

Seamless Integration with Telegram Wallet for Frictionless Airdrops: Enable one-tap claims directly in the Telegram Wallet, reducing barriers for newcomers. This integration with Telegram Stars allows instant asset exchanges, boosting adoption as users earn and spend TON rewards effortlessly within mini-apps.

-

Tiered Airdrops for Telegram Channel Growth and Premium Users: Scale loyalty by offering escalating rewards for channel engagement and Telegram Premium subscribers. This nurtures dedicated communities, mirroring successful TON-driven channel expansions that enhance retention and organic growth.

-

Strategic Use of TON Foundation’s $22M Community Reward Pool: Sustain long-term funding with dedicated Toncoin allocations, including $22M for airdrops and quests from the TON Foundation. Combined with $40M boosts, this underpins resilient growth, as evidenced by TON’s community takeover and 2026 Telegram Stars synergies.

Observing 2026’s landscape, Telegram Stars emerges as the linchpin, letting users trade in-app assets for TON without crypto prerequisites. This has spiked participation in telegram airdrop toncoin projects, with millions funneled from games to staking pools. Retention metrics rival traditional finance, as small, frequent rewards at $0.4918 compound into portfolios that weather dips. For investors, it’s a reminder: true value accrues through ecosystems that reward patience, not pumps.

TON’s trajectory, rooted in these airdrop mechanics, positions it as Web3’s mass-market bridge. Developers and communities wielding them wisely will capture Telegram’s vast user sea, driving Toncoin toward enduring utility and appreciation. In a field of fleeting trends, this measured approach promises lasting waves.