In the dynamic landscape of blockchain adoption, few initiatives capture the imagination quite like the Tonso Network’s push into Telegram’s creator economy. As of February 2026, this platform has onboarded over 8,000 Telegram creators, igniting a wave of toncoin telegram adoption that aligns perfectly with TON’s ambitious vision. These creators, spanning channels with millions of followers, are not just joining a network; they are becoming active participants in a decentralized future woven directly into everyday messaging.

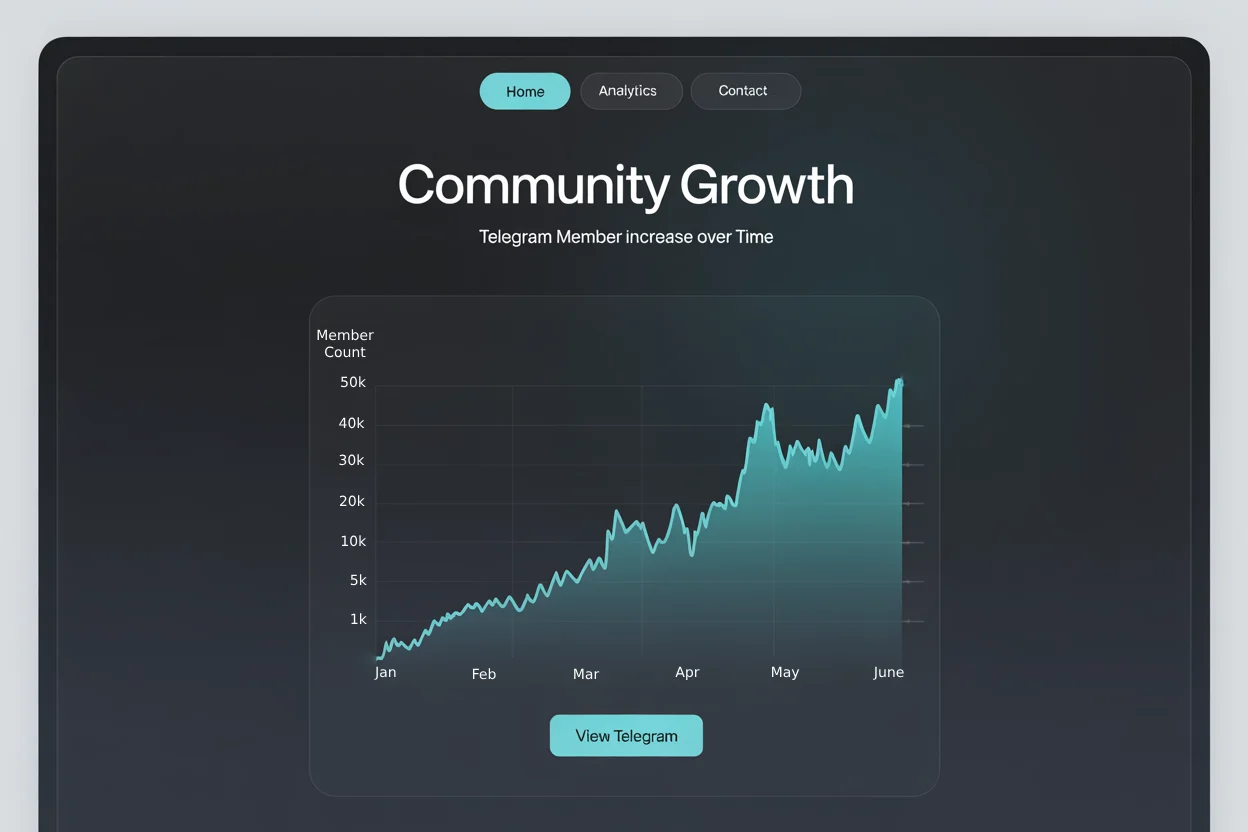

The synergy between Tonso and Telegram represents a thoughtful evolution in how blockchains scale. Telegram’s 800 million-plus users provide fertile ground, and Tonso’s AI-driven indexing of over 30,000 channels ensures that content discovery happens seamlessly. This isn’t hype; it’s measurable momentum, with 47,000 active users in January alone signaling robust early traction in the tonso network toncoin space.

