In the vibrant ecosystem of Telegram, where billions of messages fly every day, mergeable Telegram gifts have emerged as a clever bridge to blockchain adoption. These digital trinkets, starting as fun animated stickers in late 2024, quickly evolved into full-fledged NFTs on the TON blockchain by early 2025. Users can now seamlessly ‘move gifts to the blockchain’ right from their profile, minting emotional gestures into tradable assets. This frictionless process is supercharging Toncoin wallet onboarding, drawing in users who might never have touched crypto otherwise. Even as Toncoin trades at $0.6783, down -0.0446% over the last 24 hours from a high of $0.7321, the momentum from these gifts points to enduring growth in telegram gifts toncoin adoption.

The Mechanics of Mergeability: From Social Fun to On-Chain Value

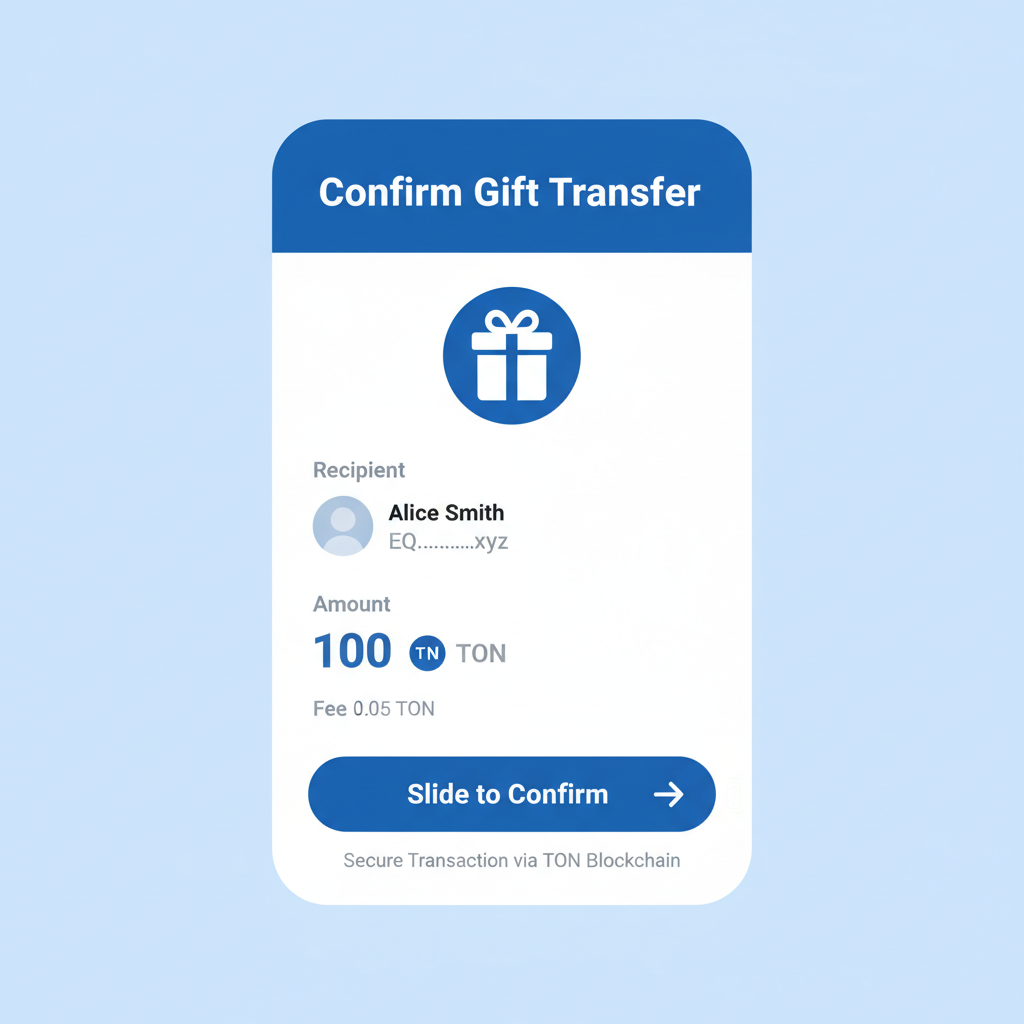

I see mergeable Telegram gifts as a stroke of genius in design thinking. They tap into our innate love for gifting within chats, turning fleeting interactions into lasting digital ownership. Head to My Profile and gt; Gifts, tap a gift, and select Transfer and gt; Send via Blockchain. In moments, it’s an NFT on TON, complete with low fees that make it accessible even for casual users. This isn’t hype; it’s proven utility. Sources like TON’s own reports highlight how these gifts transform social capital into digital ownership, proving blockchain’s worth in everyday social settings.

What sets them apart is the ‘mergeable’ aspect. Users combine gifts to create rarer versions, boosting scarcity and engagement. This gamified layer encourages repeated interactions with the TON wallet, essential for TON NFT gifts onboarding. No need for clunky extensions or seed phrases upfront; TON Space, Telegram’s self-custodial wallet, handles it natively. By November 2024, it hit 100 million registrations, a testament to how gifts lower the entry barrier.

