Toncoin’s institutional story has entered a new era, and TON Strategy Co. (NASDAQ: TONX) is at the center of this transformation. The company’s bold pivot into Toncoin ($TON) as a treasury reserve is not just a headline; it’s a signal that digital asset adoption is evolving far beyond Bitcoin and Ethereum. With Toncoin currently priced at $4.11, TON Strategy Co. is offering public market investors a regulated onramp to the Telegram blockchain ecosystem, staking out a unique position in the growing landscape of crypto treasury management.

TON Strategy Co.: From Verb Technology to $558 Million TON Treasury

The rebranding of Verb Technology Company to TON Strategy Co. in August 2025 was more than cosmetic. It marked the launch of a $558 million private placement, with proceeds earmarked specifically for acquiring Toncoin as the company’s primary treasury asset. This move made TONX the first Nasdaq-listed entity to establish $TON as its core reserve, putting it ahead of institutional peers and signaling confidence in Toncoin’s long-term value proposition.

TON Strategy’s approach is notable for its scale and structure. Backed by over 110 institutional investors, the company has accumulated one of the largest public treasuries of $TON, aligning itself with a broader trend of digital asset diversification among public companies. Notably, AlphaTON Capital Corp’s recent $30 million Toncoin purchase reinforces this growing appetite for exposure to Telegram’s blockchain ecosystem among publicly traded firms.

Bridging Crypto and Capital Markets: What Makes TONX Unique?

For investors accustomed to Bitcoin-focused treasury strategies, TON Strategy Co. ’s model offers something different. By focusing on Toncoin, TONX is positioning itself as both a liquidity provider and an institutional anchor for the Telegram blockchain. The company’s hybrid approach blends:

- Long-term accumulation of $TON to build balance sheet strength

- Active staking, with 82% of reserves staked as of September 2025, generating an estimated $24 million in annualized staking rewards

- Shareholder value initiatives, including a $250 million stock repurchase program at prices below Treasury Asset Value (TAV) per share ($12.18 vs. average buyback price of $8.32)

This strategy not only aims to enhance shareholder returns but also supports network security and liquidity within the TON ecosystem.

Toncoin’s Path to Mainstream Access: The Role of Exchanges and Platforms

The integration of Toncoin into major platforms like Gemini, Robinhood, and Zengo has significantly expanded retail access to $TON. For public market investors, this means increased liquidity and price discovery, critical factors for any asset transitioning from niche adoption to mainstream recognition.

As regulatory clarity improves and more companies diversify their digital asset reserves, TONX is uniquely placed to benefit from these tailwinds. Its public listing provides transparency and governance that many crypto-native vehicles lack, a key consideration for institutional allocators seeking compliant exposure to emerging blockchain assets.

TON Strategy Co. (TONX) Stock Price Prediction 2026-2031

Forecasts based on current market context, company fundamentals, and institutional Toncoin adoption trends

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3.80 | $6.20 | $14.00 | +50% | TON staking revenue ramps, stock trades toward TAV |

| 2027 | $4.50 | $8.10 | $18.50 | +31% | Increased retail/institutional TON adoption, buyback impact |

| 2028 | $5.70 | $10.00 | $23.00 | +23% | TONX profits from staking, further TAV growth |

| 2029 | $7.00 | $11.80 | $28.00 | +18% | Broader crypto adoption, regulatory clarity boosts multiple |

| 2030 | $8.10 | $13.50 | $32.50 | +14% | TON ecosystem matures, TONX considered proxy for digital asset treasury |

| 2031 | $9.20 | $15.00 | $37.00 | +11% | TONX achieves blue-chip status, stable staking revenue |

Price Prediction Summary

TON Strategy Co. (TONX) is positioned as a leading vehicle for public market exposure to Toncoin, with strong treasury backing, robust staking revenues, and aggressive share repurchases. The stock is expected to trend upward over the next six years, with average annual returns moderating as market capitalization grows and the TON ecosystem matures. Upside potential hinges on continued TON adoption and execution of capital allocation strategies, while downside risk is cushioned by the underlying asset value.

Key Factors Affecting TON Strategy Co. Stock Price

- TON Strategy Co.’s $TON treasury asset value per share (TAV) and continued accumulation

- Share repurchase program supporting stock price and reducing float

- TON staking revenue, projected at $24M+ annually, funding operations and buybacks

- Expansion of TON trading on mainstream platforms (Gemini, Robinhood, etc.)

