Prediction markets are heating up on the TON blockchain, and TONCO DEX makes it effortless to dive in right from Telegram using Toncoin. With Toncoin trading at $1.53 as of January 24,2026, down 1.10% over the last 24 hours from a high of $1.55 and low of $1.52, this is a prime moment to explore how these markets blend forecasting fun with real DeFi potential. TONCO DEX, the pioneering concentrated liquidity DEX on TON, recently rolled out prediction markets that let you wager on events like sports outcomes or crypto price moves, all settled transparently on-chain.

I’ve managed portfolios through bull and bear cycles, and what stands out here is TONCO’s capital efficiency. Unlike traditional AMMs, its concentrated liquidity means your Toncoin works harder within specific price ranges, amplifying yields for liquidity providers while traders get tighter spreads. Prediction markets take this further: you buy ‘yes’ or ‘no’ shares on outcomes, and correct bets pay out in TON. It’s speculative yet structured, perfect for hedging or pure plays on events.

Why TONCO DEX Stands Out for Toncoin Prediction Markets

TONCO DEX isn’t just another swap platform; it’s the first on TON with concentrated liquidity, inspired by successes like Uniswap V3 but optimized for Telegram’s massive user base. Prediction markets on TONCO leverage this by pooling liquidity into event-specific pairs, say TON-yes or TON-no for ‘Will Toncoin hit $2 by Q2?’. This setup minimizes impermanent loss and maximizes every trade, as their site highlights. For Telegram TON predictions, the seamless bot integration means no app switching – just tap, predict, and earn TON predictions rewards if you’re spot on.

From my experience, these markets shine in volatile times like now, with Toncoin’s $3.72 billion market cap and $88.57 million daily volume underscoring robust liquidity. They’re not gambling; they’re crowd-sourced intelligence tools, often outperforming polls or experts. TON blockchain DeFi predictions add a layer of accessibility – no KYC, instant settlements, and gas fees under a penny.

Toncoin (TON) Price Prediction 2027-2032

Forecasts based on TONCO DEX prediction markets adoption, Telegram ecosystem growth, and market trends from current price of $1.53 (2026)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $1.45 | $1.75 | $2.15 |

| 2028 | $1.70 | $2.05 | $2.60 |

| 2029 | $2.00 | $2.45 | $3.20 |

| 2030 | $2.30 | $2.90 | $3.80 |

| 2031 | $2.70 | $3.40 | $4.60 |

| 2032 | $3.10 | $4.00 | $5.50 |

Price Prediction Summary

Toncoin is projected to experience steady growth from its current $1.53 level, fueled by TONCO DEX prediction markets and Telegram integration. Average prices could rise from $1.75 in 2027 to $4.00 by 2032 in base scenarios, with maximums reaching $5.50 amid bullish adoption and market cycles.