Telegram Gifts provide large-scale, low-fee proof of blockchain utility in social settings.

Hard Numbers: Wallets and Holders Skyrocket

Let’s talk data, because raw metrics cut through the noise. By September 2025, Telegram Gifts powered over 414,275 unique on-chain wallets and 1.66 million unique holders across platforms. That’s not niche; that’s mainstream traction. Compare this to traditional NFT drops, which often fizzle after whales dominate. Here, social virality drives organic spread, with users wearing gifts on profiles like badges of honor.

This surge ties directly to Toncoin’s ecosystem. The TON Foundation’s exclusive partnership with Telegram for Mini Apps amplifies it, embedding blockchain into games, payments, and more. Tools like @push bots for non-custodial transfers complement gifts, letting users send TON or jettons in chats effortlessly. It’s a flywheel: gifts onboard wallets, wallets enable DeFi, DeFi retains users.

TON Space deserves special mention. Integrated directly into Telegram, it eliminates the ‘where’s my wallet?’ headache. For deeper dives on its user experience, check how TON Wallet’s seamless UX drives adoption. Gifts act as the spark, igniting wallet activations at scale.

Social-First Onboarding: The Key to Billion-User Scale

Why does this matter for mass adoption? Traditional crypto onboarding feels like assembling IKEA furniture blindfolded: daunting and error-prone. Mergeable gifts flip the script with social-first mechanics. A friend sends a sticker-gift; you claim it on-chain to wear or trade. Boom – you’re in a Toncoin wallet without tutorials.

Analysts like those at CCN note Telegram Gifts as TON’s fastest-growing trend, with NFTs users flaunt on profiles. Crypto. news echoes this, positioning TON to reach Telegram’s billion users via simple actions like sending USDT or playing Mini Apps. Affluent’s DeFi push and AlphaTON’s AI connectors build on this foundation, but gifts are the entry point.

Toncoin (TON) Price Prediction 2027-2032

Bullish scenarios driven by Mergeable Telegram Gifts adoption, wallet onboarding, and Telegram ecosystem growth

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY Growth (Avg %) |

|---|---|---|---|---|

| 2027 | $1.05 | $1.85 | $3.20 | +164% |

| 2028 | $1.60 | $2.70 | $5.00 | +46% |

| 2029 | $2.20 | $4.00 | $7.50 | +48% |

| 2030 | $3.00 | $5.50 | $10.50 | +38% |

| 2031 | $3.80 | $7.00 | $13.50 | +27% |

| 2032 | $5.00 | $9.20 | $18.00 | +31% |

Price Prediction Summary

Toncoin’s price is forecasted to experience substantial growth from 2027 to 2032, propelled by mass adoption via Telegram Gifts evolving into tradable NFTs, TON Space wallet registrations exceeding 100M, and exclusive Mini App integrations. Average prices are projected to rise from $1.85 in 2027 to $9.20 by 2032, with maximum potentials reaching $18 amid bullish market cycles and Web3 utility expansion.

Key Factors Affecting Toncoin Price

- Rapid Telegram Gifts adoption minting NFTs on TON, surpassing 1.66M holders and driving wallet growth

- TON Space self-custodial wallet enabling frictionless DeFi for Telegram’s billion+ users

- Exclusive TON blockchain for Telegram Mini Apps, boosting on-chain activity

- Favorable regulatory clarity for social-Web3 integrations

- Scalability improvements and low-fee transactions enhancing competitiveness

- Broader market cycles and potential market cap growth to $20B+ in optimistic scenarios

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

At $0.6783, Toncoin reflects short-term volatility, yet gifts ensure long-term stickiness. They embed telegram stickers toncoin growth into daily habits, converting lurkers to holders. This model scales because it’s fun, not forced – a rare win in crypto’s history.

Investors eyeing toncoin wallet activation gifts should note how this social layer fortifies TON against market dips. At $0.6783, with a 24-hour low of $0.6650, Toncoin demonstrates resilience rooted in utility, not speculation. Mergeable gifts create habitual on-chain activity, turning one-time gifters into daily transactors.

Hands-On: Merge Your First Gift Today

Practical adoption hinges on simplicity, and Telegram nails it. Imagine receiving a quirky animated sticker from a group chat; instead of letting it vanish, you elevate it to an NFT. This process not only secures ownership but sparks curiosity about TON’s broader DeFi landscape. As someone who’s tracked adoption curves for over a decade, I view this as the textbook playbook for scaling Web3: start with delight, layer in value.

