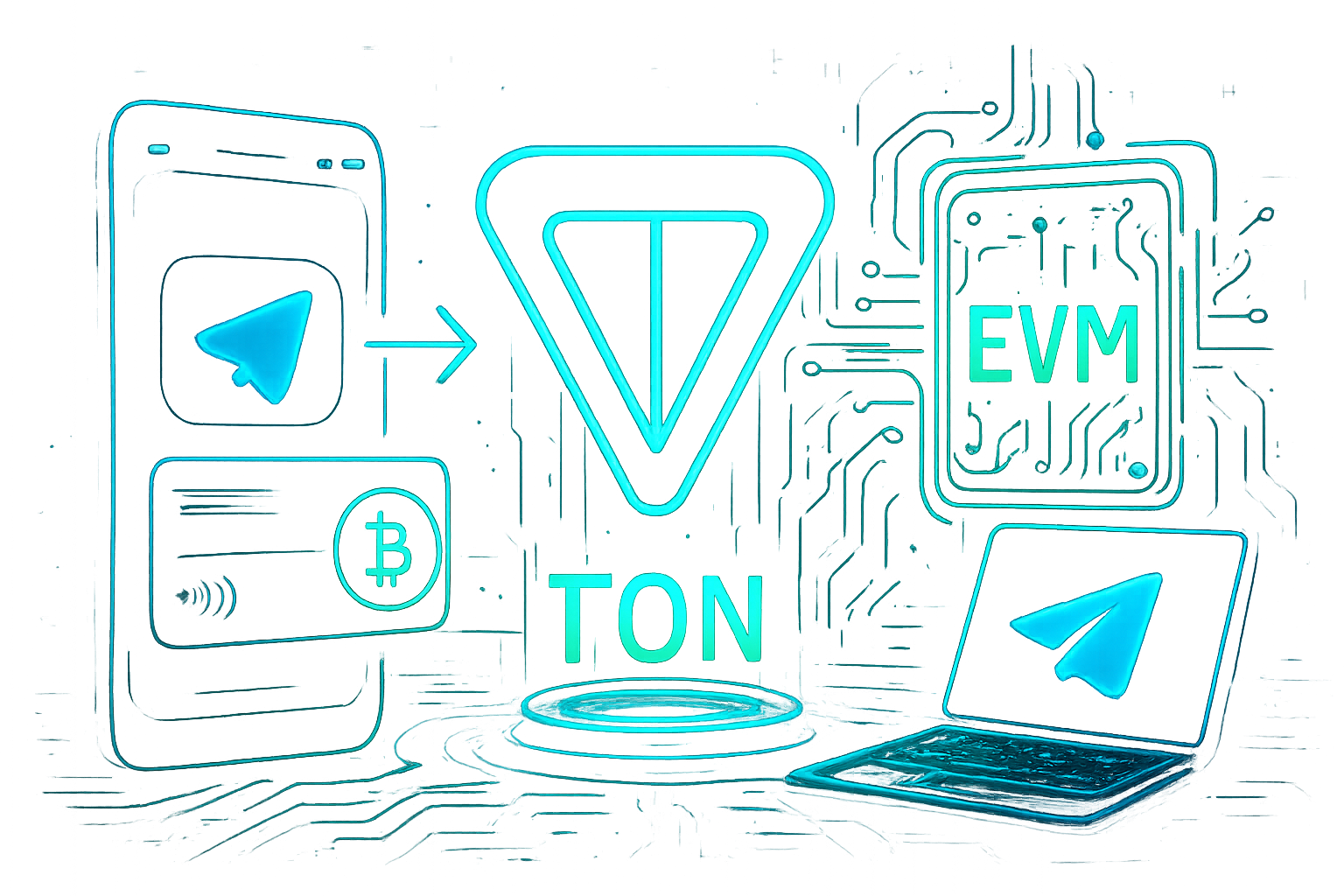

Toncoin (TON) is rapidly emerging as a frontrunner in the race for blockchain mass adoption, thanks to a trio of powerful advantages: seamless built-in payments for Telegram’s billion-user base, full EVM compatibility via the TAC mainnet, and unparalleled network effects stemming from Telegram’s global reach. With TON currently priced at $1.27 and a 24-hour change of and 0.79%, the momentum behind its adoption strategy is impossible to ignore.

Seamless Built-In Payments for Telegram’s Billion-User Base

One of TON’s most compelling features is its native integration with Telegram, which boasts over 900 million active users. This strategic partnership transforms Telegram from a mere messaging app into a full-fledged financial ecosystem. With TON Space, users can manage their Toncoin directly within Telegram, no external wallets or complicated onboarding required.

