The landscape of decentralized finance on the TON blockchain is rapidly evolving, and at the heart of this transformation is the integration of Omniston and Tonco. This partnership is not just another technical upgrade – it’s a fundamental shift in how liquidity is sourced, aggregated, and delivered to users and developers across the TON ecosystem. As DeFi matures beyond its Wild West days, unified liquidity protocols are becoming essential for scalability, efficiency, and seamless user experiences. The Omniston-Tonco integration exemplifies this new era.

Why Unified Liquidity Matters on TON

Historically, fragmented liquidity has been a persistent bottleneck for emerging blockchains. On TON, different decentralized exchanges (DEXs) and protocols have operated in silos, leading to suboptimal swap rates, high slippage on large trades, and a fractured user experience. Omniston addresses these challenges as a TON blockchain liquidity aggregator, pooling resources from multiple DEXs and RFQ resolvers into a single access point. This means users can tap into deeper liquidity without hopping between platforms or sacrificing price efficiency.

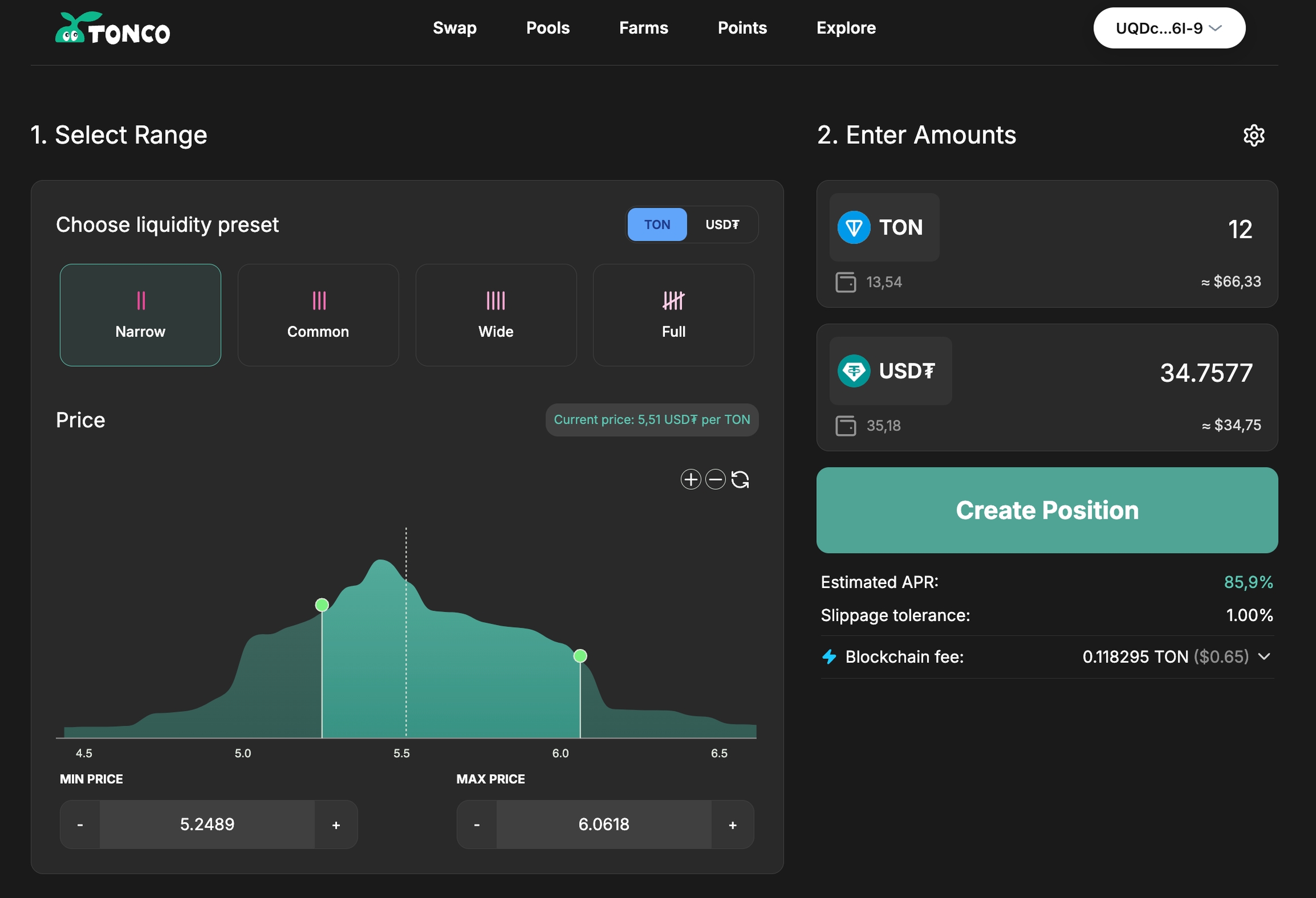

The recent integration with Tonco takes this even further. Tonco brings concentrated liquidity to the table – allowing providers to allocate capital within specific price bands for greater capital efficiency. By incorporating Tonco’s pools into Omniston’s aggregation engine, traders now enjoy tighter spreads and more stable prices across a wider range of tokens.

How Omniston and Tonco Unlock Smarter Swaps

The synergy between these two protocols delivers several tangible benefits:

Key Benefits of Omniston-Tonco Integration for TON DeFi Users

-

Access to Unified Deep Liquidity: By aggregating Tonco’s concentrated liquidity pools with other sources via Omniston, users benefit from deeper and more unified liquidity across the TON ecosystem, reducing fragmentation and improving trading outcomes.