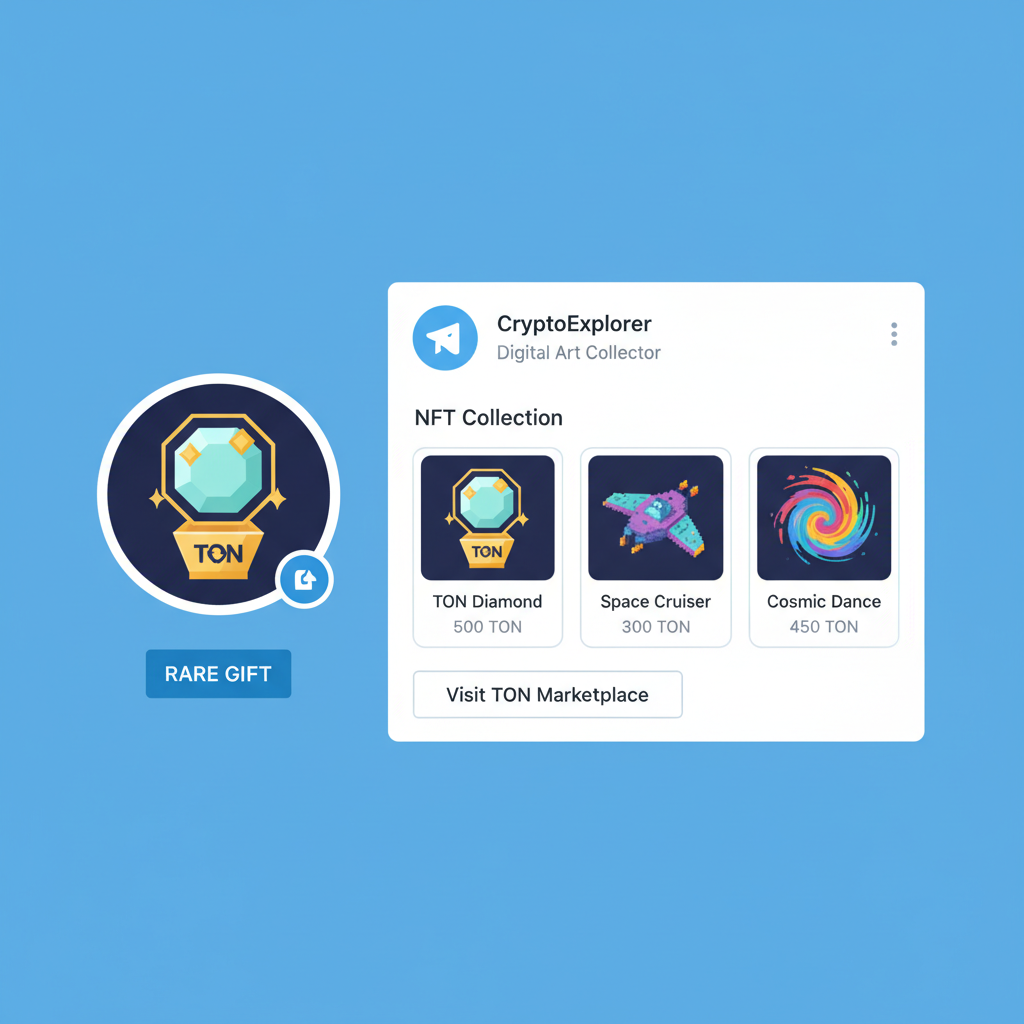

Once merged, rarer gifts command premium prices on TON marketplaces, incentivizing deeper wallet use. This loop – gift, mint, merge, trade – mirrors successful game economies but with real asset backing. Early movers who grasped this in 2025 saw outsized returns as holder counts ballooned to 1.66 million. For newcomers, it’s an accessible ramp to TON NFT gifts onboarding, far removed from the complexities of standalone chains.

Evolution in Action: A Timeline of Breakthroughs

Tracing this timeline reveals a deliberate build-out. What began as playful stickers in late 2024 morphed into mergeable NFTs by January 2025, aligning with Telegram’s crypto pivot. TON Space’s 100 million milestone by November 2024 wasn’t accidental; gifts funneled users straight into self-custody. Fast-forward to September 2025, and the stats – 414,275 unique on-chain wallets – reflect viral spread through profiles and chats.

This progression dovetails with ecosystem expansions. @push bots enable seamless non-custodial transfers of TON and jettons mid-conversation, while Affluent layers DeFi tools atop Telegram. AlphaTON’s Claude Connector even weaves AI into asset management, but gifts remain the gateway. TON’s exclusive role in Mini Apps ensures every tap-to-play game or payment reinforces wallet habits.

From my vantage as an investment strategist, these integrations signal mergeable telegram gifts TON as a compounding force. Unlike fleeting trends, they leverage Telegram’s billion-user moat for frictionless scaling. Users don’t adopt crypto; crypto adopts their social flow. At $0.6783, Toncoin trades at a discount to its utility trajectory, especially with 24-hour highs touching $0.7321 underscoring latent demand.

Picture the flywheel accelerating: gifts spark wallets, wallets fuel Mini Apps, apps drive Toncoin demand. We’ve seen echoes in platforms like OpenSea for NFTs, but none match Telegram’s intimacy. Sources from Decrypt to TON. org affirm this shift, with gifts converting digital gestures into tradable ownership. For developers and businesses, it’s a blueprint – embed fun utilities to bypass education hurdles.

Stakeholders in traditional finance might dismiss it as gimmicky, yet the numbers persuade otherwise. Over 1.66 million holders isn’t hype; it’s conviction. As Telegram evolves into a DeFi super app, mergeable gifts stand as the unsung hero, quietly onboarding legions to Toncoin. This isn’t just growth; it’s the redefinition of mass adoption, one merged NFT at a time.