The real breakthrough came in April 2024, when Tether (USDT) launched natively on the TON blockchain. This move enabled stablecoin transfers within chats, making digital payments as intuitive as sending a text message. The result? Frictionless peer-to-peer payments that feel familiar to billions but are powered by decentralized rails beneath the surface.

This level of accessibility is unprecedented in crypto. Unlike other blockchains that require users to download separate wallets or learn new interfaces, TON’s payment solutions are embedded where people already spend their digital lives, inside Telegram.

Full EVM Compatibility via TAC for Effortless dApp Integration

The launch of the TAC (TON Application Chain) mainnet in July 2025 marks another leap forward for TON mass adoption. TAC brings Ethereum Virtual Machine (EVM) support directly to the TON ecosystem, allowing developers to deploy popular DeFi and Web3 applications inside Telegram with zero downloads or technical friction.

This isn’t just theoretical: established protocols like Curve, Morpho, and Euler can now run natively within the messaging app interface millions already trust. For users, this means accessing lending markets, swaps, and NFT platforms without ever leaving Telegram, or even realizing they’re interacting with blockchain technology at all.

The implications for onboarding are enormous. By removing technical barriers like wallet extensions and browser-based dApp stores, TAC slashes friction at every stage of the user journey. Developers benefit too: they can tap into Ethereum’s vast tooling while instantly reaching one of the world’s largest digital audiences.

How TAC Powers EVM dApps Inside Telegram

-

Seamless Built-In Payments for Telegram’s Billion-User Base: TON enables frictionless, native crypto payments directly within Telegram, instantly unlocking mass adoption potential through an interface familiar to over 1 billion users. With features like TON Space self-custodial wallets and native USDT support, users can send, receive, and manage crypto assets without ever leaving the app.

-

Full EVM Compatibility via TAC for Effortless dApp Integration: The launch of TAC mainnet brings Ethereum Virtual Machine (EVM) support to TON, allowing developers to deploy popular DeFi and Web3 apps inside Telegram without additional downloads, dramatically lowering user onboarding barriers. This means established protocols like Curve, Morpho, and Euler can operate natively within Telegram, making DeFi accessible to everyone.

-

Unmatched Network Effects from Telegram’s Global Reach: TON leverages Telegram’s massive, engaged user base and social graph, providing projects with immediate access to hundreds of millions of potential users and a built-in distribution channel that accelerates network growth far beyond traditional crypto ecosystems. This unique synergy positions TON as the gateway for mainstream Web3 adoption.

Unmatched Network Effects from Telegram’s Global Reach

No other blockchain project enjoys an organic distribution channel on par with Telegram’s global user base. With more than 900 million active accounts, and ambitions to cross one billion soon, Telegram provides an instant audience orders of magnitude larger than most crypto-native platforms.

This social graph is deeply engaged and highly mobile-first; it represents not just numbers but real communities ready for new financial tools and digital experiences. Projects building on TON gain immediate access to this pool without costly marketing campaigns or speculative incentives, the reach is baked into the infrastructure itself.

As more dApps deploy through TAC and as payment features become second nature inside chats, we’ll likely see an exponential acceleration in network growth, a virtuous cycle where utility begets adoption begets utility again.

Toncoin (TON) Price Prediction 2026-2031

Forecast based on adoption trends, Telegram integration, and EVM dApp ecosystem growth

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.10 | $1.70 | $2.30 | +34% | Adoption surges as EVM dApps mature on Telegram; volatility from macro environment |

| 2027 | $1.30 | $2.10 | $3.20 | +24% | Wider DeFi and payments adoption; regulatory clarity in major markets |

| 2028 | $1.60 | $2.60 | $4.20 | +24% | Mainstream adoption accelerates; competition from other L1s increases |

| 2029 | $1.90 | $3.20 | $5.00 | +23% | Sustained network growth; integration with other social platforms possible |

| 2030 | $2.10 | $3.80 | $6.30 | +19% | TON cements position as Web3 payment and dApp hub; potential bull cycle |

| 2031 | $2.40 | $4.40 | $7.80 | +16% | Network effects peak; focus on scalability and cross-chain interoperability |

Price Prediction Summary

Toncoin’s price outlook is strongly positive, driven by Telegram’s billion-user integration, built-in payments, and seamless Ethereum dApp support via TAC. As adoption grows, TON is well-positioned to outperform many peers, but faces volatility from competition and market cycles. Prices are expected to trend upward with substantial upside in bullish scenarios, particularly if TON captures a significant share of social and payment-based crypto activity.