Key Factors Affecting Toncoin Price

- TONCO DEX prediction markets driving TON utility and trading volume

- Telegram’s 900M+ user base boosting on-chain activity

- TON blockchain upgrades for scalability and low-cost transactions

- Favorable regulatory developments for DeFi and prediction platforms

- Crypto market bull cycles and halving-like events

- Competition from other L1s balanced by Telegram ecosystem moat

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

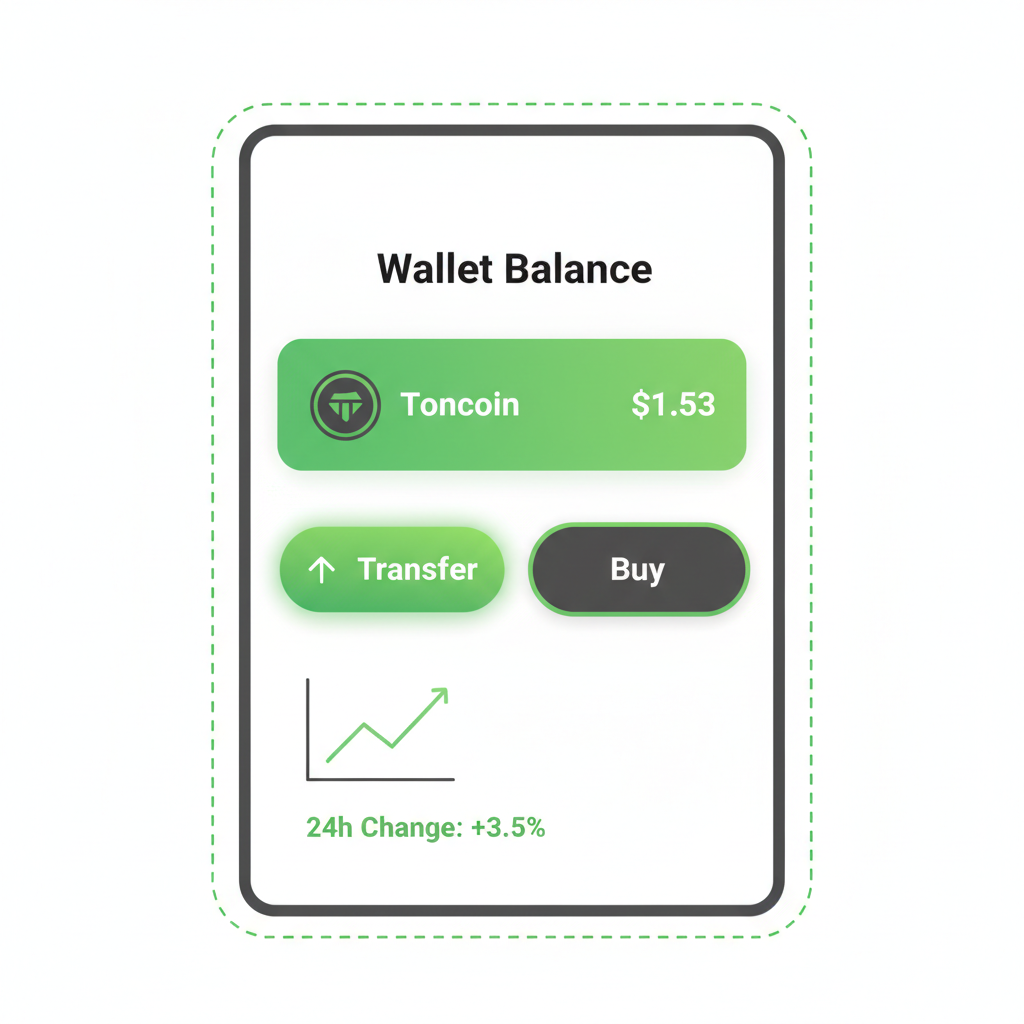

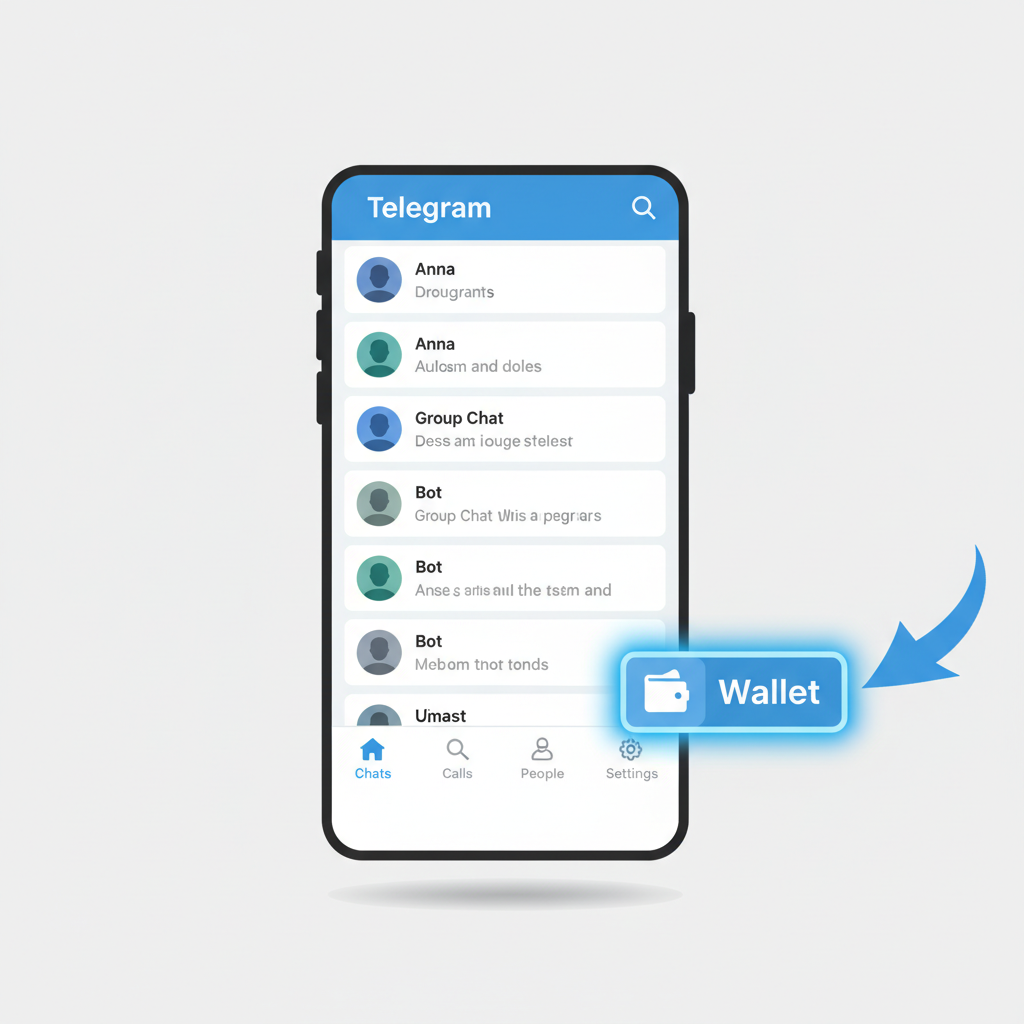

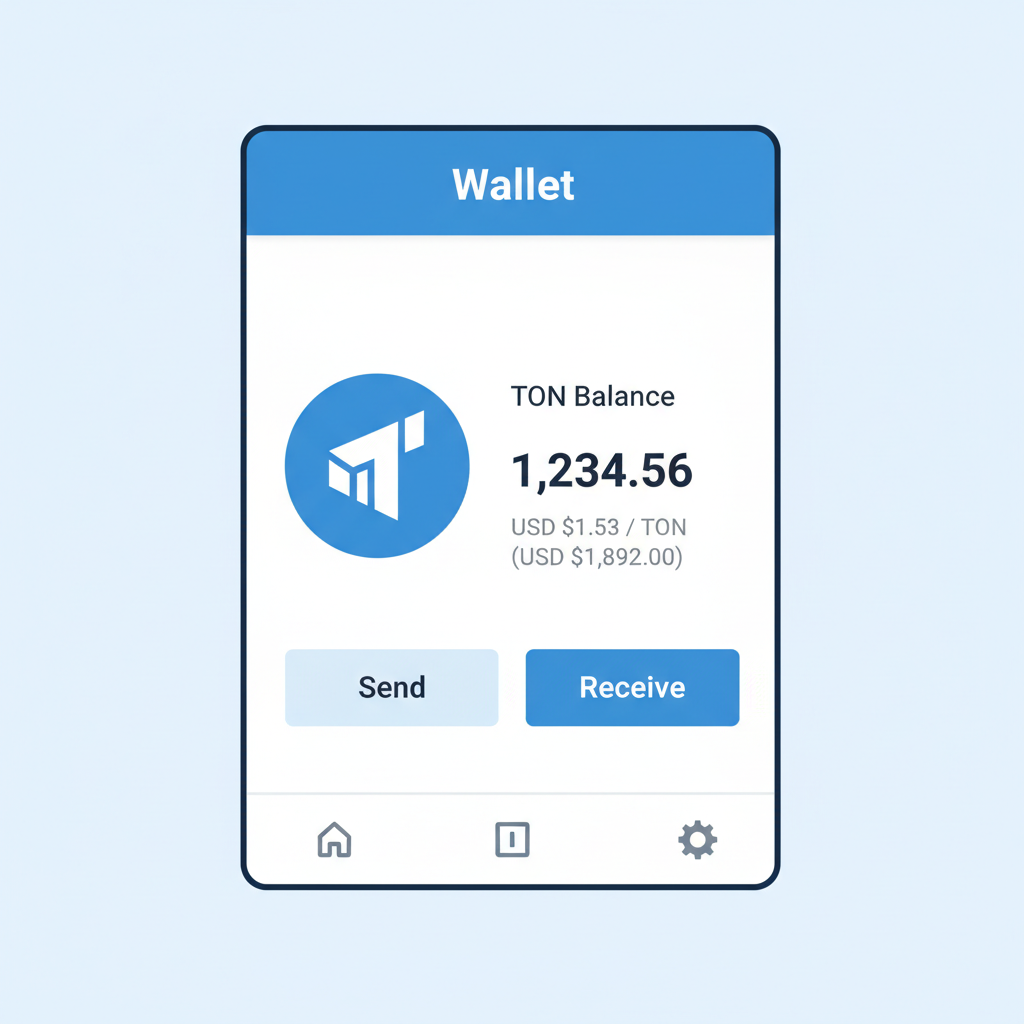

Step 1: Secure Your Toncoin in a Telegram Wallet

Before jumping into Toncoin prediction markets, you need TON in a wallet. Telegram’s built-in @wallet bot simplifies this – search for it in-app, hit ‘Start’, and create or import your non-custodial wallet. It supports TON natively, with seed phrase backup for security.

- Fund via on-ramp: Link a card or bank for fiat-to-TON buys. Fees are low, and it’s beginner-friendly.

- Or bridge from exchanges: Transfer TON from spots like OKX or Binance to your Telegram address. Always double-check the network – TON mainnet only.

- Verify balance: With Toncoin at $1.53, even a small stack like 100 TON ($153) covers multiple positions.

Pro tip: Enable 2FA in Telegram settings and never share your seed. I’ve seen too many slip-ups in DeFi; treat it like cash.

