The decentralized finance (DeFi) landscape on The Open Network (TON) is undergoing a dramatic transformation, as full-stack DeFi protocols make their way into the hands of Telegram’s 1 billion-plus users. With the recent launch of the TAC mainnet, a fully EVM-compatible Layer 1 blockchain, Ethereum’s most established DeFi applications are now natively accessible within Telegram. This convergence of TON’s high-throughput infrastructure and Telegram’s massive, engaged user base is setting the stage for what many are calling TON DeFi Summer.

TON DeFi Ecosystem Accelerates with TAC Mainnet and Protocol Integrations

At the heart of this expansion is TAC, which enables direct deployment of Ethereum-based protocols onto TON without code changes. As of September 2025, TON is trading at $1.27, reflecting a steady uptick ( and 0.79% over 24 hours) as new liquidity and user activity flood into the ecosystem. The TAC mainnet launch has been pivotal, not just for technical compatibility but also for unlocking bluechip DeFi primitives that have proven themselves on Ethereum.

Let’s examine the top five protocols launching on TON and integrating with Telegram:

Top 5 DeFi Protocols Launching on TON

-

Curve Finance (TON): A renowned decentralized exchange (DEX) for stablecoins, Curve Finance is now live on TON, bringing its efficient, low-slippage swaps and deep liquidity pools to Telegram’s massive user base. Users can trade stablecoins and earn yield directly within the Telegram ecosystem.