-

Optimal Swap Rates and Lower Slippage: Omniston’s aggregation protocol now taps into Tonco’s pools, ensuring users receive the best available swap rates with minimal slippage, even on large trades.

-

Broader Token Availability: The integration makes assets unique to Tonco accessible across all Omniston-connected wallets and dApps, offering expanded trading options for users.

-

Seamless User Experience Across Platforms: Users can trade and access liquidity directly from their preferred wallets or dApps connected to Omniston, without needing to switch platforms or interfaces.

-

Simplified Integration for Developers: Developers can connect to a single liquidity network (Omniston) to access Tonco and other DEXs, reducing integration complexity, time, and costs.

- Optimized Swap Rates: With access to Tonco’s deep liquidity pools via Omniston’s routing engine, users consistently receive best-in-market swap rates without manual searching or platform-switching.

- Lower Slippage: Aggregated pools mean that even large trades experience minimal price impact – crucial for both retail traders and institutional participants seeking stability.

- Expanded Token Access: Unique assets listed only on Tonco are now available throughout any wallet or dApp connected to Omniston.

- Simplified Developer Experience: Instead of custom integrations with each DEX or pool, developers connect once to Omniston’s API for comprehensive market access.

This approach aligns with what STON. fi describes as “supercharging your TON DeFi app” – by removing friction points in both user experience and backend development. The result is a more vibrant DeFi ecosystem where innovation can flourish atop robust infrastructure.

The Tech Under the Hood: Aggregation Meets Concentrated Liquidity

Diving deeper into the technology stack reveals why this integration is such a game changer for TON DeFi scalability. Omniston acts as an intelligent router – constantly scanning all connected sources (including DEXs like STON. fi and now Tonco) for optimal trading paths. When a user initiates a swap, Omniston automatically routes their order through whichever combination of pools provides the best execution at that moment.

The addition of concentrated liquidity from Tonco means that capital within these pools is deployed more efficiently than traditional constant product models. Liquidity providers can focus their funds within price ranges where most trading occurs – leading to deeper books exactly where they’re most needed. For end users, this translates into less volatility when swapping tokens, especially during periods of heightened activity or larger order sizes.

For developers and DeFi projects, this integration provides a crucial building block for next-generation financial tools. Instead of spending valuable resources on bespoke integrations with every new liquidity source, developers can leverage Omniston as a unified API gateway. This dramatically reduces time-to-market for new dApps and trading platforms while ensuring they remain competitive on pricing and liquidity depth.

From a user perspective, the experience is seamless. Whether executing swaps through a wallet like TON Wallet or interacting via a DeFi dashboard, users are automatically routed to the best available liquidity. There’s no need to worry about where an asset is listed or which pool has the deepest order book, everything is handled behind the scenes by Omniston’s aggregation logic.

Implications for TON Ecosystem Growth

The broader impact of unified liquidity goes beyond just better swaps. By making it easier for both individual users and institutional players to access deep, efficient markets, Omniston and Tonco are laying the groundwork for more sophisticated DeFi products on TON. Derivatives, lending protocols, and automated market-making strategies all benefit from reliable access to deep pools of capital with minimal slippage.

This is particularly significant as the TON ecosystem continues to attract attention from both retail users and professional traders seeking alternatives outside legacy chains. The integration also positions TON as a serious contender in the cross-chain DeFi race, especially as interoperability solutions mature and demand for frictionless trading rises across ecosystems.

The Road Ahead: What to Watch

Looking forward, several trends are worth monitoring:

Key Trends Shaping TON DeFi After Omniston-Tonco Integration

-

Unified Liquidity Pools Drive Deeper Market DepthOmniston now aggregates liquidity from Tonco’s concentrated pools and multiple DEXs, resulting in deeper liquidity and reduced price impact for large trades on the TON blockchain.

-

Optimized Swap Rates and Lower SlippageBy routing swaps through both Omniston and Tonco, users benefit from best-available swap rates and minimal slippage, making trading more cost-effective across dApps and wallets.

-

Expanded Token Accessibility Across the EcosystemAssets unique to Tonco’s pools are now available to all platforms connected to Omniston, increasing token variety and trading opportunities for users.

-

Enhanced User Experience via Seamless IntegrationTraders can access optimal liquidity directly through their preferred wallets or dApps, eliminating the need to switch platforms and simplifying the DeFi experience.

-

Developer Efficiency Through Simplified AccessDevelopers can now integrate with Omniston’s unified liquidity network instead of multiple DEXs, reducing development time and costs while expanding reach.

- Increased developer activity: As barriers to entry drop, expect more projects building on top of Omniston’s aggregated infrastructure.

- Greater token diversity: With Tonco’s unique assets now accessible across Omniston-connected dApps, new trading pairs and innovative tokens will emerge.

- Enhanced user education: As DeFi becomes more approachable thanks to simplified interfaces, onboarding campaigns may accelerate mainstream adoption within Telegram’s massive user base.

The fusion of aggregation (Omniston) with concentrated liquidity (Tonco) is already raising the bar for what users expect from decentralized exchanges on emerging blockchains. The real test will be how this infrastructure supports future waves of growth, and whether it can attract capital away from more established ecosystems by offering superior efficiency and usability.

For anyone tracking TON blockchain liquidity aggregator developments or seeking actionable opportunities in this space, keeping an eye on further upgrades from STON. fi and Tonco is essential. As always in crypto, those who understand the underlying mechanics stand to benefit most as adoption accelerates, and with integrations like this one leading the charge, TON’s DeFi future looks increasingly robust.