Tonso’s Creator Onboarding Revolutionizes Telegram Engagement

What sets Tonso apart is its focus on empowering telegram creators tonso with tools that bridge content creation and blockchain utility. Creators gain access to analytics, monetization via Toncoin, and AI-powered insights that were previously siloed in Web2 platforms. Imagine a channel owner analyzing audience sentiment in real-time or distributing Toncoin rewards effortlessly, all within Telegram Mini Apps. This frictionless integration eliminates the barriers that have long plagued crypto onboarding.

Pavel Durov’s announcement that all Telegram payouts will be in Toncoin underscores this shift, turning ad revenue into a direct catalyst for ecosystem growth.

From my vantage as an investment strategist tracking adoption trends, this move is strategic brilliance. It leverages Telegram’s scale to distribute Toncoin natively, fostering organic demand without aggressive marketing. Early data shows transaction volumes surging as creators experiment with payments and subscriptions, proving that utility drives retention better than speculation.

Key Drivers Behind Tonso’s Rapid User Growth

Diving deeper into the metrics, Tonso’s tonso active users growth tells a compelling story. The platform’s AI excels at tonso ai indexing channels, surfacing relevant content across Telegram’s vast network. This has led to exponential engagement, with creators reporting higher retention rates and diversified revenue streams. TON Foundation’s goal of onboarding 30% of Telegram’s user base by 2028 feels increasingly attainable when you consider these grassroots efforts.

Benefits for Tonso Creators

-

AI Analytics: Unlock audience insights with advanced AI tools for Telegram channels.

-

Toncoin Monetization: Seamlessly earn and receive payments in Toncoin directly on Telegram.

-

Indexed Discovery: Get your channel indexed for easy discovery within the Tonso Network.

-

Boosted Engagement: Enhance metrics and user interaction through Tonso’s growth tools.

-

Mini Apps Integration: Seamlessly connect with Telegram Mini Apps for expanded reach.

TON’s competitive edge lies in its embedding within daily digital habits, from payments to digital identity. Projects like Tonso amplify this by targeting influencers who shape user behavior. As one LinkedIn analysis notes, TON is embedding blockchain into everyday interactions, and creator onboarding is the linchpin. The Bybit report highlights Telegram’s monthly active users as a launchpad, with Tonso accelerating the flywheel effect.

Strategic Implications for Toncoin’s Long-Term Trajectory

Looking ahead, the implications for Toncoin are profound. With Telegram mandating TON for ad payouts, creators are incentivized to hold and use the asset, creating sustained demand. This creator-led adoption mirrors successful Web2-to-Web3 transitions but with blockchain’s transparency baked in. Tonso’s 8,000-strong cohort is just the vanguard; as more channels index and users activate wallets, network effects will compound.

In my experience analyzing digital asset trends, sustainable growth stems from real utility. Tonso delivers that by making Toncoin indispensable for creators seeking to monetize authentically. The result? A virtuous cycle where Telegram ad payouts in TON fuel a new creator economy, drawing in developers, investors, and everyday users alike.

Developers building on Tonso are already seeing the ripple effects. Mini Apps integrated with the network allow creators to launch token-gated content or NFT drops directly in chats, turning passive viewers into active participants. This isn’t theoretical; transaction volumes on TON have spiked alongside Tonso’s tonso active users growth, as reported in recent ecosystem updates. From my perspective, this grassroots momentum positions Toncoin as a frontrunner in seamless Web3 entry points, outpacing rivals reliant on standalone apps.

Real-World Impact: Creators Leading the Charge

Consider a mid-sized Telegram channel with 100,000 subscribers. Through Tonso, the owner indexes their content for AI-driven recommendations, unlocking Toncoin-based subscriptions that generate steady revenue. One creator shared on X how tonso ai indexing channels doubled their discovery rate, leading to a 40% engagement lift. These stories compound across 8,000 creators, forming a decentralized media layer atop Telegram. It’s a model that scales organically, sidestepping the pitfalls of forced crypto integrations elsewhere.