Key Factors Affecting Toncoin Price

- Telegram’s user base and native wallet adoption

- Success of EVM dApps and DeFi protocols on TON via TAC

- Regulatory developments affecting crypto payments and messaging platforms

- Partnerships and ecosystem expansion

- Technological improvements in scalability and user experience

- Competition from other scalable L1 blockchains and integrated social platforms

- General crypto market cycles and macroeconomic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What sets TON apart isn’t just its technical prowess, but the way it merges blockchain utility with everyday digital habits. By embedding payments and dApp access directly into Telegram’s familiar chat interface, TON eliminates the steep learning curve that has long hampered mainstream crypto adoption. The result is a seamless user experience where sending money or interacting with decentralized finance becomes as routine as sharing a photo or voice note.

For developers, TAC’s EVM compatibility is a game changer. Instead of building from scratch or waiting for users to migrate to unfamiliar platforms, projects can instantly deploy Ethereum-based applications to an audience already numbering in the hundreds of millions. This dramatically reduces time-to-market while opening new monetization pathways through Telegram’s built-in payment rails and social features.

From an investment perspective, TON’s network-driven approach offers a compelling edge over rivals like BNB Chain or Solana, which rely more heavily on external marketing and incentives. With Toncoin currently trading at $1.27, its value proposition is increasingly tied to real-world usage and organic growth rather than speculative hype alone.