-

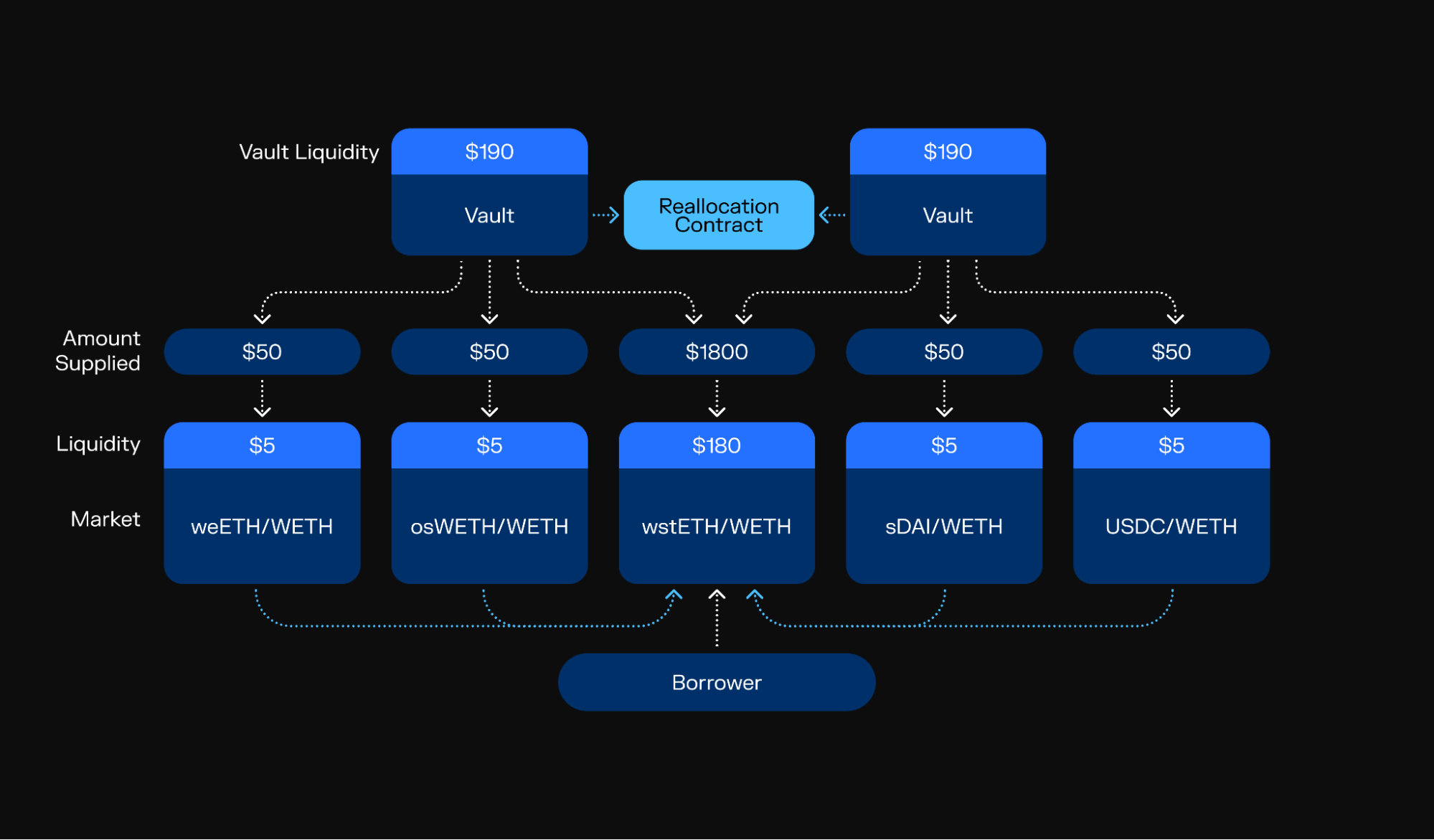

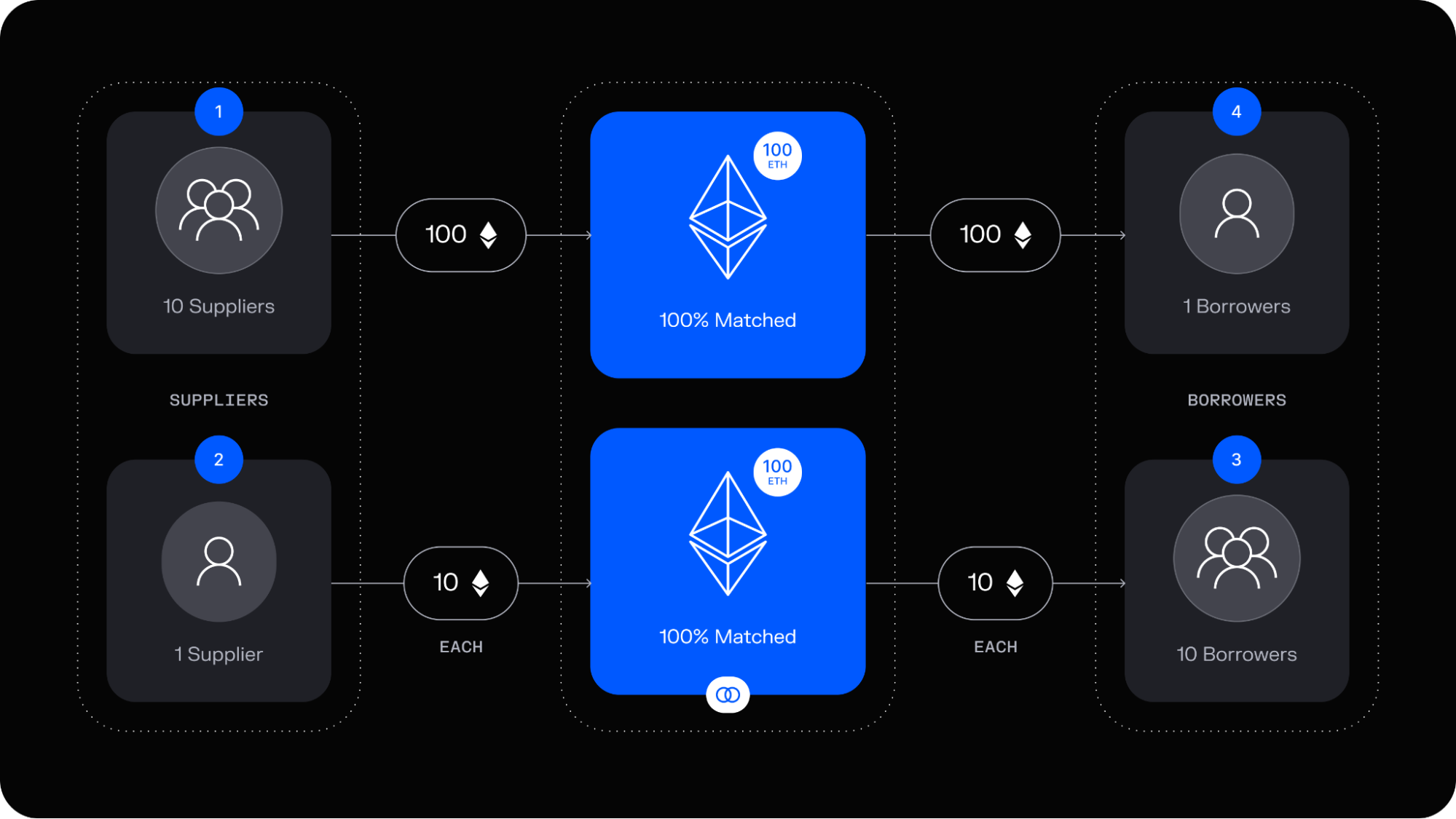

Morpho (TON): Morpho is a leading lending and borrowing protocol, now integrated with TON. It optimizes lending rates for users by matching lenders and borrowers peer-to-peer, offering improved yields and lower costs for Telegram users accessing DeFi services.

-

Bancor (TON): Bancor brings its automated market maker (AMM) and single-sided liquidity pools to TON, allowing Telegram users to provide liquidity and earn fees without the risk of impermanent loss, all within a familiar messaging environment.

-

ZeroLend (TON): ZeroLend is a decentralized lending protocol now available on TON, enabling users to supply and borrow assets with competitive rates. Its integration with Telegram makes DeFi lending accessible and user-friendly for a global audience.

-

Affluent: Affluent is a TON-native money market protocol designed to make Telegram a super app for DeFi. It offers lending, borrowing, and yield optimization features, empowering users to manage digital assets seamlessly within the Telegram interface.

Curve Finance (TON): Bringing Deep Liquidity to Telegram Users

Curve Finance, renowned for its efficient stablecoin swaps and deep liquidity pools, is now available to TON users via TAC. Curve’s arrival means that Telegram users can access low-slippage swaps between stablecoins like USDT, USDe, FDUSD, and tgUSD, all within familiar chat interfaces or dedicated bots. This integration makes it possible for anyone in the Telegram ecosystem to participate in yield farming or provide liquidity with minimal technical barriers.

The synergy between Curve’s algorithmic market making and TON’s scalable architecture could redefine what “liquidity” means in messaging-centric finance. For those seeking both yield and stability, Curve on TON offers a compelling entry point.