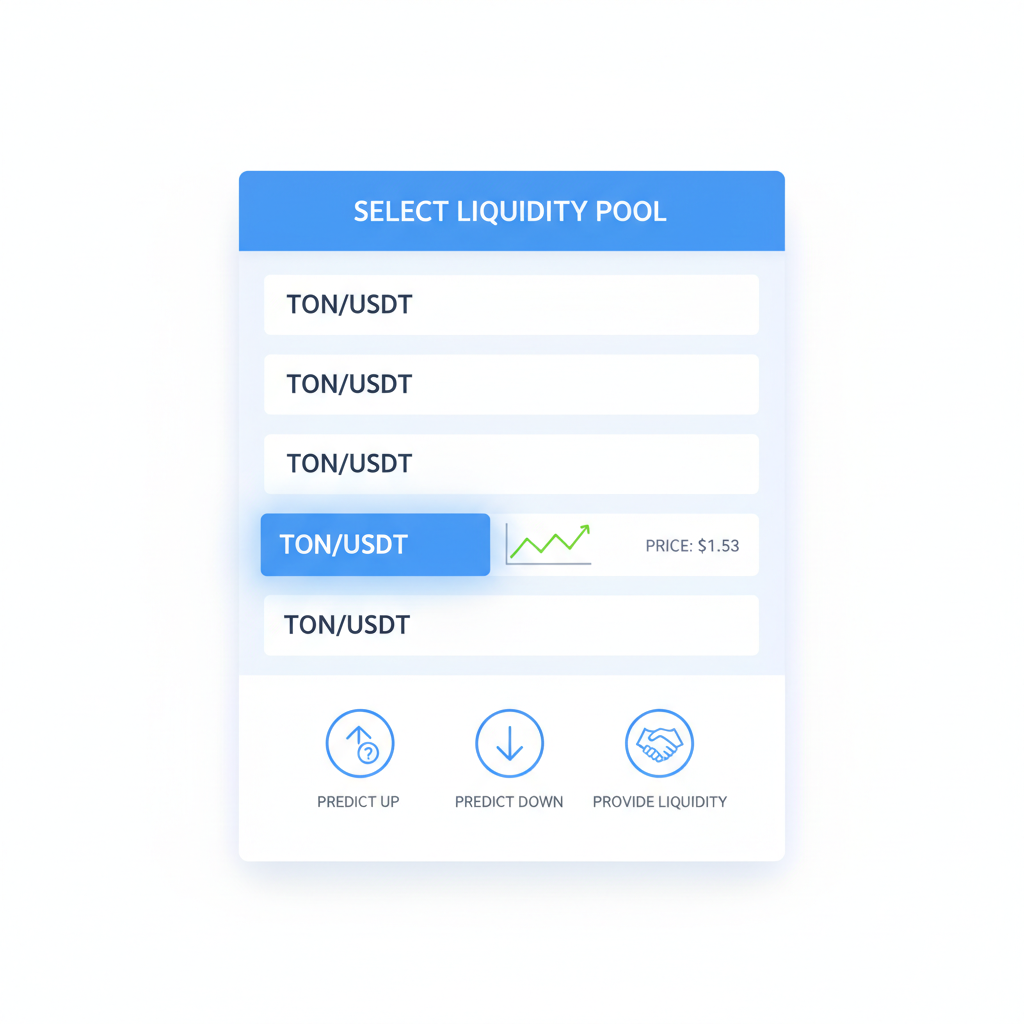

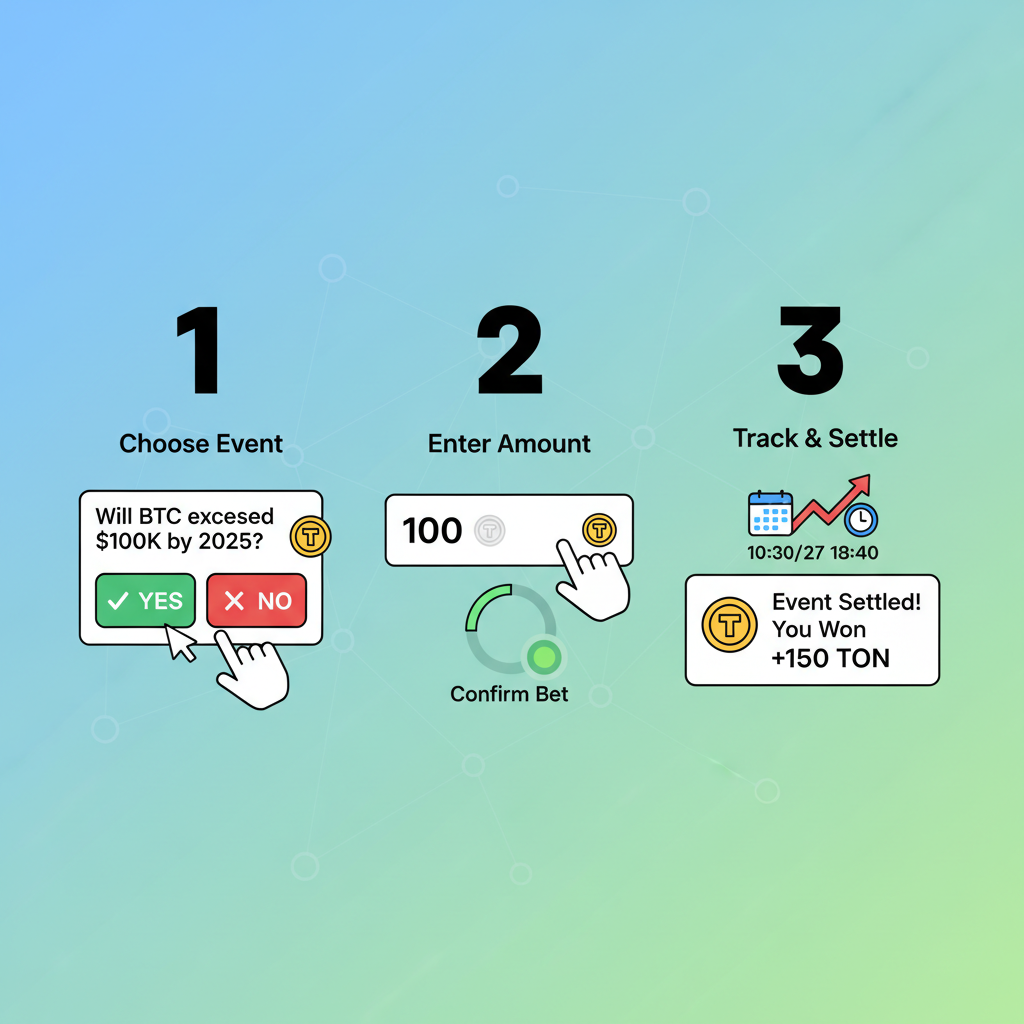

Step 2: Launch TONCO DEX and Spot Prediction Markets

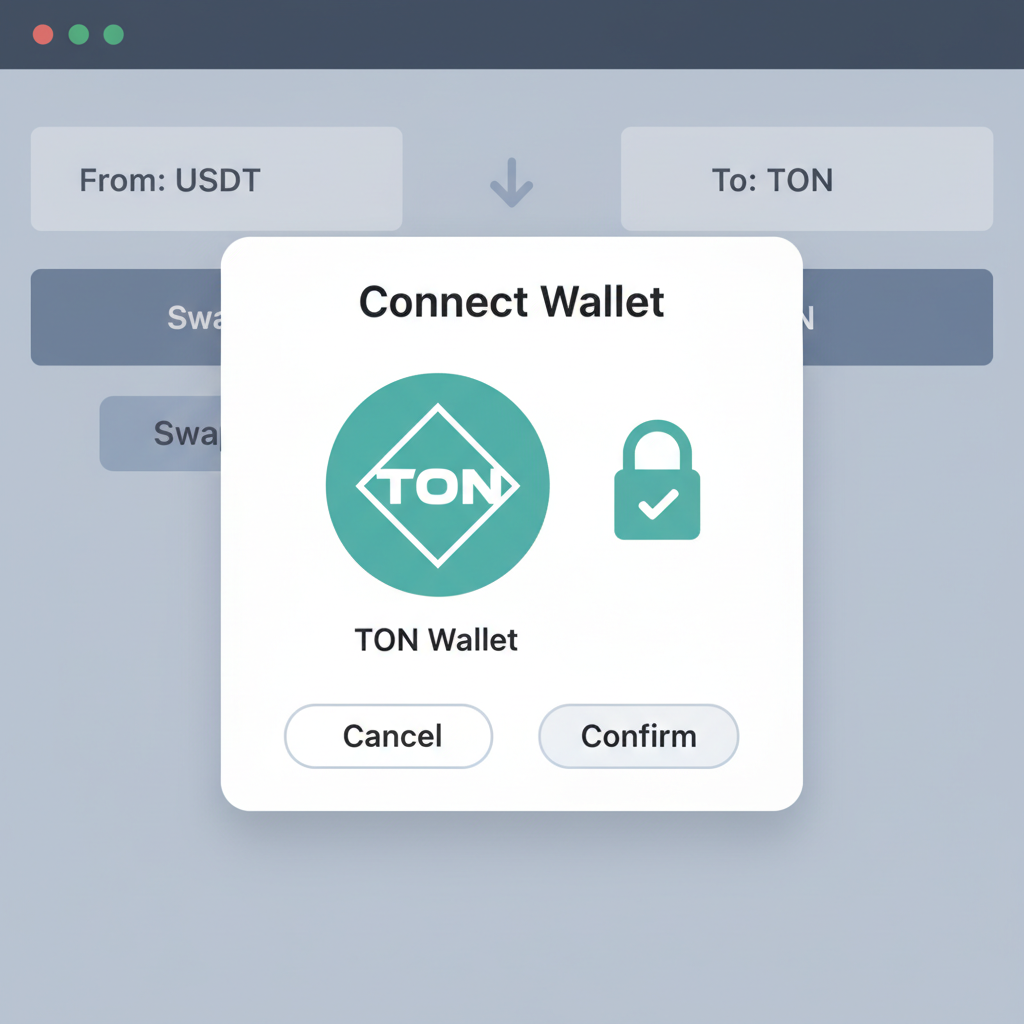

TONCO lives as a Telegram mini-app – search ‘@tonco_dex_bot’ or visit via t. me links from their channel. Once open, approve wallet connection; it’s permissionless, revokable anytime.

- Navigate to ‘Markets’ tab: Here, prediction markets glow under categories like Crypto, Sports, Politics.