Toncoin Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:TONUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As a seasoned technical analyst with 5 years of experience focusing on balanced TA, draw a prominent downtrend line connecting the swing high at 2026-10-20 around $3.50 to the recent lower high at 2026-01-15 around $1.90, extending it forward to project potential resistance near $1.40. Add horizontal lines at key support $1.20 (strong) and $1.00 (major). Mark a recent consolidation rectangle from 2026-01-10 to 2026-02-01 between $1.20-$1.50. Place arrow_mark_down on the sharp breakdown candle around 2026-12-20. Use callouts for volume divergence and MACD bearish crossover. Fib retracement from the Oct low to high for potential pullback levels. Add text notes for entry zone at $1.35 and risk assessment.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold with strong fundamentals from TON adoption; wait for confirmation to avoid whipsaws

Market Analyst’s Recommendation: Consider long positions on breakout above $1.50 with tight stops, aligning with my medium risk tolerance and balanced TA style

Key Support & Resistance Levels

📈 Support Levels:

-

$1.2 – Recent lows holding with volume support, aligns with 0.618 fib

strong -

$1 – Psychological and prior range low, major floor

strong

📉 Resistance Levels:

-

$1.6 – Recent swing high, first hurdle post-consolidation

moderate -

$1.9 – Downtrend line projection and prior resistance

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.35 – Bounce from support with bullish volume divergence, aligns with medium risk tolerance

medium risk

🚪 Exit Zones:

-

$1.8 – Profit target at resistance confluence

💰 profit target -

$1.15 – Tight stop below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: bullish divergence – decreasing on downside

Volume spikes on declines but fading on recent lows, suggesting exhaustion

📈 MACD Analysis:

Signal: bearish crossover but histogram contracting

MACD line below signal with narrowing histogram, potential bullish flip soon

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

The TON Foundation’s playbook, embedding blockchain in messaging, gains potency through initiatives like Tonso. With USDT on TON and trending tokens gaining traction, liquidity flows effortlessly. Creators aren’t just earning; they’re innovating with DeFi tools, gaming elements, and social tokens, all native to the platform. This creator-centric approach accelerates toncoin telegram adoption, making blockchain feel like an upgrade rather than an add-on.

Navigating Challenges and Scaling Sustainably

Of course, rapid growth invites hurdles. Regulatory scrutiny around crypto payouts and ensuring AI fairness in content indexing demand vigilant oversight. Yet Tonso’s team, backed by Telegram’s infrastructure, appears equipped to address these. Pavel Durov’s commitment to Toncoin-exclusive payouts minimizes friction, while community governance could refine tools iteratively. In my 16 years tracking markets, I’ve seen ecosystems falter on scalability; TON sidesteps this via sharding and Telegram’s proven load-handling.

Investors eyeing long-term plays should note the network effects at work. As more channels onboard, Tonso’s indexing becomes a self-reinforcing discovery engine, pulling in Telegram’s vast audience. Pair this with Toncoin’s native integration with Telegram, and you have a blueprint for billion-user scale. Early adopters, creators and holders alike, stand to benefit most from this compounding utility.

Telegram Mini Apps further amplify this, enabling viral loops where users earn Toncoin through interactions, referrals, or content shares. Tonso’s role in indexing these apps ensures creators surface amid the noise, fostering a vibrant economy. The Bybit report underscores Telegram’s user base as rocket fuel; Tonso lights the fuse with precision-targeted onboarding.

Ultimately, the Tonso Network exemplifies how focused creator empowerment drives blockchain’s mass appeal. Over 8,000 Telegram creators aren’t waiting for permission, they’re building the future, one indexed channel at a time. For developers, investors, or channel owners, engaging now means riding the crest of tonso network toncoin expansion. Watch this space; the metrics suggest Toncoin’s trajectory is just accelerating.