In a world where blockchain adoption has long been hampered by clunky interfaces and steep learning curves, TON is rewriting the script through Telegram. Imagine nearly a billion users dipping their toes into decentralized finance without even realizing it. This is TON invisible adoption, a subtle yet powerful force leveraging Telegram’s mini-apps to deliver seamless onboarding for the masses. At its current price of $0.7382, with a 24-hour change of -0.007290%, TON reflects a steady presence amid market fluctuations, underscoring its foundational strength rather than hype-driven volatility.

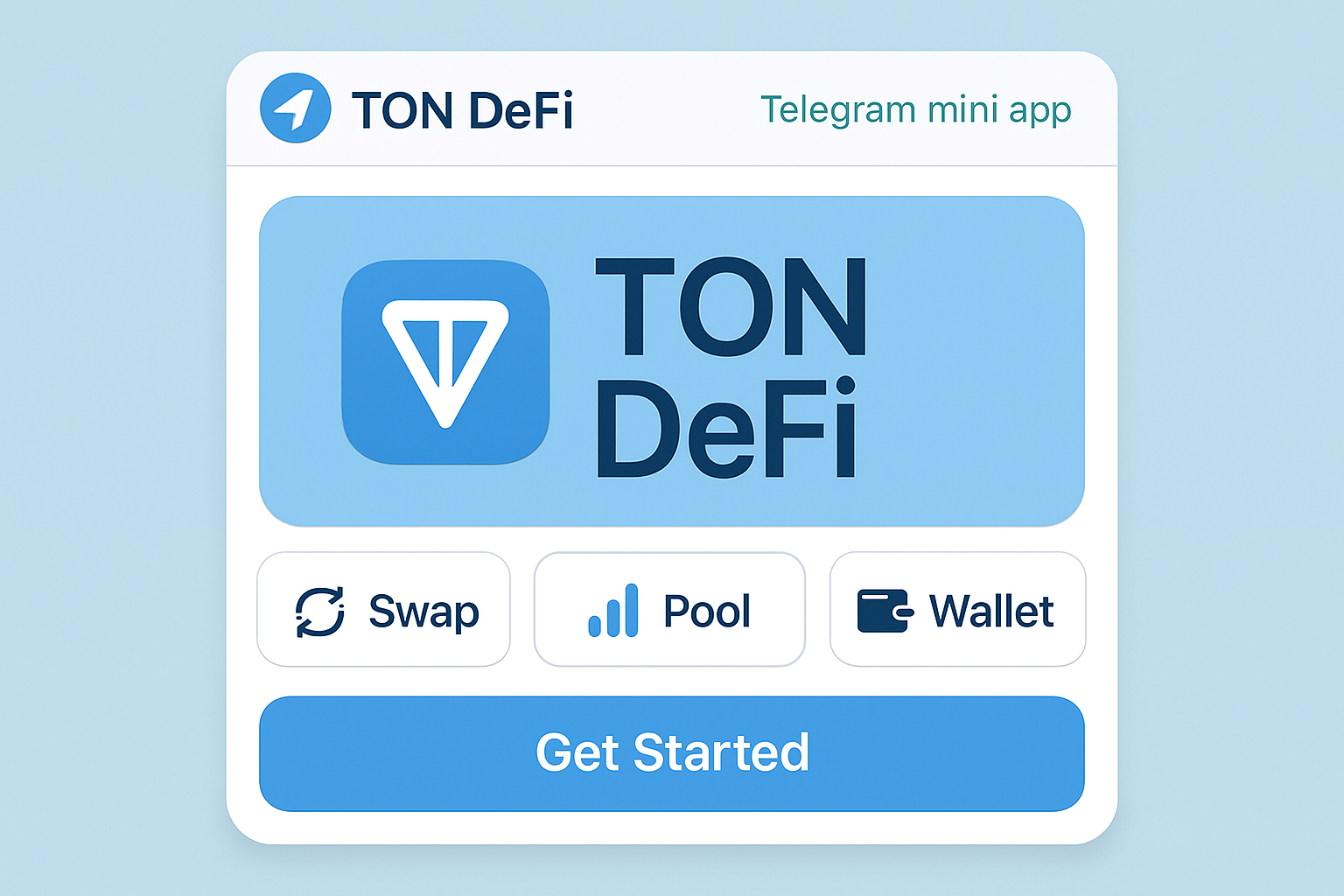

Telegram’s ecosystem, boasting over 900 million active users, serves as the perfect conduit. Mini-apps, lightweight JavaScript-based services embedded directly in chats, bypass traditional app store hurdles. Users engage with games, DeFi tools, or NFT marketplaces right from their messaging app, unaware they’re interacting with the TON blockchain. This frictionless entry point aligns perfectly with TON blockchain Telegram integration, positioning it to capture the next wave of crypto users organically.