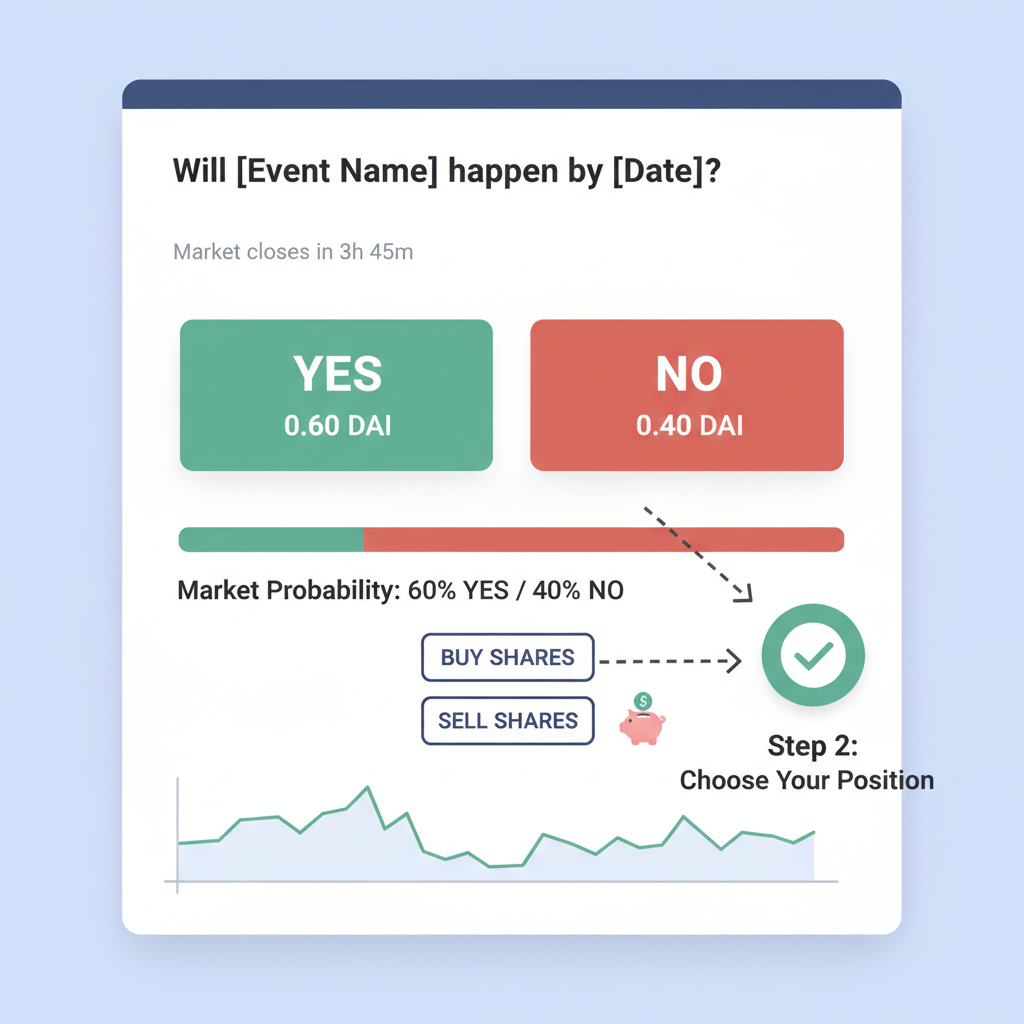

- Select one: Pick ‘Will Toncoin exceed $1.60 this week?’ – shares priced dynamically based on liquidity.

- Review odds: TONCO’s UI shows implied probabilities, pool sizes, and your potential payout.

This Telegram TON predictions flow feels native, like chatting with a savvy trader. Concentrated positions let you set ranges around $1.53, earning fees while holding for resolutions. Volumes are climbing, signaling trust in the protocol.

Now that you’re in the markets tab, it’s time to commit some Toncoin to a prediction. These aren’t wild guesses; prices reflect collective wisdom, often sharper than Vegas odds. With Toncoin at $1.53, a modest 10 TON bet ($15.30) can yield intriguing returns if the crowd sways your way.