The Road Ahead: Adoption at Internet Scale

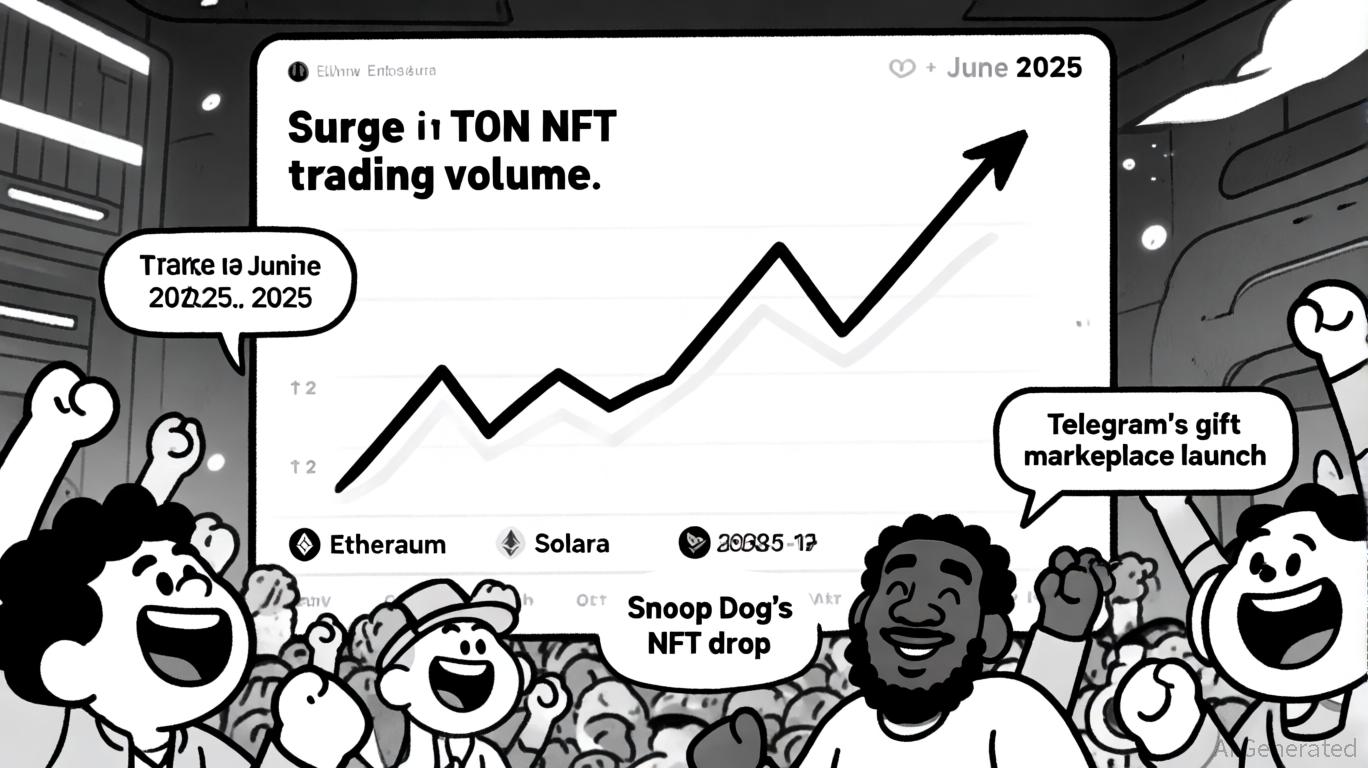

The fusion of seamless payments, effortless dApp onboarding via TAC, and Telegram’s unrivaled distribution creates a feedback loop few other blockchains can match. As more users transact in Toncoin or USDT within chats, and as DeFi apps become one-tap experiences inside Telegram groups, both liquidity and engagement are poised to surge.

This isn’t just theory: early data shows surging asset inflows and user activity since the TAC mainnet launch. The ability for Ethereum-native protocols to reach new audiences without sacrificing composability could spark the next wave of DeFi innovation, this time powered by social connectivity rather than isolated wallets or exchanges.

Key Benefits of TON’s Network Effects

-

Seamless Built-In Payments for Telegram’s Billion-User Base: TON enables frictionless, native crypto payments directly within Telegram, instantly unlocking mass adoption potential through an interface familiar to over 1 billion users. With features like the TON Space self-custodial wallet and native USDT support, users can send, receive, and manage digital assets without leaving the app, making crypto transactions as simple as sending a message.

-

Full EVM Compatibility via TAC for Effortless dApp Integration: The launch of TAC mainnet brings Ethereum Virtual Machine (EVM) support to TON, allowing developers to deploy popular DeFi and Web3 apps inside Telegram without additional downloads, dramatically lowering user onboarding barriers. This seamless integration means established protocols like Curve, Morpho, and Euler can reach Telegram’s vast audience, expanding access to decentralized finance.

-

Unmatched Network Effects from Telegram’s Global Reach: TON leverages Telegram’s massive, engaged user base and social graph, providing projects with immediate access to hundreds of millions of potential users and a built-in distribution channel that accelerates network growth far beyond traditional crypto ecosystems. This unique synergy offers unparalleled opportunities for viral adoption and ecosystem expansion.

It’s important to note that these trends are still in their early innings. Regulatory clarity, continued security enhancements, and ongoing education will be essential as billions encounter crypto for the first time through Telegram. But if current momentum holds, and all signs suggest it will, TON is positioned not just as another blockchain but as the backbone for Web3 at internet scale.

For those seeking exposure to networks with sustainable adoption strategies, TON stands out for its ability to blend usability with deep liquidity and scale. Whether you’re a developer aiming for instant reach or an investor tracking real-world traction over speculation, keeping an eye on TON’s evolution is more relevant than ever.

Toncoin (TON) Price Prediction 2026-2031

Projected Price Ranges Based on Mass Adoption, EVM Integration, and Telegram Ecosystem Growth

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.40 | $1.85 | $2.30 | +45% | Continued Telegram integration, growing EVM dApp activity, rising user adoption. |

| 2027 | $1.70 | $2.35 | $3.10 | +27% | DeFi usage expands, more payment features, but possible regulatory scrutiny. |

| 2028 | $2.10 | $2.95 | $4.00 | +26% | Wider global adoption, bullish on new dApps, some volatility from macro trends. |

| 2029 | $2.50 | $3.60 | $4.90 | +22% | Steady growth, institutional interest, competition from other L1s increases. |

| 2030 | $2.90 | $4.20 | $5.80 | +17% | Matured ecosystem, mainstream payments, potential for first major bear cycle correction. |

| 2031 | $2.70 | $4.00 | $6.50 | -5% | Market consolidation, possible regulatory headwinds, but strong long-term adoption. |

Price Prediction Summary

Toncoin (TON) is positioned for significant growth through 2031, leveraging Telegram’s billion-user ecosystem, seamless EVM dApp integration, and built-in payment solutions. The price is expected to rise steadily with mass adoption, though subject to crypto market cycles and regulatory developments. The average price could more than triple by 2031 compared to 2025 levels, with bullish scenarios depending on continued adoption and ecosystem expansion.

Key Factors Affecting Toncoin Price

- Telegram’s user base and integration depth

- Adoption and transaction volume of EVM-compatible dApps on TON

- Global regulatory changes impacting crypto and payments

- Development and uptake of stablecoins (e.g., USDT) on TON

- Competition from other scalable L1 blockchains (e.g., Solana, Avalanche)

- Overall crypto market sentiment and Bitcoin cycles

- Security, scalability, and developer ecosystem growth

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.