Mini-Apps as the Silent Engine of Mass Adoption

Telegram CEO Pavel Durov has dubbed these mini-apps an “Internet Phenomenon, ” spotlighting successes like Hamster Combat and Catizen, which generated $25 million in revenue. Notcoin’s viral tap-to-earn model proved the concept, onboarding millions who traded simple interactions for TON-based rewards. Sources like Forbes describe them as a “Web3 Adoption Trojan Horse, ” slipping decentralized tech into everyday messaging without fanfare.

This isn’t mere gimmickry; it’s strategic brilliance. Mini-apps handle gaming, memes, DeFi, and NFTs, simplifying Web3 for Telegram’s vast audience. Developers benefit too, with the TON Foundation offering up to $50,000 in ad credits for migrations. The result? A flourishing ecosystem where users link crypto wallets effortlessly, often via tap-to-earn mechanics that reward engagement with tradable tokens.

Built-In Wallets: Erasing the Onboarding Barriers

At the heart of this invisible adoption lies the default TON Wallet, activated instantly upon entering any mini-app. No key management, no address copying, no separate downloads, just an immediate display of your Toncoin balance at $0.7382. This preserves user privacy and security through Telegram identities, making blockchain feel like an extension of familiar messaging rather than a foreign tech stack.

Reports from Bybit and CryptoSlate highlight TON and Telegram’s ambition to onboard 500 million users via such integrations and crypto incentives. LongHash Ventures notes the promise in tapping Telegram’s 900 million users, while BlockApex credits Notcoin for manifesting Telegram’s 500 million onboarding dream. For newcomers, this means payments, rewards, and services embedded in daily routines, fostering habits that scale to billions.

From Games to DeFi: Use Cases Fueling Exponential Growth

Early successes like Catizen and Hamster Combat demonstrate mini-apps’ revenue potential and user stickiness. Now, DeFi projects integrate seamlessly, allowing in-app lending, staking, or swaps with TON. Hackernoon details how open-market tokens serve as rewards and payments, building complex economies within chats. Observers. com points to TON’s strategy leveraging this boom to draw in new users, while My Web3 Startup reveals targeted wallet-linking in tap-to-earn apps.

Toncoin (TON) Price Prediction 2025-2030

Factoring Mini-App Adoption, Telegram Growth to 1B Users, and DeFi Integration Impacts

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY Growth % (Avg from Prev) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2025 | $0.60 | $1.80 | $4.00 | +143% (from $0.74) | Baseline growth from current amid initial mini-app surge and market recovery |

| 2026 | $2.50 | $5.50 | $12.00 | +206% | Accelerated adoption as Telegram hits 950M users; DeFi TVL explodes |

| 2027 | $4.00 | $9.00 | $20.00 | +64% | Maturing ecosystem; regulatory clarity boosts confidence |

| 2028 | $6.00 | $13.00 | $28.00 | +44% | 1B user milestone; widespread mini-app payments and gaming |

| 2029 | $9.00 | $18.00 | $38.00 | +38% | Deep DeFi integration; competition intensifies but TON leads Telegram economy |

| 2030 | $12.00 | $25.00 | $50.00 | +39% | Mass adoption peak; potential $100B+ market cap in ultra-bullish cycle |

Price Prediction Summary

Toncoin is set for transformative growth through Telegram’s frictionless Web3 onboarding via Mini Apps, targeting 1B users. Projections show average price rising from $1.80 in 2025 to $25 by 2030 (1,288% cumulative gain), with min/max reflecting bearish dips, base adoption, and hyper-bullish scenarios driven by network effects, though subject to market cycles and regulations.