Morpho (TON) and Bancor (TON): Lending Meets Automated Market Making

Morpho brings optimized peer-to-peer lending directly into the Telegram app environment. By leveraging Morpho on TON, users can supply assets like stablecoins or native TON tokens to earn competitive yields or borrow against collateral without leaving their chat window. The protocol’s design ensures efficient rates by matching supply and demand more directly than traditional pooled lending models.

Bancor (TON), meanwhile, introduces automated market making with impermanent loss protection, a major boon for retail liquidity providers wary of volatility risks. Its integration allows seamless token swaps inside Telegram while letting LPs earn fees safely. Together, Morpho and Bancor create a robust foundation for decentralized lending and trading at unprecedented scale.

ZeroLend (TON): Instant Loans and Flexible Credit in Your Pocket

ZeroLend is designed for speed and simplicity, offering instant loans against crypto collateral right inside Telegram chats. This protocol caters to both power users who need rapid access to credit lines as well as newcomers looking for an approachable entry point into decentralized borrowing. ZeroLend leverages TON’s fast finality for near-instant approvals, making it ideal for microloans or bridging short-term cash flow gaps among a global audience.

Affluent: Transforming Telegram Into a Super App for Money Markets

Affluent, purpose-built from the ground up for TON, aims to make Telegram a true super app by embedding money market functionality into daily messaging experiences. Affluent lets users deposit assets to earn yield or borrow directly from group chats, blurring the line between social interaction and financial empowerment. Its vision aligns closely with TON’s mission: onboarding hundreds of millions by making DeFi approachable within everyday digital life.