- Broader institutional and retail adoption of Toncoin

- Regulatory clarity around digital asset treasuries and staking income

- Macro trends in cryptocurrency markets and equity valuations

- Potential for further capital raises or strategic partnerships

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

The Network Effect: Why Institutional Adoption Matters for Toncoin Holders

Institutional adoption isn’t just about price speculation; it’s about creating sustainable demand for underlying assets. By locking up substantial amounts of $TON in its treasury, and actively participating in network staking, TON Strategy Co. is reducing circulating supply while simultaneously funding ecosystem growth via staking rewards.

This dynamic can have outsized effects on both network stability and price resilience, especially as more public companies follow suit or allocate even small percentages of their reserves to Toncoin. For those seeking deeper insights into how institutional players are shaping the Telegram blockchain’s future, our analysis on TON’s institutional adoption dynamics offers further context.

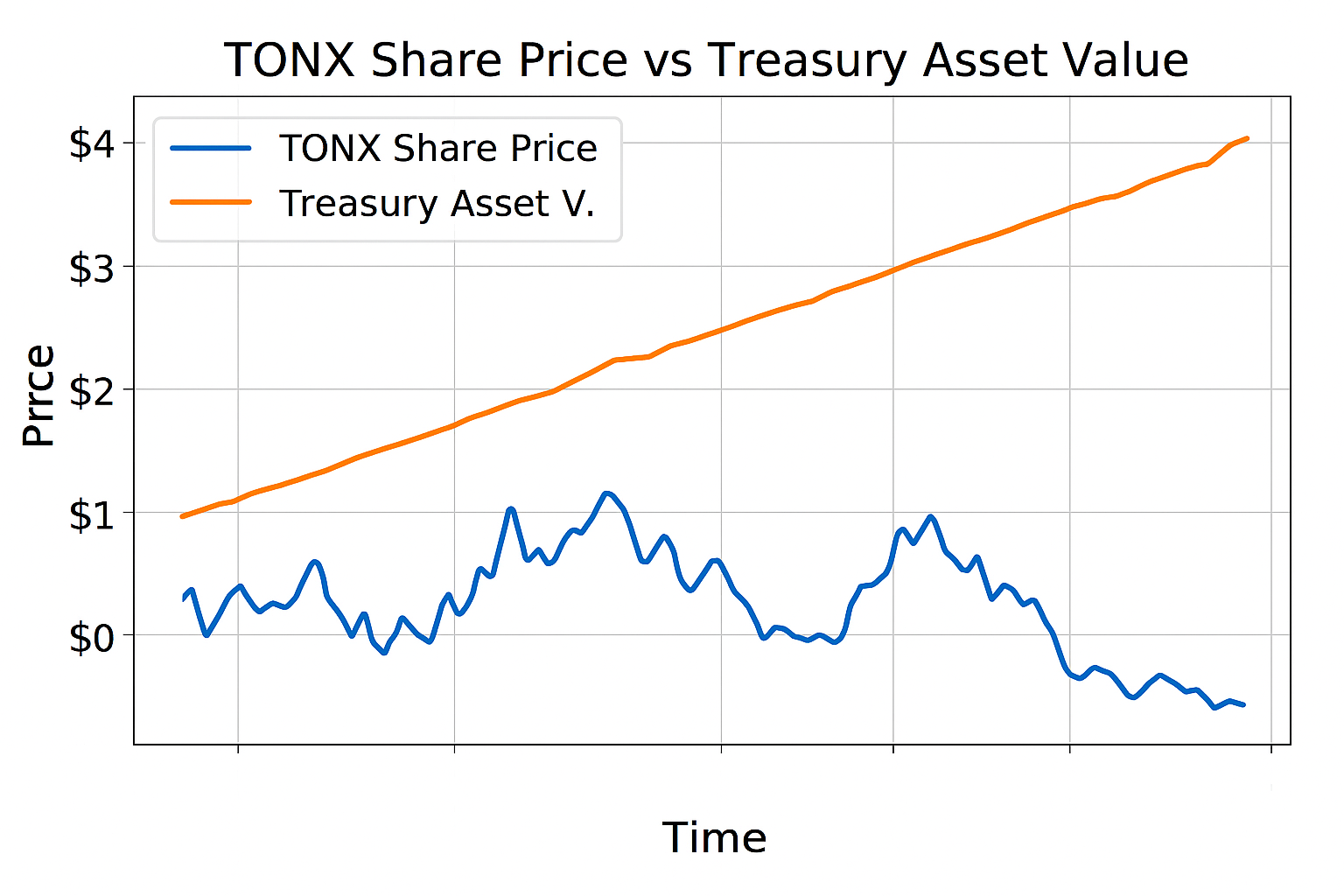

With the TONX treasury asset value per share ($12.18) still notably above its recent average buyback price of $8.32, TON Strategy Co. is demonstrating capital discipline rarely seen in the digital asset space. This arbitrage between market price and underlying asset value offers a compelling risk-reward profile, particularly for investors seeking exposure to both Toncoin and a professionally managed, compliant public vehicle.