Key Factors Affecting Toncoin Price

- Telegram Mini Apps as Web3 trojan horse for seamless adoption

- Native TON Wallet for 1B users without blockchain friction

- Developer incentives ($50K grants) fueling ecosystem boom

- DeFi, gaming, and payments integration boosting TVL and utility

- Bullish market cycles and Telegram’s 900M+ user growth

- Regulatory tailwinds for integrated blockchains

- Competition from other L1s but TON’s unique positioning

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Al Leong’s analysis emphasizes pulling key levers for the next billion users, with Telegram’s untapped ad network as a multiplier. As prices hold at $0.7382 despite a slight 24-hour dip to a low of $0.7231, TON’s value proposition shines through utility, not speculation. This patient build-out rewards long-term holders, turning Telegram into a Web3 gateway without the usual friction.

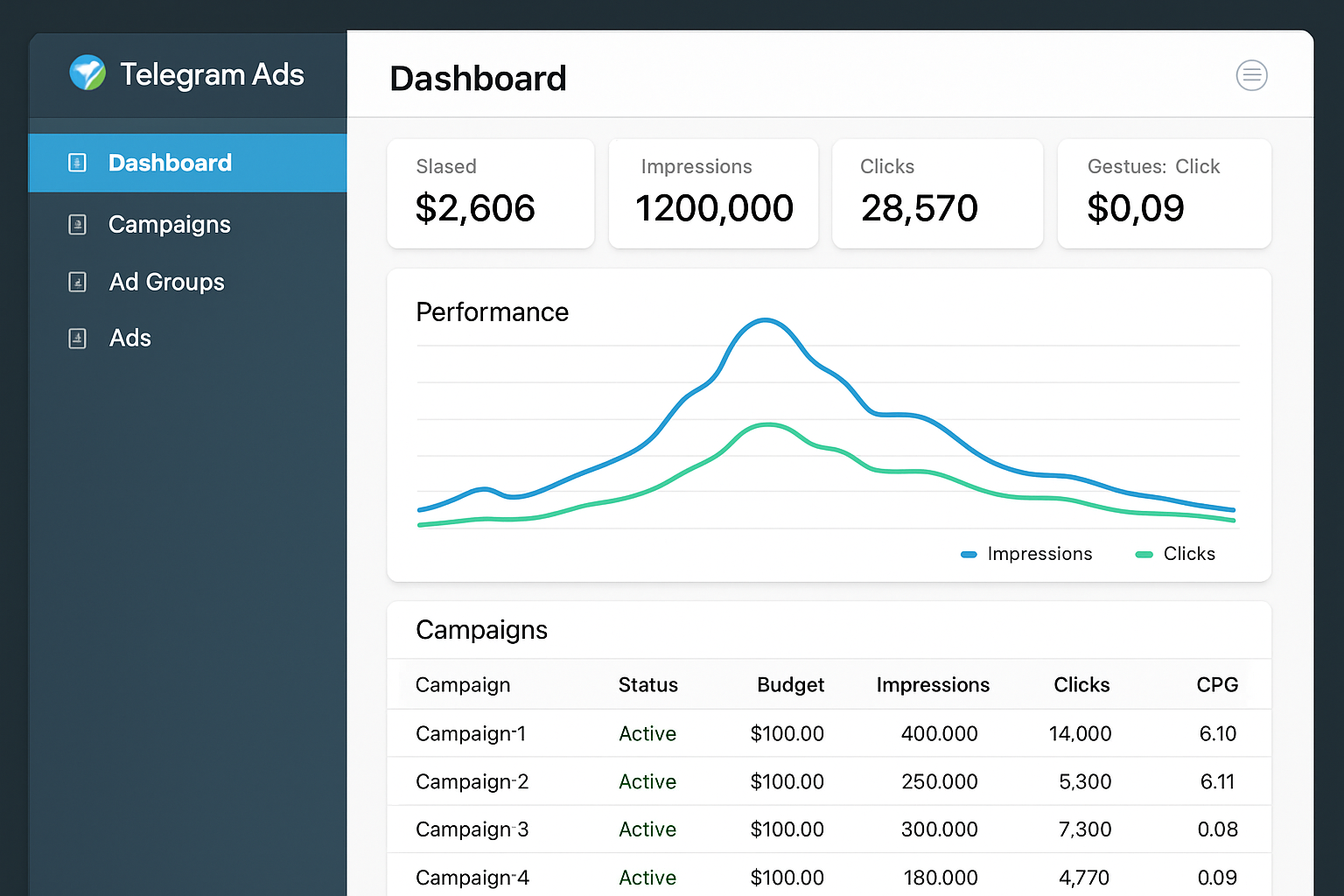

Telegram’s untapped ad network emerges as a game-changer in TON mass adoption strategies. With targeted advertising reaching engaged users mid-conversation, projects can funnel traffic directly into mini-apps. This creates a virtuous cycle: ads drive discovery, interactions yield rewards in Toncoin at $0.7382, and retention builds through seamless experiences. Earlybird’s insights on the mini-apps revolution underscore how phenomena like Hamster Combat pave the way for sustainable growth, blending virality with real utility.