Toncoin (TON) Price Prediction 2026-2031

Forecast based on DeFi integration, Telegram adoption, and evolving crypto market cycles (2025 baseline: $1.27)

| Year | Minimum Price (Bearish) | Average Price (Likely) | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.10 | $1.60 | $2.10 | +26% | Ongoing DeFi adoption; early EVM integration; moderate regulatory headwinds |

| 2027 | $1.35 | $2.05 | $2.80 | +28% | DeFi user growth via Telegram; stablecoin traction; competition from other L1s |

| 2028 | $1.50 | $2.60 | $3.70 | +27% | Mainstream DeFi usage; improved cross-chain operability; regulatory clarity emerging |

| 2029 | $1.80 | $3.30 | $4.90 | +27% | Major user onboarding (250M+); institutional interest; DeFi maturing on TON |

| 2030 | $2.10 | $4.10 | $6.30 | +24% | Wider mass adoption; new killer apps; potential market cycle peak |

| 2031 | $2.40 | $4.70 | $7.10 | +15% | Sustained user base; DeFi/TradFi convergence; global crypto regulation |

Price Prediction Summary

Toncoin (TON) is positioned for substantial long-term growth, leveraging deep integration with Telegram’s billion-plus user base and a rapidly expanding DeFi ecosystem. While short-term volatility remains likely due to market cycles and regulatory factors, progressive adoption of EVM-compatible DeFi protocols and stablecoins points to steadily increasing average prices. Bullish scenarios could see TON benefit from mass adoption and new financial use cases, while bearish cases may arise from regulatory or competitive pressures.

Key Factors Affecting Toncoin Price

- Integration of Ethereum DeFi protocols via TAC mainnet and EVM compatibility

- Telegram’s massive user base as a funnel for DeFi adoption

- Stablecoin ecosystem growth (USDT, USDe, FDUSD, tgUSD) within Telegram

- Regulatory developments in global crypto and DeFi markets

- Potential competition from other Layer 1 blockchains and super app platforms

- Technical improvements to TON chain scalability and user experience

- Market cycles typical to the crypto sector (bull/bear phases)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The arrival of these full-stack DeFi protocols is more than just a technical milestone for TON and Telegram. It signals a fundamental shift in how decentralized finance can be delivered: frictionless, social, and accessible to billions. By leveraging Telegram’s native chat interfaces, bots, and wallet integrations, these protocols are lowering the barriers that have historically kept DeFi out of reach for everyday users.

Consider the impact of Curve Finance (TON) now that it’s live on TAC’s mainnet. For the first time, liquidity providers and yield seekers can interact with deep stablecoin pools from within Telegram itself, no separate browser extensions or complex onboarding required. The ability to swap between USDT, USDe, FDUSD, and tgUSD at minimal cost is particularly powerful for users in emerging markets where remittances and savings are lifelines.

Morpho (TON) further enhances this ecosystem by offering peer-to-peer lending with highly competitive rates. Its integration means that Telegram groups can organize collective lending pools or facilitate direct loans among trusted contacts, all while maintaining full custody over their funds. This peer-centric approach is likely to drive organic adoption as communities experiment with new forms of group finance.

Bancor (TON)’s automated market making brings another layer of utility: impermanent loss protection. For retail users who may be wary about providing liquidity due to price volatility, Bancor’s solution offers peace of mind, a critical factor as mainstream audiences begin experimenting with DeFi for the first time.

ZeroLend (TON) addresses one of the most persistent needs in global finance: fast, flexible access to credit. Its instant loan mechanism is especially relevant for freelancers, gig workers, or anyone facing short-term liquidity crunches. With approvals happening at the speed of TON’s finality layer, often seconds, ZeroLend could become a go-to tool for financial resilience worldwide.

Affluent, meanwhile, is pushing boundaries by embedding money market tools directly into group chats and personal conversations. Imagine splitting a dinner bill or organizing a community investment pool without ever leaving your favorite Telegram group, that’s the promise Affluent brings to life.

Why This Matters: Mass Adoption Through Familiar Interfaces

The significance of these launches goes beyond technical innovation. By meeting users where they already spend their digital lives, inside Telegram, TON-based DeFi protocols are poised to leapfrog traditional onboarding hurdles. No more juggling browser wallets or navigating unfamiliar websites; instead, DeFi becomes as easy as sending a message or joining a group chat.