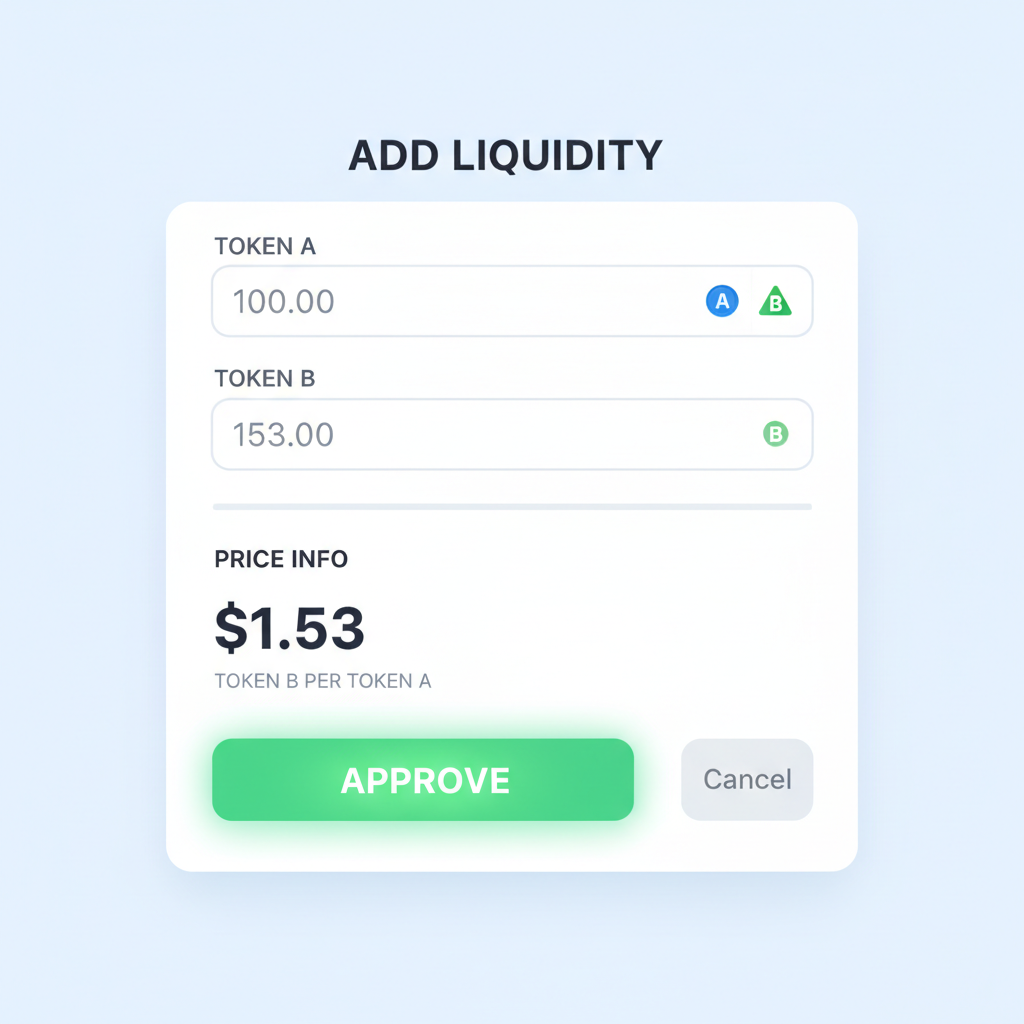

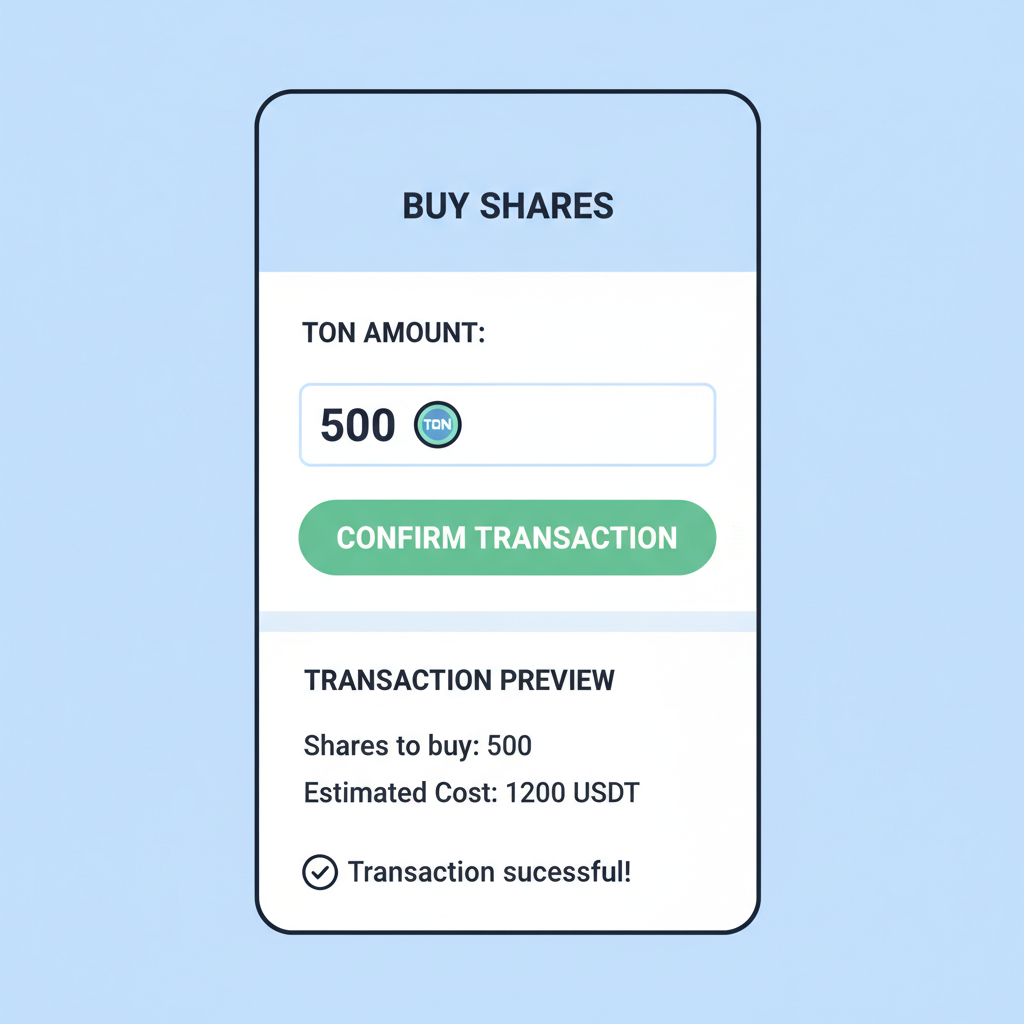

Step 3: Enter a Position: Buy Yes or No Shares

Choose your event, say a crypto milestone like ‘Toncoin above $1.60 by Friday?’ Current liquidity dictates share prices – a 60% ‘yes’ probability might cost 0.60 TON per share, redeemable at 1 TON if correct. Tap ‘Buy Yes’ or ‘No’, input amount, and review the concentrated liquidity range. TONCO lets you focus liquidity near $1.53 for efficiency, earning swap fees alongside prediction payouts.

- Adjust slippage tolerance to 0.5-1% for smooth execution amid Toncoin’s -1.10% daily dip.

- Confirm swap: TONCO routes through optimal paths, settling on-chain instantly.

- Track in portfolio: Shares appear as NFTs or tokens, tradable pre-resolution for early exits.

I’ve allocated to similar setups in DeFi portfolios, and the edge comes from stacking predictions with liquidity provision. Earn TON predictions by providing to the yes/no pools, capturing fees as traders pile in.