But the story goes deeper than simple balance sheet math. By staking 82% of its $TON reserves, TONX isn’t just passively holding tokens, it’s actively securing the Telegram blockchain, earning an estimated $24 million in annualized staking revenue. This income stream is being recycled into ongoing share repurchases, creating a feedback loop that can reward patient shareholders while supporting network health.

TON Whale Supply and Ecosystem Impact: A New Kind of Institutional Anchor

TON Strategy Co. ’s accumulation strategy has made it one of the largest public holders of Toncoin, effectively transforming it into a “whale” within the Telegram blockchain ecosystem. This concentrated ownership brings both opportunity and responsibility: TONX’s actions can set benchmarks for corporate governance, treasury transparency, and long-term alignment with decentralized networks.

Key Benefits of Investing in TONX vs Direct Toncoin Holding

-

Regulated, Public Market Access: TON Strategy Co. (NASDAQ: TONX) offers investors exposure to Toncoin ($TON) via a regulated, Nasdaq-listed equity, providing greater transparency, oversight, and accessibility compared to direct crypto ownership.

-

Share Repurchase Program Enhances Shareholder Value: TONX has initiated a $250 million stock repurchase program, buying back shares below their Treasury Asset Value (TAV) per share of $12.18, potentially offering upside beyond Toncoin price appreciation.

-

Staking Revenue for Investors: By staking 82% of its Toncoin reserves, TONX generates approximately $24 million in annualized staking revenues, which can be used to fund further share repurchases and enhance returns for shareholders.

-

Institutional-Grade Security and Custody: TONX provides institutional-grade custody and security for its Toncoin holdings, reducing risks related to self-custody, wallet management, and private key loss for individual investors.

-

Liquidity and Simplicity: Investors can buy and sell TONX shares easily on Nasdaq using traditional brokerage accounts, avoiding the complexities of setting up crypto wallets or navigating exchanges.

-

Potential Premium to Asset Value: TONX shares may trade at a premium or discount to the underlying Toncoin Treasury Asset Value, offering opportunities for arbitrage or enhanced returns not available through direct Toncoin holding.

-

Participation in TON Ecosystem Growth: TONX’s active involvement in the TON ecosystem—including staking and capital allocation—positions investors to benefit from network growth, adoption, and new integrations (e.g., Gemini, Robinhood, Zengo) beyond simple price exposure.

For retail and institutional investors alike, this model reduces barriers to entry. It also provides indirect exposure to staking yields, liquidity provision, and the broader utility growth of $TON, without requiring technical expertise or self-custody risk. As more exchanges like Gemini and Robinhood list $TON, market depth improves, making it easier for new participants to enter or exit positions without significant slippage.

The ongoing evolution of regulatory frameworks further enhances TONX’s appeal. As a Nasdaq-listed entity, it must adhere to stringent reporting standards and governance practices, features that are increasingly valued as digital assets mature from speculative bets to institutional-grade investments.

Looking Ahead: Strategic Growth Catalysts for TONX and Toncoin

Several growth levers could accelerate TONX’s impact on both its own valuation and Toncoin’s adoption curve:

- Staking expansion: Continued increases in staked $TON could further reduce liquid supply and enhance network security.

- Ecosystem development: As staking rewards are recycled into share buybacks or potentially into builder grants, ecosystem projects may see increased funding.

- Broader institutional entry: If other public companies follow TONX’s playbook, allocating treasury assets to $TON, the resulting demand shock could be significant.

For those tracking the intersection of institutional capital and blockchain utility, TON Strategy Co. is a live experiment in how traditional finance can catalyze real-world crypto adoption. The company’s dual focus on shareholder returns and network health sets it apart from passive holding vehicles, and may ultimately serve as a blueprint for future entrants keen on bridging public markets with decentralized ecosystems.

Toncoin’s journey from Telegram-native token to a regulated asset on Nasdaq highlights just how quickly the lines between crypto and legacy finance are blurring. Investors now have a front-row seat, and a direct stake, in this transformation. For an even deeper dive into how large-scale treasury strategies are shaping supply dynamics and price stability within TON, explore our analysis on TONX’s role in ecosystem stability and growth.