Top 5 DeFi Protocols Launching on TON for Telegram Users

-

Curve Finance (TON): A leading decentralized exchange for stablecoins, Curve Finance now operates on TON, enabling Telegram users to swap stablecoins and other assets with low fees and minimal slippage. Its integration brings deep liquidity pools and efficient trading directly inside Telegram, making DeFi accessible to over 1 billion users.

-

Morpho (TON): Morpho is a next-generation lending protocol that optimizes lending and borrowing rates by matching peer-to-peer transactions. Its TON deployment allows Telegram users to earn competitive yields or access loans seamlessly, leveraging the scalability and speed of The Open Network.

-

Bancor (TON): Bancor brings its automated market maker (AMM) and single-sided staking to TON, letting Telegram users provide liquidity and earn fees without the risk of impermanent loss. This integration offers a simple, user-friendly DeFi experience within Telegram’s familiar environment.

-

ZeroLend (TON): ZeroLend is a decentralized lending platform now live on TON, providing Telegram users with instant access to collateralized loans and lending markets. Its integration supports a wide range of assets and offers transparent, on-chain borrowing and lending directly in the app.

-

Affluent: Affluent is a TON-based money market protocol aiming to turn Telegram into a super app for DeFi. It provides lending, borrowing, and yield optimization tools, allowing users to manage their digital assets and earn returns without leaving Telegram.

This user-centric approach is already reflected in TON’s market performance. With TON trading at $1.27, up 0.79% over 24 hours according to real-time data (

What Comes Next?

The pace at which new protocols are joining TON suggests that this “DeFi Summer” may only be the beginning for Telegram-based finance. As more bluechip primitives arrive, and as user education ramps up through intuitive bots and wallet integrations, the ecosystem will become richer and more resilient.

If you’re new to decentralized finance or looking for actionable ways to participate in this wave of adoption growth, start by exploring these five protocols inside your Telegram app today. Each offers unique opportunities, from passive yield generation with Curve Finance (TON) to instant credit via ZeroLend (TON), all within an environment designed for mainstream accessibility.

Toncoin (TON) Price Prediction 2026-2031

Forecast based on current DeFi integration, Telegram adoption, and evolving crypto markets (Baseline price: $1.27 as of Sep 2025)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.10 | $1.60 | $2.40 | +26% | DeFi adoption accelerates on Telegram; early regulatory uncertainty |

| 2027 | $1.30 | $2.00 | $3.20 | +25% | Broader stablecoin usage, more EVM apps; competition from other L1s |

| 2028 | $1.60 | $2.60 | $4.10 | +30% | Global crypto recovery, more users onboarded, mature DeFi landscape |

| 2029 | $2.00 | $3.40 | $5.30 | +31% | Institutional DeFi interest, Telegram super-app vision gains traction |

| 2030 | $2.40 | $4.30 | $6.80 | +26% | Regulatory clarity, mainstream adoption, strong user growth |

| 2031 | $2.80 | $5.10 | $8.20 | +19% | Potential market saturation, TON as a top 10 crypto, consolidation phase |

Price Prediction Summary

Toncoin (TON) is poised for significant growth over the next six years, driven by the integration of DeFi protocols with Telegram’s vast user base and the expansion of EVM-compatible dApps. The forecasts anticipate a steady rise in TON’s average price, with the potential for outsized gains if adoption continues and regulatory frameworks remain favorable. While minimum prices reflect possible bearish scenarios (market corrections, regulatory setbacks), the maximum prices account for strong network effects and successful execution of TON’s super-app vision within Telegram.

Key Factors Affecting Toncoin Price

- Adoption rate of DeFi protocols by Telegram’s user base

- Expansion and integration of stablecoins (USDT, USDe, etc.)

- Regulatory developments impacting global DeFi access

- Competition from other Layer 1 and Layer 2 blockchains

- Technological upgrades and scalability improvements on TON

- Market cycles (bull/bear phases) and macroeconomic trends

- Developer ecosystem growth and new use cases within Telegram

- User experience enhancements and security of TON-based dApps

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.