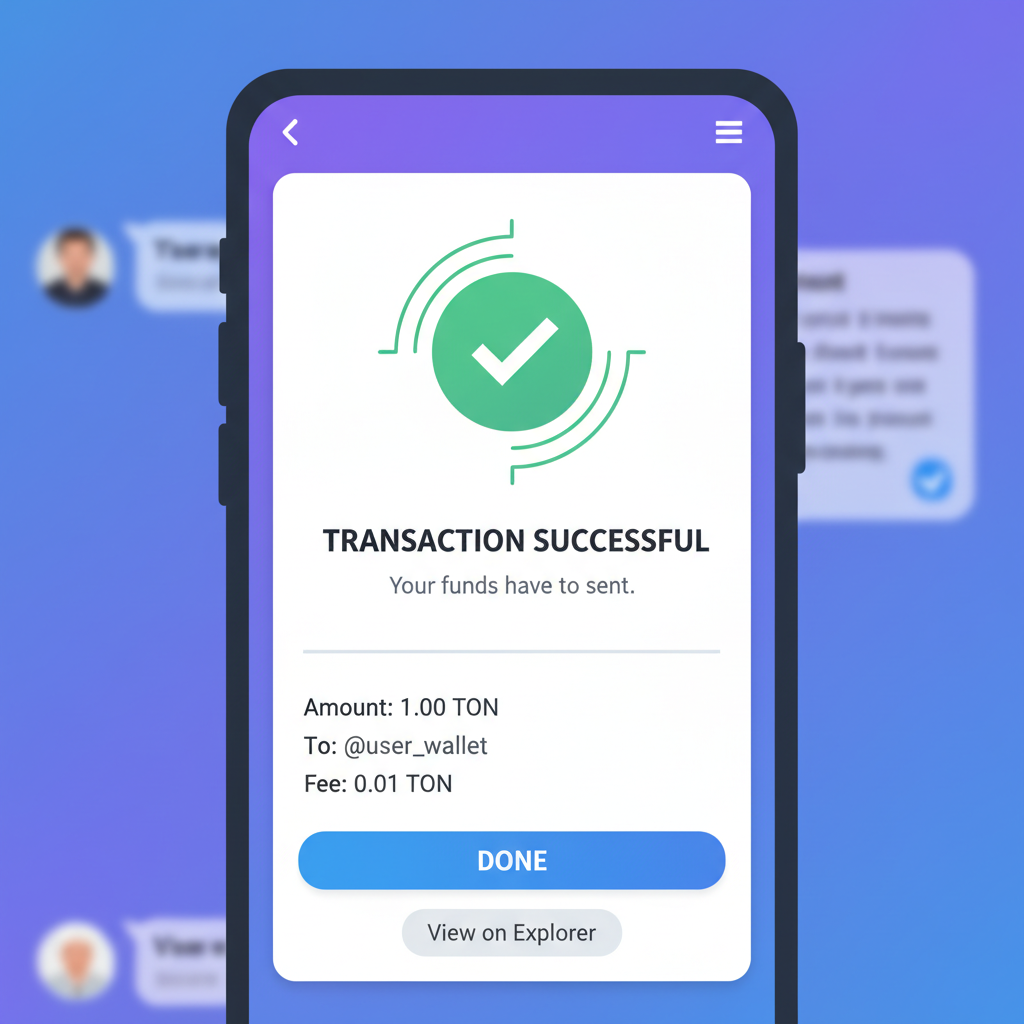

Step 4: Monitor, Exit, and Claim Rewards

Post-entry, head to ‘Positions’ for real-time updates. Oracle feeds from trusted sources resolve events automatically – no disputes, pure blockchain truth. If your call hits, burn shares for full TON payout; wrong bets go to zero. Early sellers can flip positions if sentiment shifts, like after Toncoin’s dip to $1.52.

- Fees: Under 0.01 TON per action, thanks to TON’s speed.

- Compounding: Reinvest winnings into new Telegram TON predictions for momentum plays.

- Analytics: TONCO dashboards show your win rate, ROI, and pool health.

This loop builds skill over time. In volatile markets with $88.57 million daily volume, prediction markets on TONCO DEX guide better decisions, from portfolio tilts to event hedges.

Navigating Risks in Toncoin Prediction Markets

No DeFi play lacks pitfalls, and TONCO’s are manageable but real. Oracle failures could delay resolutions, though multi-source verification mitigates this. Impermanent loss in concentrated ranges bites if Toncoin swings wildly beyond $1.55 highs. Manipulation risks exist in low-volume markets, so stick to high-liquidity ones tied to $3.72 billion cap assets like TON.

From 11 years steering portfolios, my rule: Never bet more than 2-5% per position. Diversify across events – mix sports with TON blockchain DeFi predictions. Telegram’s frictionless access tempts overtrading; set limits. Audit trails on-chain mean transparency trumps centralized books every time.

TONCO DEX guide users often overlook tax implications – track trades for your jurisdiction, as gains from earning TON predictions count as income.

Why Prediction Markets Accelerate Toncoin Adoption

TONCO fuses gaming with finance in Telegram, onboarding millions who skip clunky dApps. Prediction markets turn passive scrollers into active Toncoin holders, boosting network effects. As volumes grow, so does liquidity, drawing pros for Toncoin prediction markets arbitrage.

Picture this: Your casual bet on a game pays in TON at $1.53, sparking swaps, staking, or more predictions. It’s viral DeFi, and with TON’s PoS validators securing it all, scalability holds. I’ve watched ecosystems explode via such hooks – TONCO positions Toncoin as the everyday crypto, blending utility with excitement.

Start small, learn the ranges, and watch your stack compound. In a space crowded with hype, TONCO’s blend of efficiency and accessibility feels like the sustainable path forward for mass adoption.