Leveraging Five Key Pillars for Billion-User Scale

Al Leong outlines precision levers to propel TON toward the next billion: seamless mini-app proliferation, incentive-aligned rewards, developer grants, ad network activation, and ecosystem interoperability. Each pillar reinforces the others, turning Telegram into a self-sustaining Web3 hub. Consider the quiet wallet-linking in tap-to-earn apps, as noted by My Web3 Startup; it identifies ready users without invasive prompts, nurturing organic progression from play to stake.

Top 5 TON Adoption Levers

-

Mini-Apps Boom: Telegram Mini Apps, powered by TON, like Hamster Kombat, Catizen, and Notcoin, drive viral adoption for 900M+ users via seamless games and rewards.

-

Wallet Incentives: Built-in TON Wallet activates instantly in Mini Apps, showing Toncoin balance without key management, easing onboarding for newcomers.

-

Dev Grants up to $50K: TON Foundation provides up to $50,000 in advertising credits for projects migrating to TON, fueling Mini App growth.

-

Telegram Ads: Untapped ad network targets Telegram’s massive audience, promoting TON apps and boosting user acquisition efficiently.

-

DeFi Integrations: Mini Apps embed DeFi for payments, rewards, and NFTs directly in Telegram, simplifying Web3 for millions.

These elements compound quietly. A user tapping for coins in a game unwittingly stakes them in DeFi via the same interface, all powered by TON’s efficient blockchain. Forbes’ Trojan Horse analogy fits perfectly: Web3 slips in unnoticed, fostering habits that endure beyond fads. At a 24-hour high of $0.7563 and low of $0.7231, TON’s price stability signals market confidence in this groundwork, not fleeting pumps.

Onchain’s breakdown reveals mini-apps spanning memes to sophisticated dApps, each lowering the Telegram TON seamless onboarding threshold. No seed phrases, no gas fee puzzles; just instant Toncoin visibility. This democratizes access, especially in emerging markets where Telegram dominates as the de facto super-app. Developers flock here for low barriers, spawning innovations like in-chat payments or NFT drops that feel native, not bolted-on.

Privacy and Security: The Unsung Heroes of Trust

Critically, TON preserves Telegram’s end-to-end encryption while layering blockchain security. Users retain control via self-custodial wallets tied to their identities, minimizing phishing risks common in Web2-Web3 bridges. This balance builds trust incrementally, essential for scaling to Telegram’s projected billion-plus users. BlockApex’s reflection on Notcoin’s success illustrates how such trust manifests Telegram’s vision, converting skeptics into participants without overt sales pitches.

TON isn’t shouting from rooftops; it’s whispering opportunities into daily chats, letting curiosity lead the way.

LongHash Ventures captures the curiosity factor: Telegram’s scale offers unmatched user acquisition, but TON executes with subtlety. CryptoSlate’s Bybit report quantifies the ambition at 500 million onboarded, yet the path feels effortless. As mini-apps evolve, expect DeFi yields, social tokens, and governance tools to embed deeper, rewarding early adopters handsomely amid TON’s steady $0.7382 valuation.

From my vantage as a long-term investor, this invisible adoption mirrors the patient compounding I advocate. TON sidesteps hype cycles by embedding value in utility, much like early internet protocols that scaled through ubiquity. Investors eyeing Telegram mini-apps Web3 entry should watch monthly active users in top apps; surges there precede price resilience, as seen in today’s -0.007290% shift holding firm.

Hamster Combat and Catizen set precedents, but the real surge lies ahead with DeFi migrations and ad-fueled discovery. TON’s architecture handles high throughput natively, ensuring mini-apps scale without choking. For developers, the $50,000 credits lower entry costs; for users, it’s pure serendipity discovering Toncoin rewards at $0.7382 in familiar territory. This convergence positions TON not as another chain, but the invisible backbone of messaging-evolved finance.

Patience reveals the macro trend: blockchain friction dissolves when cloaked in convenience. Telegram users worldwide now hold the keys to decentralization, often without grasping the shift. That’s the beauty of TON’s approach – adoption so seamless, it feels inevitable.